BTC It is quite promising that it is on the limit of $ 109,900 and at higher levels. It sounds like yesterday, people were worried that BTC would fall below $ 15,000. Today, we see that under 110 thousand dollars of closures cause dissatisfaction. Crypto It is literally such a place. So global liquidity, bitcoin $109,658.18 What does the cycle and Fed interest route say to us? Let’s see them.

Fed Interest Route

Let’s start with an interesting information. Whales, which had purchased in the early stages of BTC last year, are around half a million BTC He sold it. This is roughly 50 billion dollars. However, the tendency of accumulation in long -term investors continues.

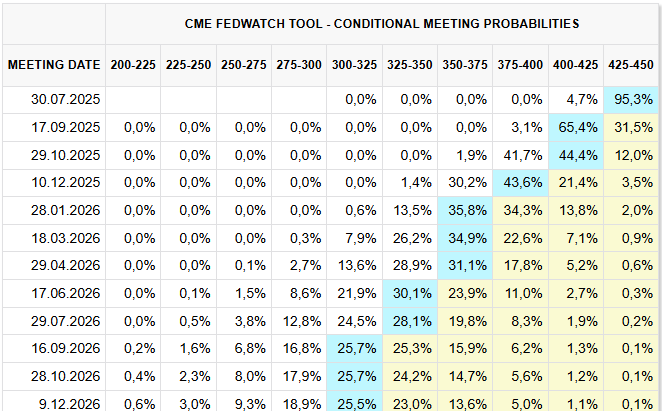

The table above will change too much over time, but it gives us important clues for this year. 2 interest rate reductions before the end of the year seems to be certain. 3 discounts are expected next year. The main reason for this is the uncertainty of the scope of additional inflation brought by tariffs. However Fed This year will make 2 interest rate reductions. If the employment weakens, they can start the first discount in September with 50BP as last year.

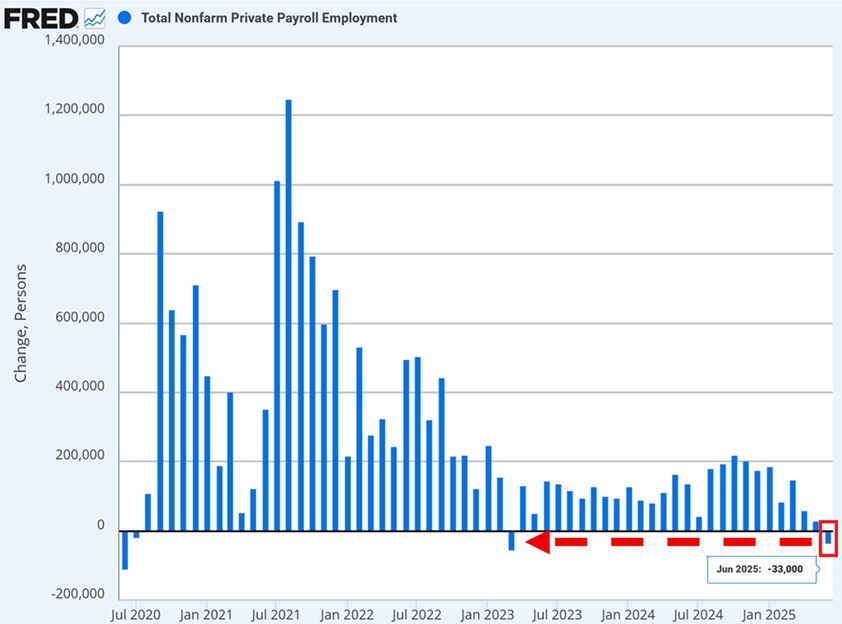

TKL shared an assessment on the latest employment data,

“According to the Adp Employment Report, the employment of private sector in the US in June decreased by 33,000 people. This has been the first decline since March 2023 and the largest decline with 2020 pandema.

In addition, May data were revised by 8,000 and announced as +29.000. As a result, the 3 -month average increase in employment decreased to 19,000 and has decreased to the weakest level since August 2020. Many indicators show that the labor market narrows. ”

The Waller said that we should start downloading interest rates in July about 2 weeks ago, but the fact that employment is close to the maximum capacity causes the majority of the FED to care about new employment figures.

The inflation data in the middle of the month will finalize the July decision, but if there is no figure that does not come much less than the expectation, there is no discount in July.

