Over the past year, there’s been a massive shift in Bitcoin’s ownership whereinthe institutional players are increasingly accumulating BTC. this trend has been accelerated soon after the approval of spot ETFs in January 2024. On the other hand, many retail investors, tempted by short-term profits or scared by volatility, are offloading their BTC holdings. But here’s the twist: they’re selling to the very institutions that long doubted Bitcoin and are the same ones who now believe BTC is a long-term store of value.

The on-chain data suggests the institutional demand for BTC has been on the rise since the start of the second quarter. Meanwhile, the demand for the token from the retail investors has taken a major hit since the start of the year, which rose marginally as the price marked a new ATH, but dropped later. This suggests the institutions are driving the current BTC uptrend, with ETFs and corporate treasuries accumulating aggressively. Meanwhile, retail’s relative absence could mean pent-up FOMO if price breaks range, leading to sharp volatility as new buyers pile in, and also more risks of local tops when sentiment spikes.

Therefore, the retail traders are expected to stay focused on volume surges and spot demand, as some of the factors point towards a major price action very soon.

At $108K, BTC Price is Still Undervalued

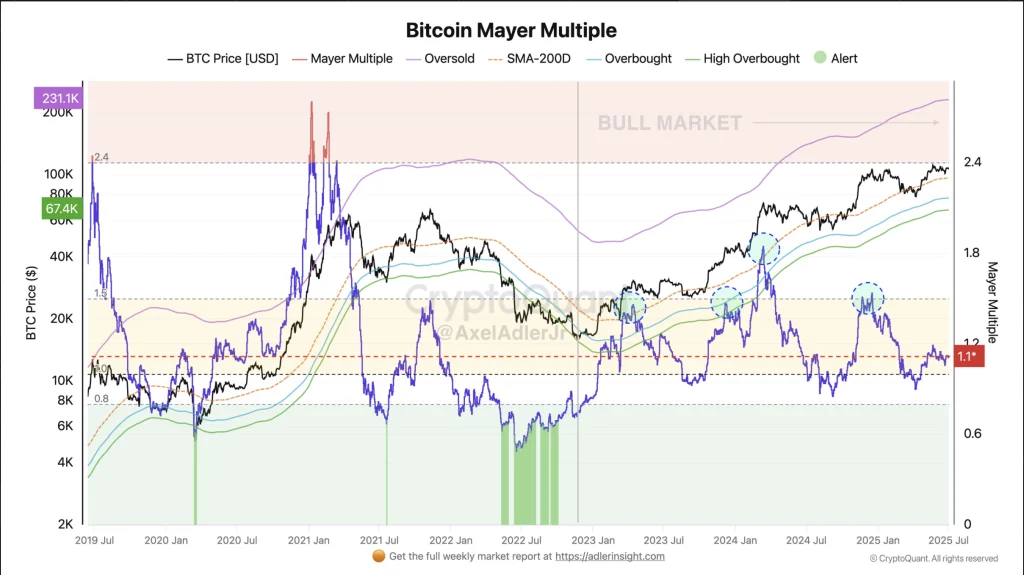

The Bitcoin price still shows room to run, as suggested by the Mayer Multiple, which is an oscillator calculated as the ratio between price and the 200-day MA. It helps to determine if Bitcoin is potentially overbought, fairly priced, or undervalued. A higher multiple suggests the BTC price is trading at a premium, however, the current rates are lower, hinting the token is at the discounted rates.

As seen in the above chart, Bitcoin’s Mayer Multiple is at 1.1x, just 10% above its 200 DMA and well below the 1.5x overheated zone. This signals it isn’t overheated even in the times when the BTC price is just an inch away from its ATH. This suggests the token seems to be still undervalued even trading at $108K.

