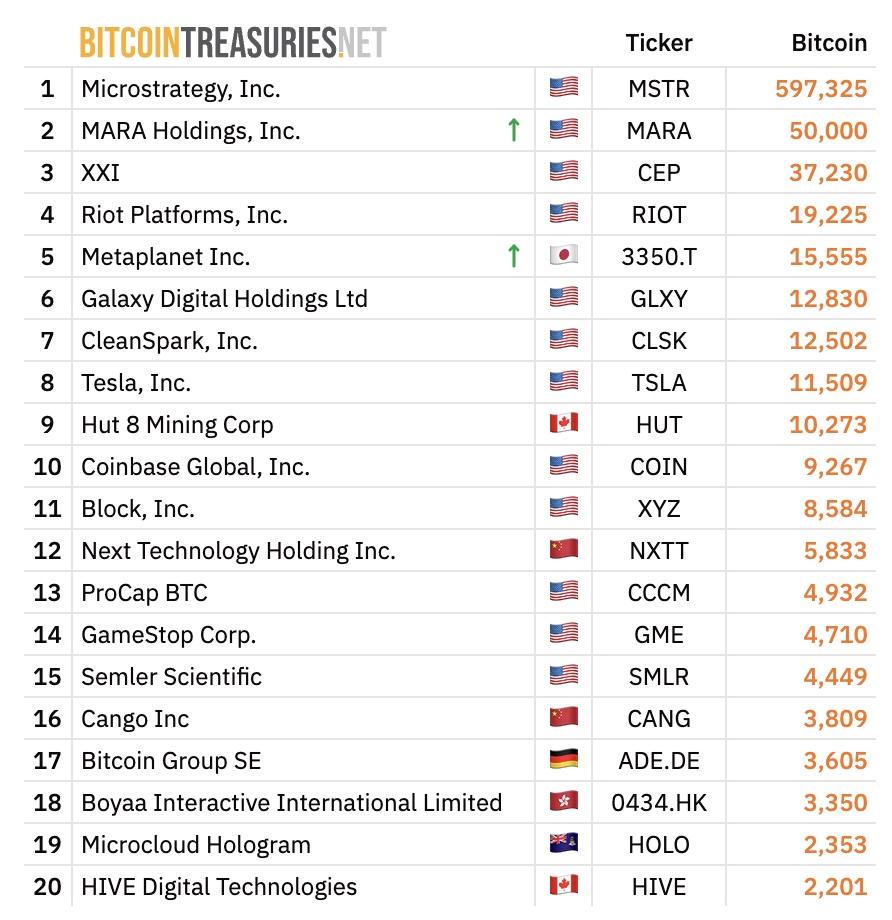

Tokyo -based company MetaplanetBitcoin consisting of 15 thousand 555 BTCs  $108,926.68 He plans to increase his treasure to 210 thousand units by 2027. While the company purchases counter enterprises including digital banking Bitcoinaims to use their use as a guarantee. Speaking to Financial Times CEO Simon GerovichDuring the period of “Bitcoin underneath”, the process described the process as a speed race that would leave its rivals behind. The aim is to be able to finance growth by reaching the escape rate of BTC accumulation. On July 7, 2025, the company had increased Bitcoin assets by taking 2 thousand 204 BTCs.

$108,926.68 He plans to increase his treasure to 210 thousand units by 2027. While the company purchases counter enterprises including digital banking Bitcoinaims to use their use as a guarantee. Speaking to Financial Times CEO Simon GerovichDuring the period of “Bitcoin underneath”, the process described the process as a speed race that would leave its rivals behind. The aim is to be able to finance growth by reaching the escape rate of BTC accumulation. On July 7, 2025, the company had increased Bitcoin assets by taking 2 thousand 204 BTCs.

Strategic growth plan with Bitcoin reserve

Metaplanet started in 2024 as a protection against inflation Bitcoin He describes his / her accumulation as “phase 1 .. The target is to reach 210 thousand BTCs corresponding to 1 percent of the total supply and to achieve the advantage of the scale in Japan. Gerovich to Financial Times in the statement “The faster we gather, the more difficult it is to get caught,” he said. This amount corresponds to 1 percent of Bitcoin’s total supply. So it has psychological importance.

The last purchase of 2 thousand 204 units in the beginning of July was spent 237 million dollars and an average price of 107 thousand 700 dollars. Thus, the average purchase amount of the company increased to 99 thousand 985 dollars. The most positive reflection of Metaplanet’s Bitcoin investments was to their shares. The company’s shares increased by 345 percent since the beginning of the year and brought the value of the company to $ 7 billion.

Digital Bank evaluates purchases

Metaplanet management plans to create cash with loan by showing a bond -like collateral in Phase 2. Gerovich, “a profitable digital bank by purchasing a more superior service to individual customers,” he explained a potential target. In this way, it is envisaged to create new income flow and feed the reserves.

On the other hand, today crypto currency Guaranteed credit trials are quite limited. In April this year Standard Chartered with OKX A pilot -oriented work started. Moreover, Metaplanet rejects convertible bonds due to stock price, while looking at the privileged share exports to finance growth.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.