British banking giant Standard Charteredin his newly published and in his report on the second half of the year Bitcoin $107,778.07 The year -end price target for $ 200 thousand protected. Head of Digital Asset Research of the Bank Geoffrey Kendrickthe price of the largest crypto currency until September 30 to 135 thousand dollars, until December 31 will rise to 200 thousand dollars. This estimate is today traded around 107 thousand 500 dollars, Bitcoin corresponds to a record leap of 92 thousand dollars in six months. As a reason for the expected rise in the report, the flows to the Spot ETFs, the treasury purchases of the companies and the expected regulatory developments were shown.

ETFs and Corporate Demand Carry The Price Up

According to the report, Spot Bitcoin ETFs and corporates 245 thousand in the second quarter BTC gathered. This amount corresponds to about 26 billion dollars. Kendrick, the continuation of passive fund allocation and public companies StrategyThis figure will be overcome in both the third and fourth quarter by imitating the leveraged treasure model. According to the data, only in the second quarter, companies except Strategy received 56 thousand BTC. Thus, companies approached Strategy’s purchase of 69 thousand BTCs in the same period.

The largest of traditional safe ports in the period of increasing the geopolitical tension. crypto currencyEither the belt increased. It was reported that the $ 12.4 billion ETF entrances in April-June leaving the entrances to the Gold ETFs and this performance reinforces Bitcoin’s macro asset identity. The limited Hedge-Fon Short positions in the Chicago futures market stands out as an element that supports the price.

Political wind adds additional strength to Bitcoin

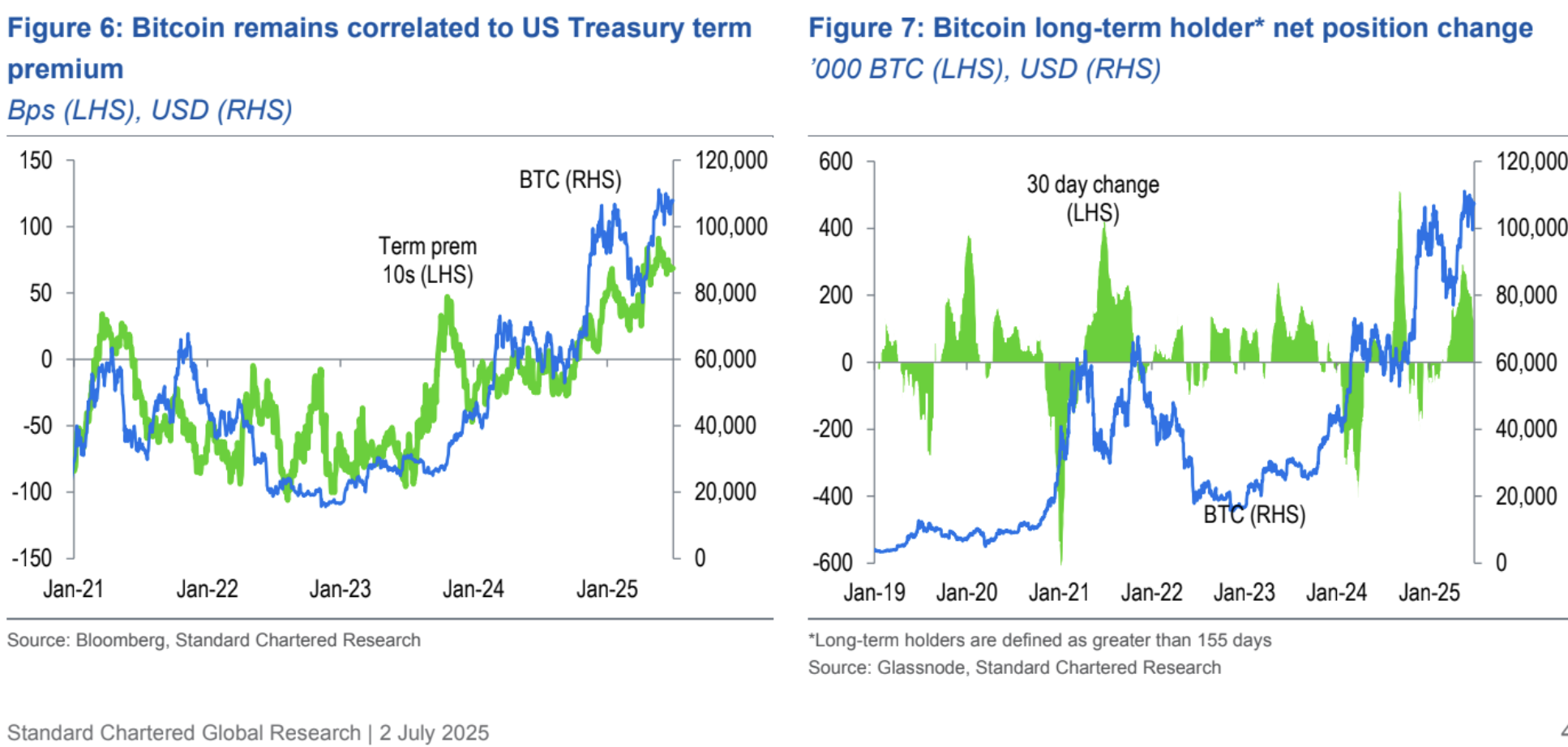

Kendrick argues that the price cycle is now shaped by permanent capital flows rather than supply shocks. In the previous cycles, halving is in other words Block award splitting The 18-month summit model was seen after the aftermath, but ETFs and institutions were not at that time. Standard Chartered predicts that long -term investors will make less sales this year and the ongoing ETF entrances will absorb possible profit purchases.

The report points to three potential political rise examination: the president Donald TrumpThe FED President Jerome Powell instead of a pro -interest name description, Double Party Supported Stablecoin Draft at Congress GeniusThe passing of the passing of the sovereign funds and the signal of the purchases 13F reports. The Bank thinks that these three developments will increase the 10 -year Treasury bond premiums and strengthen the correlation with Bitcoin and the price will carry to $ 135 thousand on September 30 and 200 thousand dollars at the end of the year.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.