Global liquidity and Bitcoin cycle

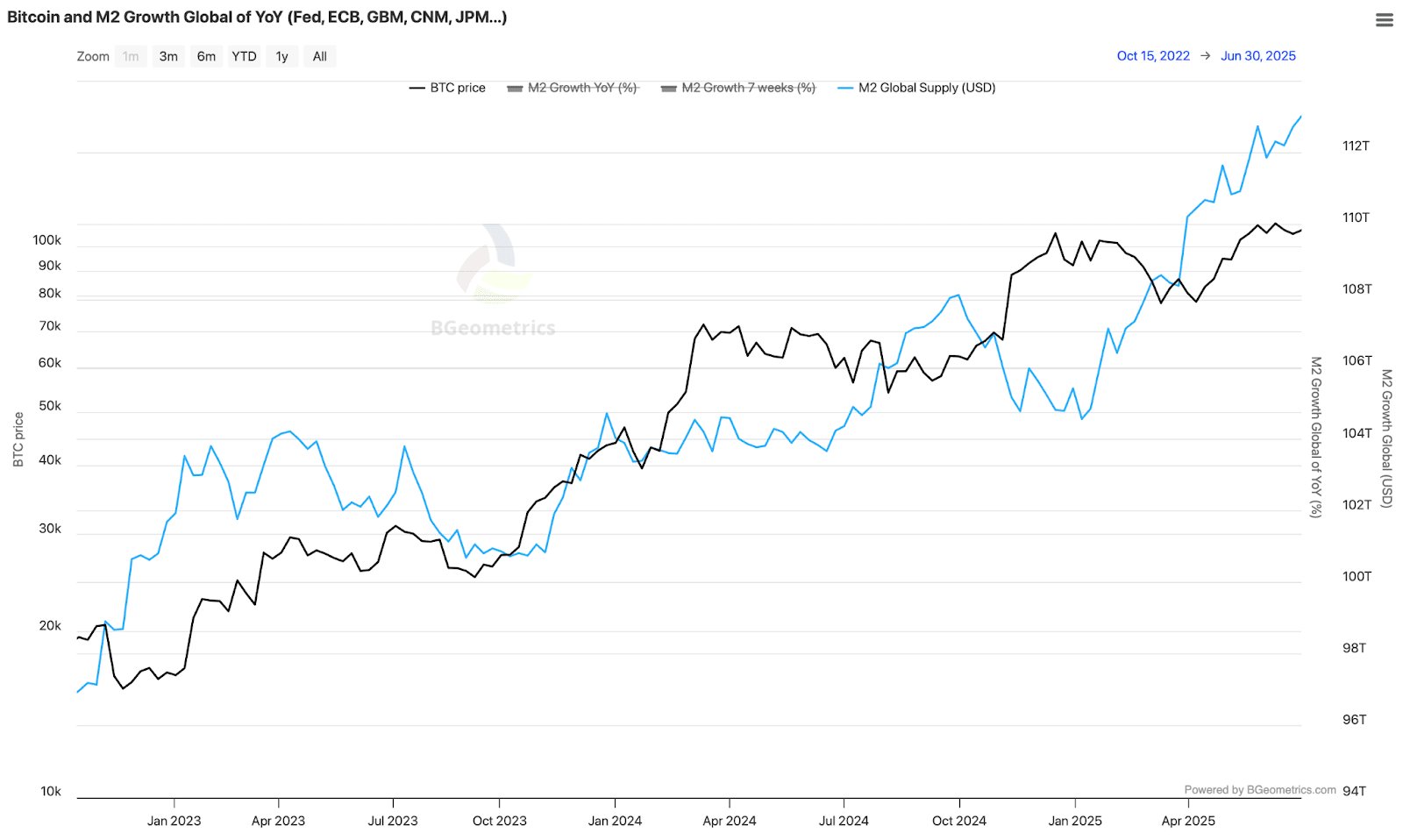

With the global M2 113 trillion, it reached new record levels of all time. The US M2, which means that money supply is in 21.94 trillion, and it is at the new AC level. Crypto Coins What is the constant rule for? Money becomes abundant, crypto coins rise. The money has become abundant and BTC rose. But not yet to the desired size. Lark Davis wrote;

“Global M2 has reached a record level of 113 trillion dollars. The US has recorded a new AC with a new AC with 21.94 trillion dollars in the US.

