Hong Kong -based chip manufacturer traded on Nasdaq Nano LabsBinance’s BNB Altcoin’a 50 million dollars by depositing 74 thousand 315 BNB BNB (OTC) on the market for an average of $ 672.45 in the market receiving. So the company Bnb‘s total supply of up to 10 percent of the goal of achieving the first big step. Nano Labs’s Bitcoin after purchase  $109,127.98 The crypto currency reserves, including, rose to $ 160 million. In total, 500 million dollars of the budget of $ 1 billion will be provided with convertible bond exports.

$109,127.98 The crypto currency reserves, including, rose to $ 160 million. In total, 500 million dollars of the budget of $ 1 billion will be provided with convertible bond exports.

Nano Labs’ 10 percent target BNB investment

Nano Labs described a $ 50 million acquisition as the beginning of the vision of holding a significant part of the supply. The company has the cash flow developed with supply chain expertise BNB CoinHe had previously received authority from the board of directors to evaluate. The OTC method allowed a high amount of purchase without affecting the market price. Thus, the average cost remained at $ 672.45. The administration plans to gradually the remaining $ 950 million purchases in the market by considering the liquidity in the market during the year.

Half of the budget will be financed by bonds that may turn into shares. This method does not immediately dilute the voting rights of the existing shareholders while the debt leverage effect in the balance sheet. Company executives emphasize that they prefer BNB because of the potential of a global payment network, while it sees it as a key tool for a long -term portfolio variety.

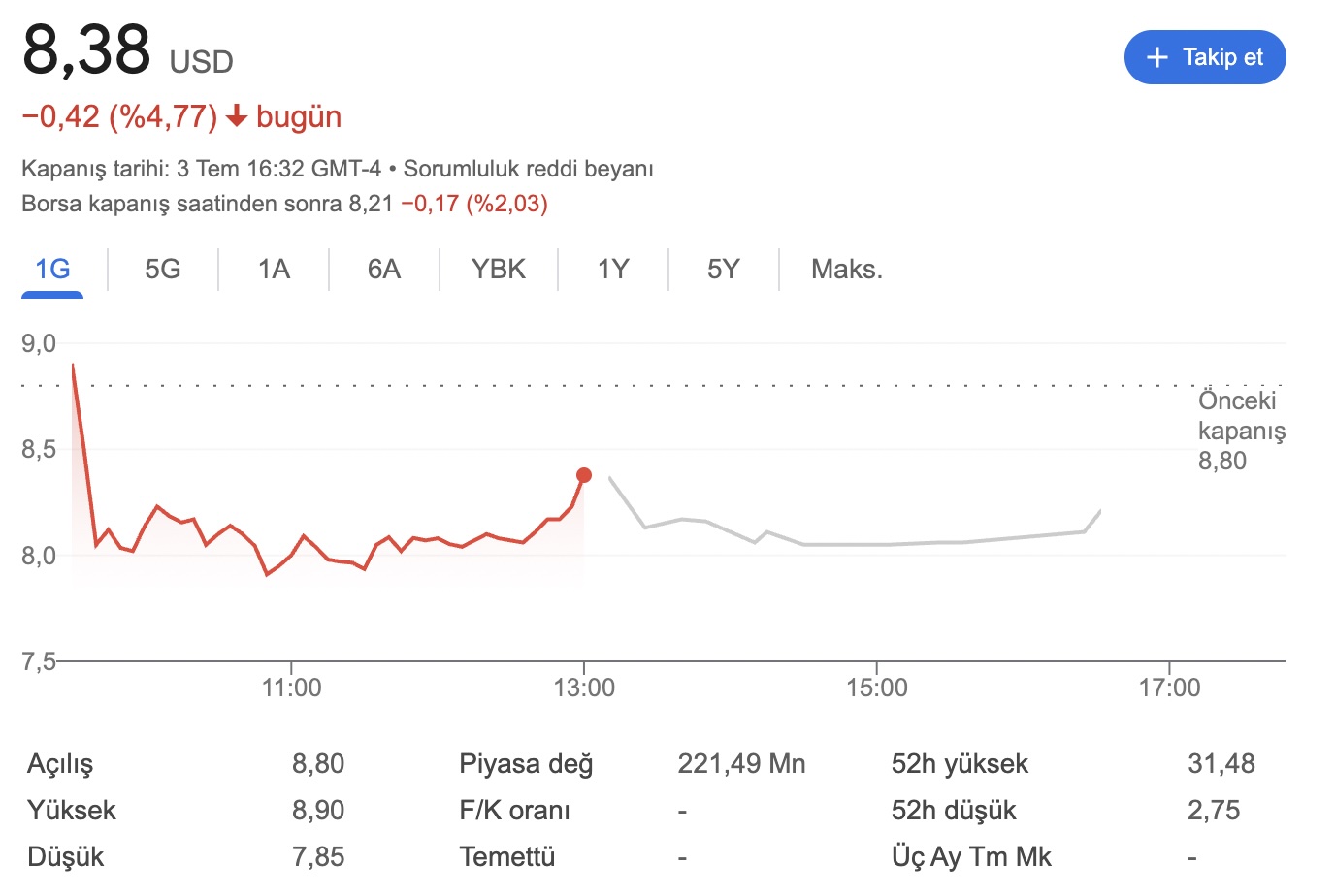

The company’s shares responded to the purchase of Altcoin with a decline

Nano Labs shares decreased by 4.7 percent to $ 8.38 after the transaction closing on Thursday, when the news spread. This decline is the result of investors’ concern that the large -scale crypto currency position can increase the volatility in the balance sheet. Analysts, about one third of the company’s cash reserves crypto currencyHe said that his binding was brave but risky.

On the other hand altcoin The idea of accumulating BNB as a “treasury existence” is spreading in institutional circles. Last month, a team of former hedge funds managers announced a BNB collection plan by establishing a 100 million dollar public company. The moves on the corporate side are subject to the supply side of Altcoin gradually increasing.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.