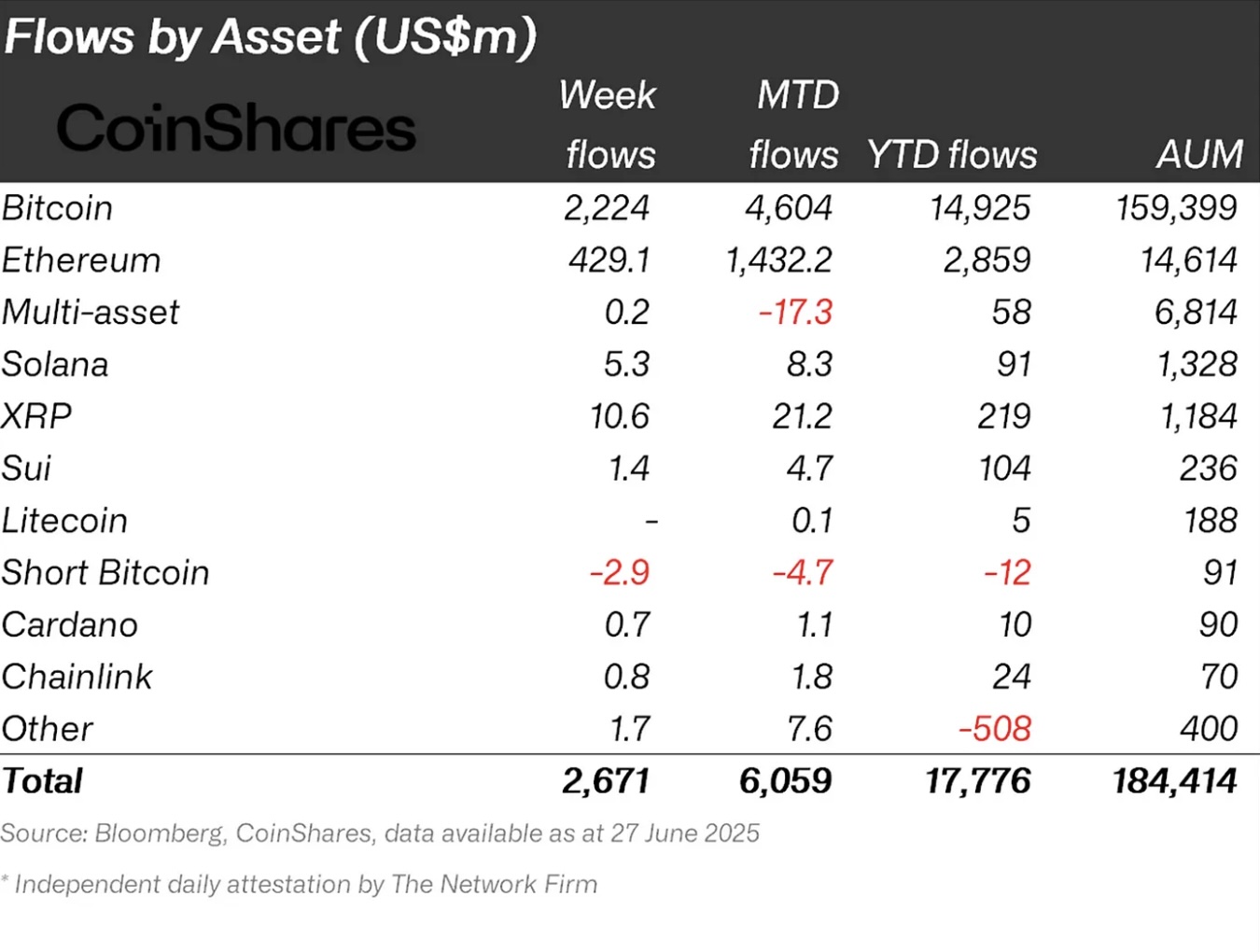

CoinsharesAccording to the latest report published by crypto currency -based investment products last week was 2.7 billion dollars entry. This means that there was a net entry to crypto currency -based investment products in a consecutive week. Moreover, the total entrance in the first six months of the year (H1) increased to $ 16.9 billion. With this performance, the investment products approached $ 18.3 billion in the end of June 2024. The US has undertaken almost all weekly entries ($ 2.65 billion) to crypto currency -based investment products.

Investor Preferences in Bitcoin and Altcoins

Bitcoin (BTC) $107,959.3683 percent of the total weekly entries (2.2 billion dollars) by undertaking the dominant crypto currency continued to be. This supports the optimistic air Short Bitcoin It was $ 2.9 million out of its products. With this output, the total output from Short Bitcoin products since the beginning of the year has reached $ 12 million.

Ethereum (ETH)  $2,465.79 It was also an important introduction of $ 429 million to based investment products. Since the beginning of the year, the total net money that has entered the Ethereum -based investment products has exceeded $ 2.9 billion. The net introduction of $ 2.9 billion reflects the ongoing investor confidence in Ethereum.

$2,465.79 It was also an important introduction of $ 429 million to based investment products. Since the beginning of the year, the total net money that has entered the Ethereum -based investment products has exceeded $ 2.9 billion. The net introduction of $ 2.9 billion reflects the ongoing investor confidence in Ethereum.

Solana Other major Altcoins, such as (left), received much more modest entrances this year. For Solana, the total entrance has only remained at the level of $ 91 million since the beginning of the year. On the other hand XRP 10.6 million dollars last week to based investment products, Sui$ 1.4 million to CARDANO  $0.565347‘Ya (island) 700 thousand dollars, Chainlink

$0.565347‘Ya (island) 700 thousand dollars, Chainlink  $13.24E (LINK) was an entrance of 800 thousand dollars. Altcoin Litecoin

$13.24E (LINK) was an entrance of 800 thousand dollars. Altcoin Litecoin  $85.68 (LTC) -based investment products did not have any input or output.

$85.68 (LTC) -based investment products did not have any input or output.

The current table shows that most of the investor capital focuses on Bitcoin and Ethereum -based investment products.

US leader in the regional fund flow

USAWith a net introduction of $ 2.65 billion, it was completely dominated by regional flows. Switzerland ($ 23 million) and Germany (19.8 million dollars) recorded much smaller -scale entrances.

Canada (13.6 million dollars output), Brazil (2.4 million dollars output) and especially Hong Kong(2.3 million dollars output) net outputs were seen. Hong Kong entered a consistent exit trend after the latest price rise. Only the net output in June reached $ 132 million.

The resulting regional distribution points to different risk perceptions and regulatory environments in global investor geography. The US leading position is remarkable.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.