Founder of Maelstrom Arthur HayesIn his last Medium article, the market may move horizontally or slightly downward before the Jackson Hole Economy Symposium in August. Underlining that the Re -Filling of up to 486 billion dollars of the Treasury General Account (TGA) can compress the dollar liquidity. Bitcoin $107,778.0790 thousand – 95 thousand dollars of the band warned that he can withdraw. Hayes shared that Maelstrom closed by selling non -liquid subcoin positions on behalf of short -term risk management, and will reduce the weight of Bitcoin in its portfolio. In the medium term, the stablecoins will be issued by large banks and the reset in the United States with the reset of the bond market 10.1 trillion dollars of the new purchasing power to return to the markets, he added that the asset prices up.

Liquidity pressure can bring a decrease in crypto currencies in the short term

Hayes, medium in the article After the debt ceiling is increased, the completion of TGA for $ 850 billion will temporarily reduce the circulating dollar. With this expectation, he warned that Bitcoin would withdraw after the current summit tests and expect him to seek support in the range of $ 90-95 thousand. However, the FED President in Jackson Hole Jerome PowellAs a new recovery may begin from the beginning of September when it gives messages to relax quantitative tightening.

According to Hayes’ statement, Maelstrom, July-August period Staked USD (Ethena USD) prefers to protect against fluctuations by keeping the position “weighted”. In this respect, the company is non-liquid that provides 2-4 times return from the purchases at the beginning of April. altcoinsold all of the s. Hayes underlined that the company can gradually alleviate the risk of bitcoin until the liquidity catalyst factor for the markets became clear.

Trillion Dollar Expectation

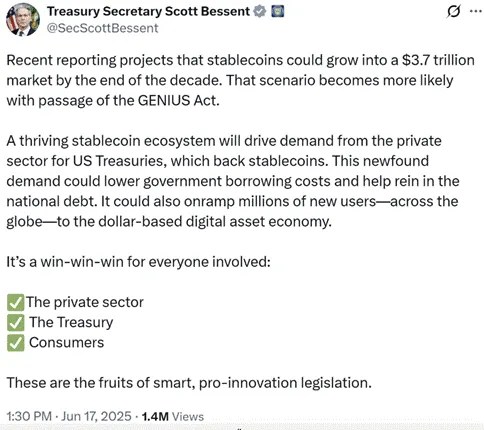

Hayes, US Treasury Minister Scott Bessent‘s support for stablecoin arrangements associates with the need to control borrowing costs. The arrangement will be released to banks (TBTF), which is called a large number of and very large. stablecoinWith the s 6.8 trillion dollars, the deposits of the treasury bonds allows the opportunity to direct. Complementary capital competence rate (SLR) exemption will pave the way for them to keep these assets with almost infinite leverage.

According to the founder of Maelstrom FedThe abolition of interest paid to bank reserves may also cause additional demand for $ 3.3 trillion. A total of $ 10.1 trillion potential has proven its success since 2022 as the new version of the “activist treasure export” model. Hayes emphasized that the regulator opened an unrivaled space to TBTF banks with the “Genius Law olan limiting FinTech exporters, and that JP Morgan’s JPMD Stablecoin is a harbinger of this strategy. He said that this mechanism could fire the wick of a long -term rally until 2026 in the stocks, bonds and especially in Bitcoin.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.