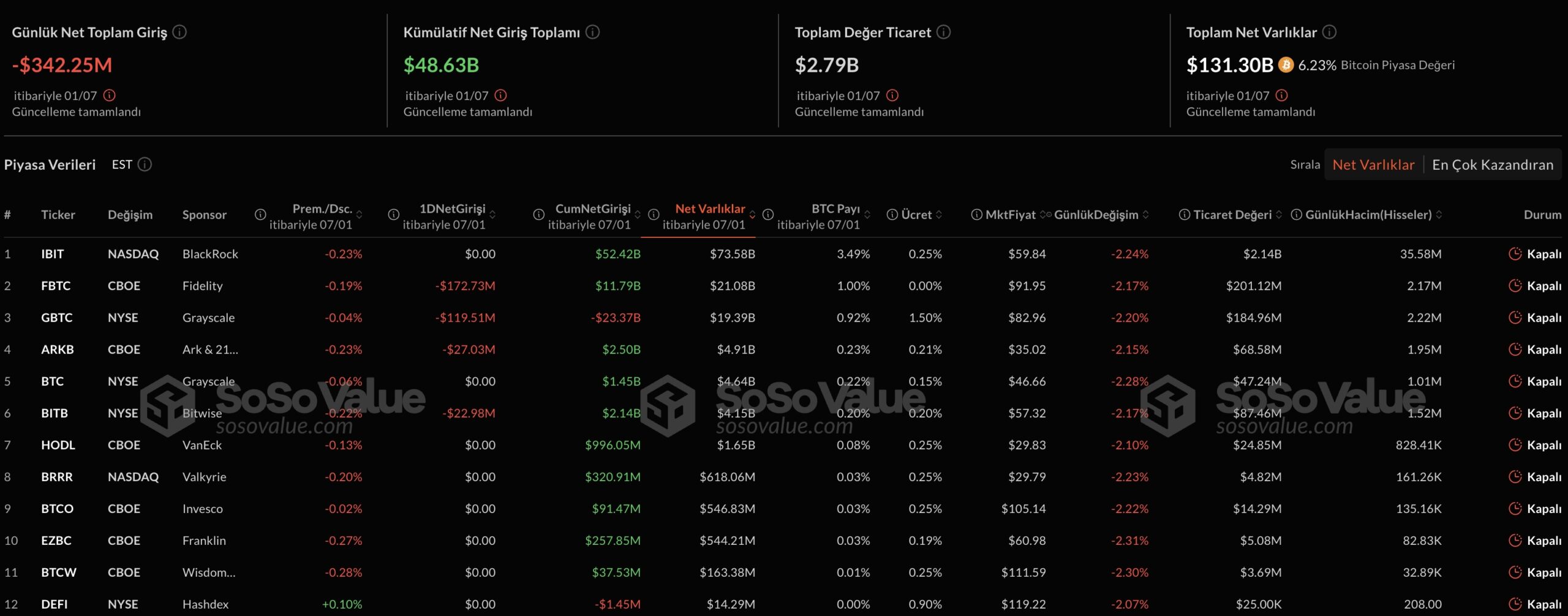

US -based Spot Bitcoin $107,778.07 ETF15 -day and 4.7 billion dollars of uninterrupted net entry series ended on Tuesday, July 1. A total of 342.2 million dollars was a net output. According to Sosovalue data, Blackrock’s prominent IBIT The fund reported zero flow for the first time after the 15 -day $ 3.8 billion entrance series. Fidelity’s FBTCWhile Grayscale is the lead with a output of $ 172.7 million, respectively GBTC119.5 million dollars, Ark Invest ARKB‘s 27 million dollars and Bitwise’s BITB‘s $ 23 million. Brn Chief Research Analyst Valentin FournierHe stressed that these outputs mean break in corporate accumulation, but there is no sign of trend change.

Bitcoin ETFs paused with unexpected outputs

Spot in the USA Bitcoin ETFs with a total of 48.63 billion dollars of net input since the launch in January 2024, 128 billion dollars in size reached. 13.5 billion dollars of this figure has happened from the beginning of the year. However, the last 15 -day strong flow acceleration slowed down with the weakening of daily entries and eventually reversed. Fournier said that the interest of the investor has cooled in the short term, and that Bitcoin is difficult to exceed 110 thousand dollars unless new catalysts come into play.