Get ready! “

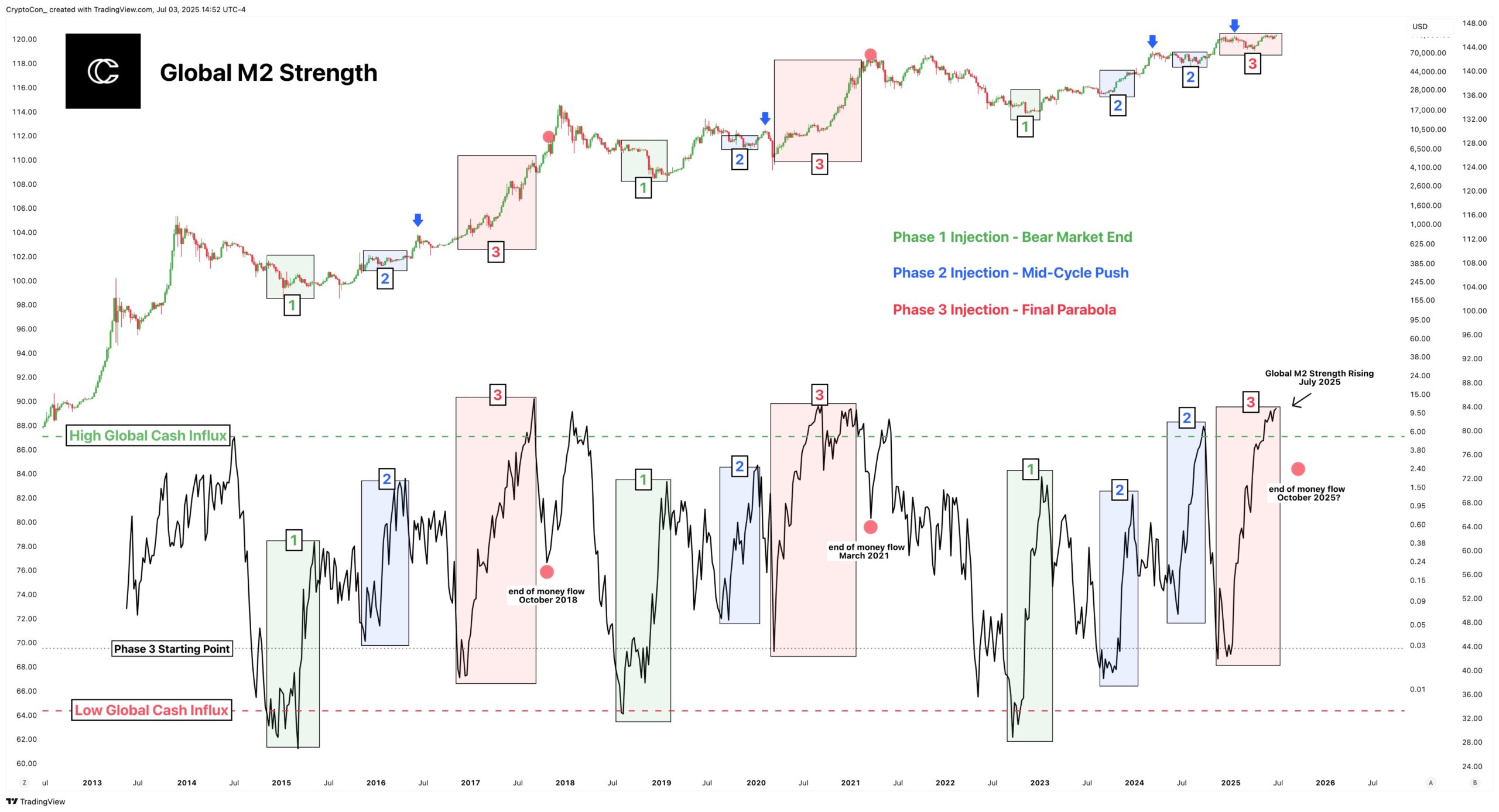

Cryptoon also draws attention to this point.

“Bitcoin‘s cycle is closely linked to the power of the global M2 and we are now in the middle of the last stage.

Each month market ends with an increase in global cash flow (stage 1).

Throughout the loop, secondary cash flows (stage 2) are seen. It is the first time we see 2 in a single cycle. The last stage begins at the starting point of excess 3 and rises to the highest point of the global cash level. It is clear that this is currently going on.

The cycle usually ends after a major decrease in cash flow power (we are not yet at this point!).

The other cycles lasted about 3-5 months from our current point in stage 3.

IMPORTANT POINT: The M2 power has entered the final stage, but has not yet ended. A large amount of money flows to crypto currencies. ”

So now it must have come.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.