Another Dormant Whale Wakes Up

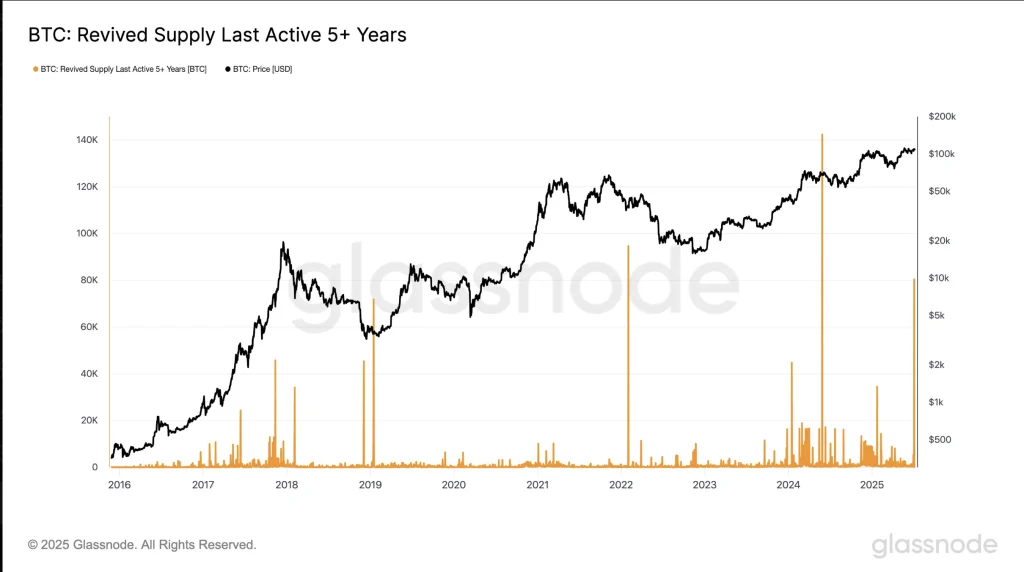

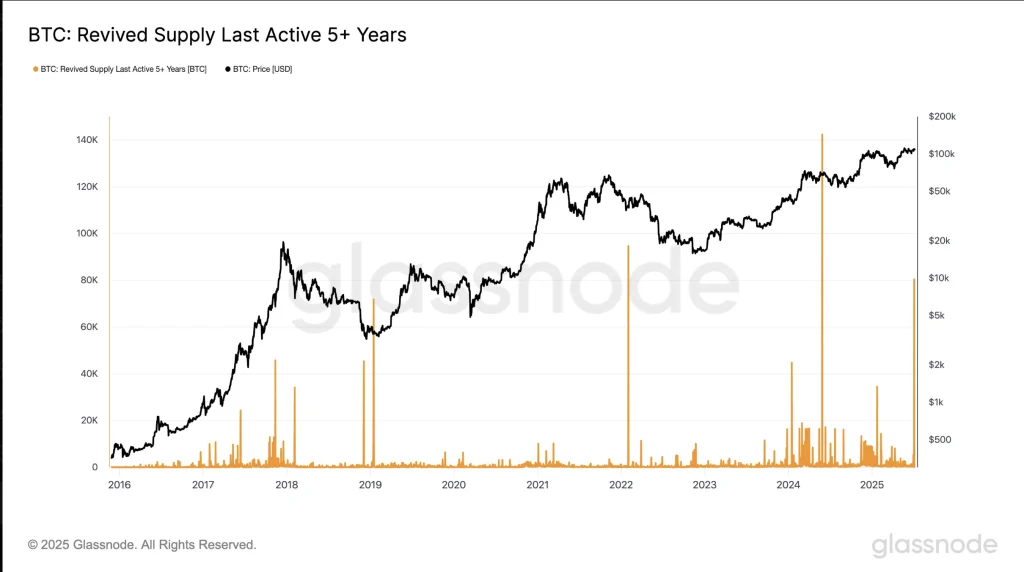

In the past few days, the crypto space witnessed a historical event of the dormant wallets suddenly turning active after 14 long years. Moreover, some of the transferred Bitcoin was reportedly being sold, which mounted enough bearish pressure over the token, but the close consolidation of the BTC price suggests the bulls are still in control. Yet a similar event has occurred where Bitcoin marked the third-largest single-day revival of old supply in history.

The data from Glassnode suggests over 80,000 BTC that remained inactive for over 5 years is on the move. A similar event occurred back in the middle of 2024 and in the first few days of 2022. In times when the market cap of Bitcoin is above $2 trillion, nearly $8.6 billion worth of BTC transfer may be a pretty big thing. However, the impact on the price in the short term remained negligible, but the supply shock could be incoming.

Wrapping it Up!

In a time when institutions are aggressively accumulating Bitcoin, retail investors must pause and reflect on the long-term implications of selling. Bitcoin’s value lies not just in price but in its design as a decentralized, finite asset. By holding, you preserve your financial sovereignty and participate in a rare economic shift. Selling now may offer short-term gains, but holding could position you for exponential value creation as global adoption and institutional interest continue to accelerate in the years ahead.