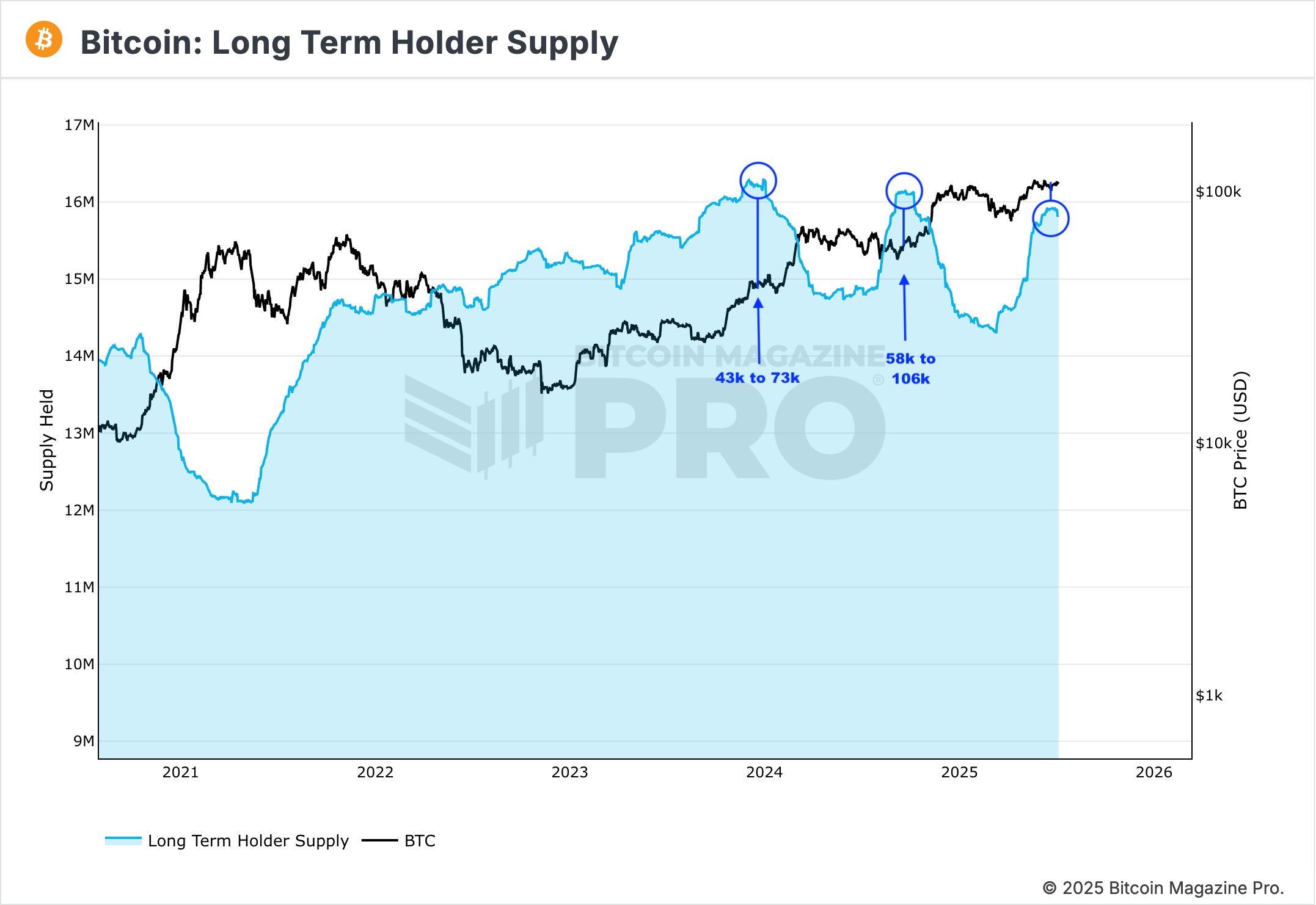

Bitcoin  $108,775.42Long -term investors, called “Diamond Hands ,, have locked 80 percent of the circulating supply in their wallets. According to analyst Credibull Crypto, this painting is preparing a new rally ground. In the past, similar jams triggered leaps from 43 thousand dollars to $ 73 thousand and $ 58 thousand dollars over 100 thousand dollars. The largest crypto currency that is currently traded around 108 thousand 312 dollars can reach $ 150,000 at the request of the new buyer.

$108,775.42Long -term investors, called “Diamond Hands ,, have locked 80 percent of the circulating supply in their wallets. According to analyst Credibull Crypto, this painting is preparing a new rally ground. In the past, similar jams triggered leaps from 43 thousand dollars to $ 73 thousand and $ 58 thousand dollars over 100 thousand dollars. The largest crypto currency that is currently traded around 108 thousand 312 dollars can reach $ 150,000 at the request of the new buyer.

How does supply scarcity affect Bitcoin’s price?

Following how much of Bitcoin’s supply is held, Blockchain data shows that four -fifths of the total supply are found in wallets that are not willing to sell. Since this ratio rises, there is no “more” coins in the market, the new demand creates a leverage effect on the price.

Credibull CryptoThe graphic shared by the end of 2024 points to two critical thresholds seen. The first one is the $ 30,000 rise after the 43 thousand dollars of jam, and the second is that Bitcoin reaches six -digit prices after the repetitive image in 58 thousand dollars. According to the analyst, the existing table corresponds to a stronger jam than these past examples, and even a small increase in demand is the aggressive price rise can bring.

Although such contraction of supply increases the flexibility of the market against the sales pressure, it prepares the ground for extreme rapid rise when the purchases are intensified. In short, even a small acceleration on the request side can rapidly raise the price.

Corporate treasures create additional upward pressure at the price

Companies that include Bitcoin in the company’s balance sheets also reduce circulating supply. To the data offered by BitcoinTreasuries according to StrategyIt is located at the top of the list with 597 thousand 325 BTCs. Marathon Digital Holdings, Metaplanet, Gamestop, Genius Group, Blockchain Group And Nakiki se such companies continue to accumulate BTC. This trend reduces the supply in the stock exchanges, while the price feeds long -term.

Credibull Crypto, both individual accumulation and corporate treasures drawn BTCThrough the s, it predicts that the next movement will be big and powerful than the previous two leaps. According to the analyst, the price can easily test a $ 150 thousand threshold by experiencing a $ 50,000 rise. Credibull Crypto’s foresight means that short -term price fluctuations are unpredictable.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.