Bitcoin (BTC) $107,959.36is traded around 111 thousand 970 dollars, the highest level of all the previous time (AC). Currently traded for $ 107 thousand 666 crypto currency5.71 percent in the last week, and the 24 -hour transaction volume was a significant leap of 32 percent. The mobility on this side raised the question of whether Bitcoin will exceed the historical summit this week with the current momentum. Blockchain internal data and price movement supports this possibility.

Blockchain indicators point to a solid rise

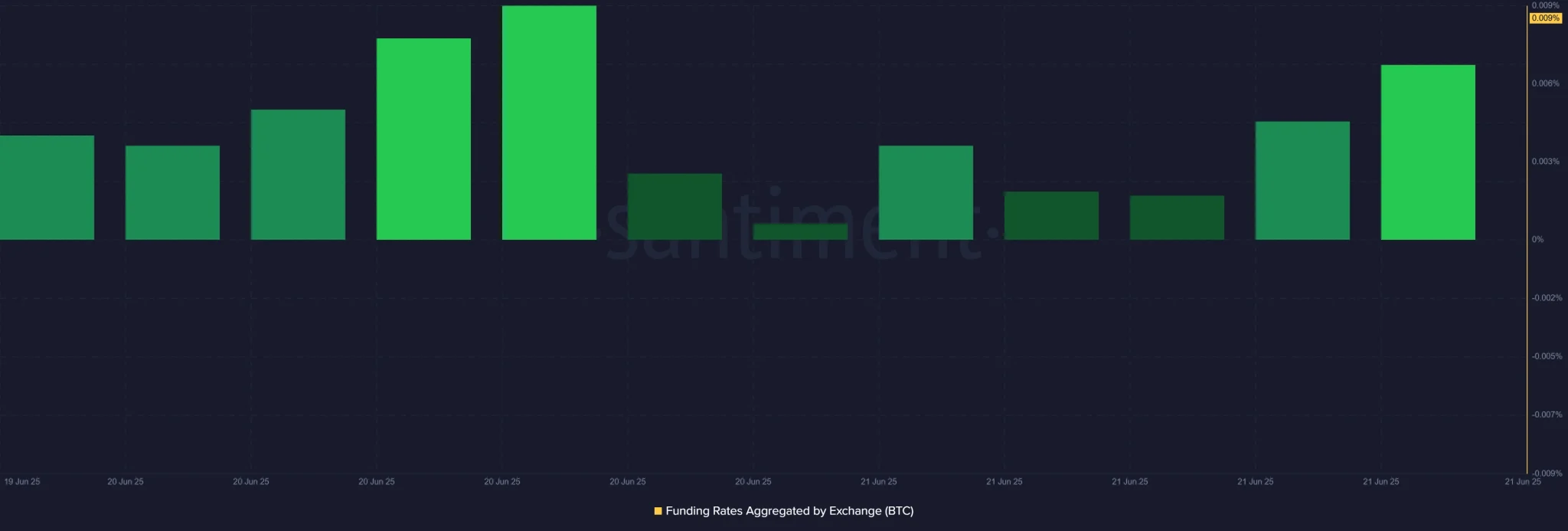

Funding Ratesis still slightly positive on large stock exchanges and is about 0.009 percent of the maximum of about 0.009 percent. 0.009 levels indicate that investors are optimistic, but there is no excessive leverage use in the market. The decrease in the funding rates on June 21 and the following stable recovery indicates that the market has a period of healthy cooling and the overheating in the long positions has passed to cool. This creates an ideal floor for a sustainable upward movement.

Net BTC outputs from the stock exchanges are also at a remarkable point. On June 20, the summit of the Stock BTC entrances were replaced by exits. The fact that investors withdraw their assets from the stock exchanges and possibly carry them to cold wallets is usually interpreted as an indicator of long -term trust. The decrease in entrances to the stock market shows that sales pressure in the short term is reduced. This increases the likelihood that the rise trend in the price is sustainable.

Bitcoin Price Analysis: Important levels in the graph

Bitcoin’s price 0.29 percent during the day and 5.71 percent in the last week with the highest level of 108 thousand 798 dollars saw the highest level. The 32 percent increase in the 24 -hour transaction volume supports the rise and gives clues that there is re -participation in the market. Only a narrow distance of approximately 3.8 percent means that Bitcoin is at a point between the current price and AS at a point where Bitcoin can force the historical summit. If the current momentum continues, it seems more and more possible to test the 112 thousand dollars.

The last peak level can trigger a permanent output “break” processes and escape from Short positions. But the supporters of the rise Ath Before the test, an important psychological barrier should be careful against sales that may occur around the $ 110 thousand level. This region is one of the last important obstacles to reach the historical summit of the price.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.