Despite the $ 119.5 million output in GBTC, Fund is still one of the largest asset pools. The fact that IBIT stops with a zero flow indicates that the leading fund is usually a cautious period. According to analysts ETF This change on the side is the result of increasing interest uncertainty and the temporary reduction of the risk appetite prior to the upcoming macro data.

Bitcoin fell below the threshold of 105 thousand 500 dollars on July 1, but he recovered in a short time and returned to around 107 thousand 800 dollars. Kronos Research CIO Vincent LiuHe said that unemployment applications to be announced in the coming days will continue to be cautious in the market until the data and other US economic indicators become clear. The $ 105,000 -110 thousand dollars, seen as a stuck band, provides a healthy consolidation for potential rise than analysts.

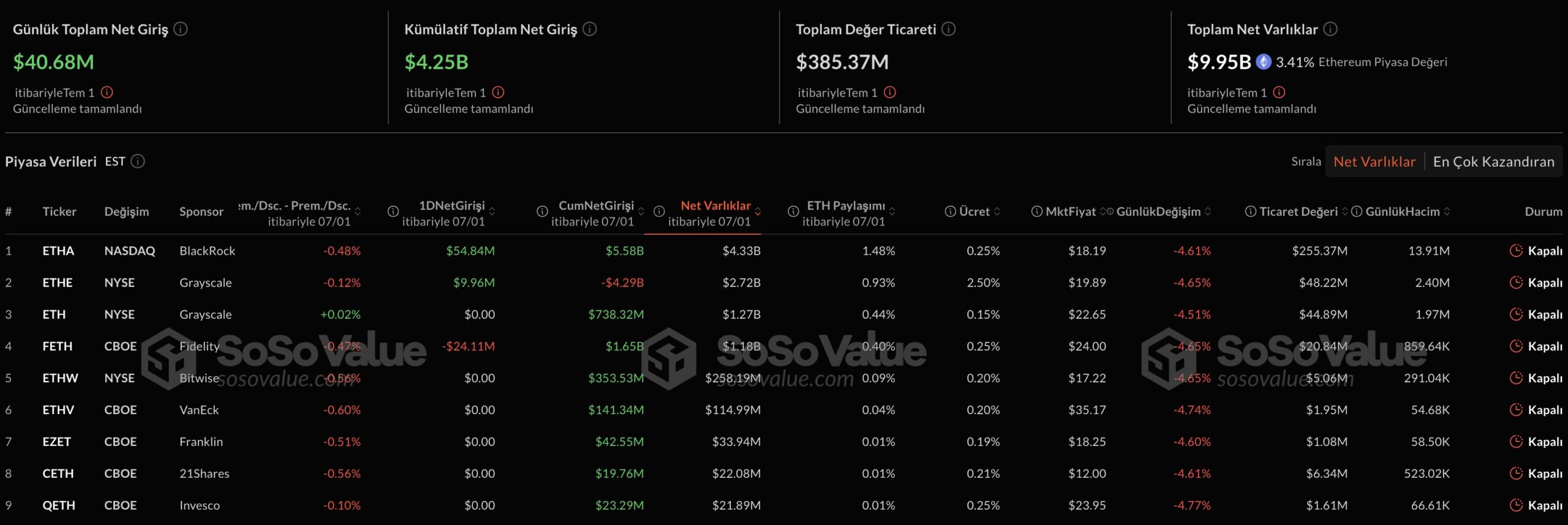

The pause in Bitcoin worked to Ethereum

On the other hand, in the USA, which was opened in July 2024 Spot Ethereum  $2,453.35 ETF40.7 million dollars on Tuesday. Blackrock’s ETHA fund alone attracted $ 54.8 million. Thus, the total net input of the Ethereum -based investment products has increased to 150 million dollars for 150 million dollars and cumulative net entries to 4.3 billion dollars.

$2,453.35 ETF40.7 million dollars on Tuesday. Blackrock’s ETHA fund alone attracted $ 54.8 million. Thus, the total net input of the Ethereum -based investment products has increased to 150 million dollars for 150 million dollars and cumulative net entries to 4.3 billion dollars.

Market experts on the Bitcoin side of the pause EthereumHe thinks that he can support institutional interest in the short term.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.