Your crypto coins It is not good to be affected and weakened by macroeconomic developments. However, this is not surprising after it proves itself as a class of being. They are now making the risk appetite of corporate investors who determine the direction in crypto currencies, and they have recently purchased strongly. What does the latest data say to us?

Crypto Coins Corporate demand

BTC Currently, $ 108,300 did not exceed, but it also protects $ 107 thousand. In crypto coins For a real movement, we need to see concrete steps of tariff agreements. But for a long time, corporate appetite signals that crypto currencies will perform much better for the rest of this year.

Nic Today is only in the last week Bitcoin (BTC) $107,352.53 listed the companies that make the purchase. Before Mstr And when there are a few companies, new ones are now added to the list, and we see companies that enter our lives with a billion dollar reserve target for BTC reserves.

“Bitcoin companies for their treasures this week;

– Strategy

– Metaplanet

– Fidelity

– ProCAP

– Bitdeer

– SMARTER Web Company

– Mega Matrix

– Panther Metals

– Bitcoin Treasury Corporation

– Lingerie Fighting Championships ”

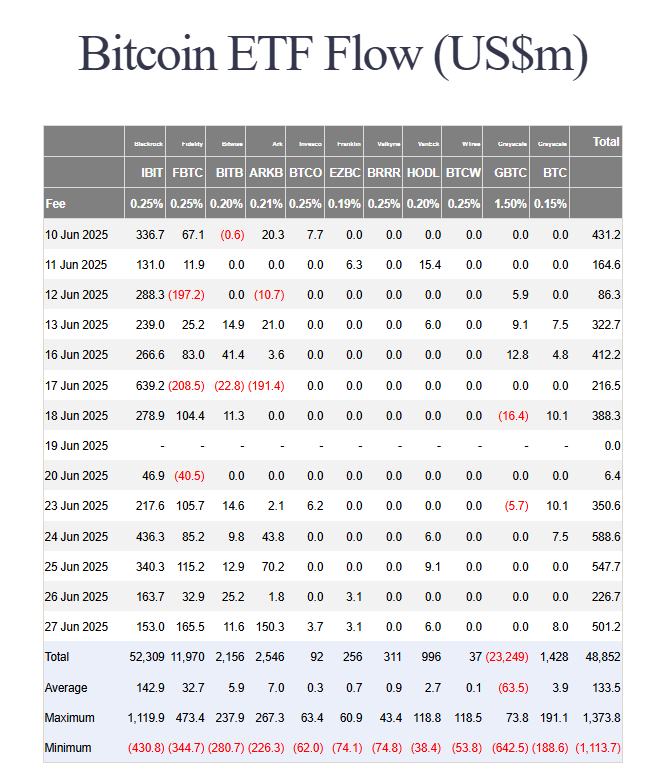

Only on June 27 BTC ETF The entrance in the channel is 501 million dollars. Moreover, the companies that Nic draw attention to are outside the demand of giants such as ETF channel MSTR that add BTC directly to the reserve. This means that we see daily corporate capital inputs exceeding $ 1 billion in a single day. In fact, considering some major purchases of MSTR, the figure may sometimes exceed $ 3 billion.

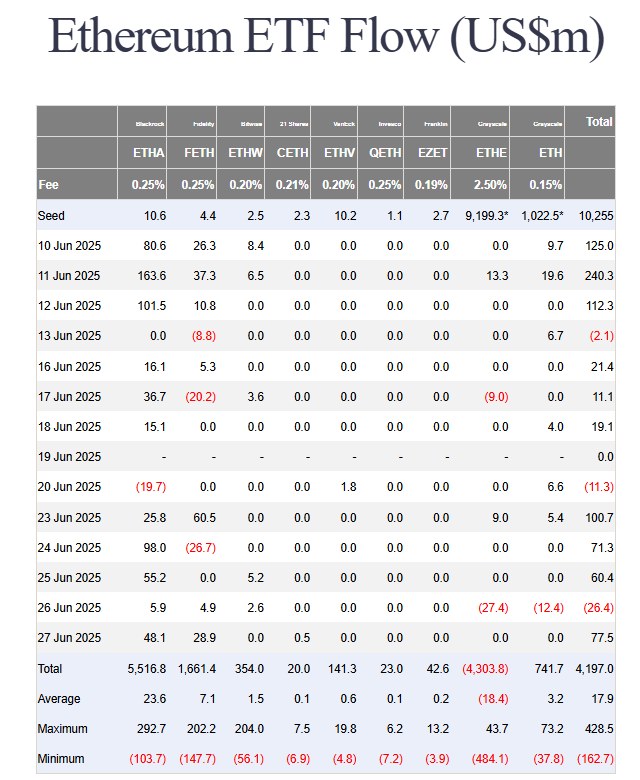

Despite all the developments last week, Spot BTC ETFs entered $ 2.2 billion. ETHs ETFs hosted $ 77.5 million entrance on Friday.

Solana (left)

In recent weeks Solana (left) ETF We see news that it is progressed to its approval. As October, many Altcoin ETF applications will expire and new, crypto money -friendly, subcoins as securities, which are expected to give easy approval. This is quite supportive for left coins in the long run.

However, in the short term Ali Martinez wrote that the price of the left coin gives a sales signal and could go down to $ 146.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.