Bitcoin (BTC) $108,194.45while sitting above 108 thousand dollars with the new week, Ethereum (ETH)  $2,457.01 It has exceeded 2 thousand 500 dollars. Many Altcoins also increased by 5 percent and exceeded. With the rise in prices, investors focused on the statements of important macroeconomic data to be announced this week and the statements of the Great Central Bank officials who will speak at the European Central Bank (ECB) forum. The crypto currency market has compensated most of the losses caused by Iran-Israelian tension and pushing Bitcoin below $ 100,000.

$2,457.01 It has exceeded 2 thousand 500 dollars. Many Altcoins also increased by 5 percent and exceeded. With the rise in prices, investors focused on the statements of important macroeconomic data to be announced this week and the statements of the Great Central Bank officials who will speak at the European Central Bank (ECB) forum. The crypto currency market has compensated most of the losses caused by Iran-Israelian tension and pushing Bitcoin below $ 100,000.

Eyes Macro Data and Powell statements

Analysts closely follow a series of critical macroeconomic data that is expected to be announced this week by market participants and the words of senior central bankers who will talk to the ECB forum. FED President Jerome Powell‘s Tuesday to be held on the Emb forum panel of the UK, South Korea and Japan Central Bank is expected to talk with the heads of the Central Bank.

Powell told US officials last week that the Fed would not be hasty in interest rate cutting. But the US President Donald TrumpOn Sunday, Powell accused the interest rates of ün keeping artificially high ”. These contradictory statements increased the uncertainty of FED’s future monetary policy in the markets.

President of the Presto Research Peter ChungDescribing this week as “important ,, May Jolts and Personnel Exchange Ratio (JOLTS) data will be announced in June, including non -agricultural employment data and unemployment rate. “This year, the foundations in the crypto currency are more powerful thanks to the policy winds and the adoption of the main current,” he said: “If this data shows weakness, interest rate reduction expectations may be strengthened and this may increase risky asset prices, including crypto currencies.”

Customs tariffs maintain its place on the agenda

Kronos Research CIO Vincent Liu He emphasized that investors closely follow the developments in customs tariff negotiations and movements in the US dollar before the 8th of July final delivery dates. Liu, “until the last date of July 8 tariff talks and the ongoing weakness of the dollar markets will attract the attention of this week,” he said.

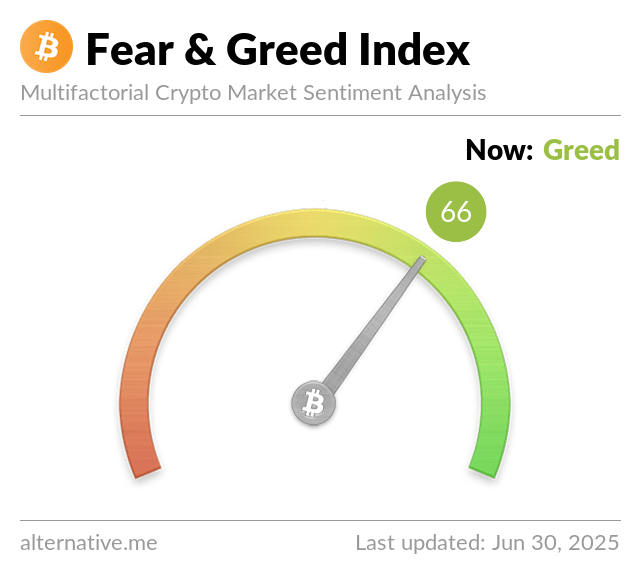

Crypto fear and greed indexStating that the 66 level of 66, Liu warned that market sensitivity is “high, but a major macro change could shake this picture. Liu completed his words by saying, “crypto coins are rising, but trust can be tested. Macro winds are lightened and acceleration occurs with the return of the risk appetite”.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.