Crypto Money Exchange Founder and former CEO of Binance Changpeng ZhaoOn June 26, 0.1 BTC’nin sooner than a US house may be more valuable. ZHAO’s claim Fannie Mae and Freddie Mac’s Bitcoin $107,254.55He came right after he invited him to prepare an offer that they could make as a financial reserve in mortgage applications. The biggest regulation housing loan evaluations crypto currencyIt can prepare the ground for the first time to formally recognize the first time. Sector representatives say that this will be an important turn in the institutional acceptance of the crypto currency market.

Roadmap for mortgage with Bitcoin reserve

FHFA Director William J. PulteHe shared the details of the model, where borrowers can offer Bitcoins as financial reserves, on June 26th. Keeping assets in US regulated stock exchanges, documenting ownership and reducing price volatility are among the main conditions. If the regulation is accepted, the credit scoring system will earn a new layer of crypto currency and savings Bitcoinwill expand the access of individuals holding the housing loan.

Finance circles interpret the proposal as an innovative move to protect liquidity in the mortgage market, while critics argues that Bitcoin’s harsh price movements will pose additional risks for loans and debtors. Although the FHFA officials argue that they may balance the risks with volatility reduction, the details of the application are expected to be discussed by congress and sector representatives.

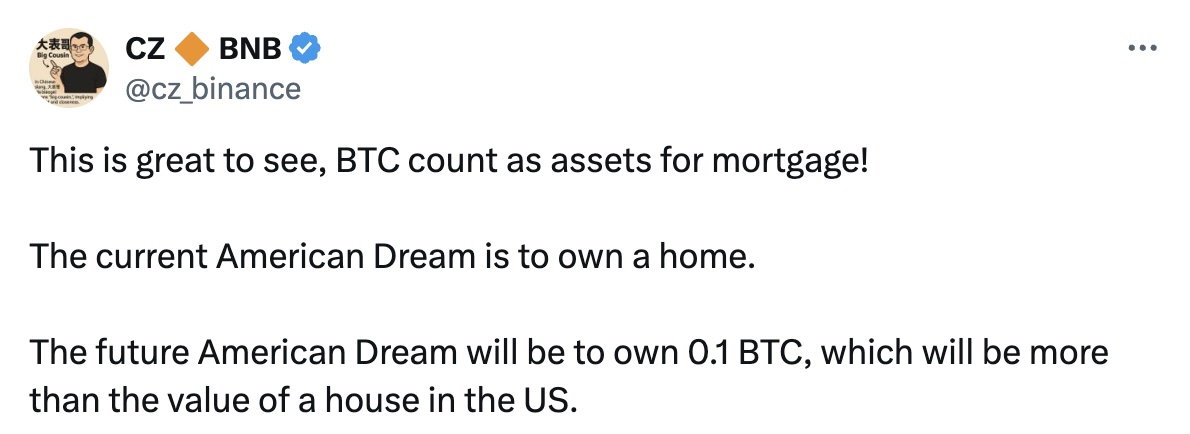

New American Dream: 0.1 BTC

Changpeng Zhao, in his comment on X, not a home of the future “American Dream” in the future 0.1 pieces BTCclaimed that it would be measured by having. The limited Bitcoin supply and the increasing institutional demand draw an optimistic picture for long -term investors. Zhao’s interpretation of the community, while defenders, state institutions to accept crypto currency as a guarantee has become inevitable.

On the other hand, some analysts say that crypto currency -backed mortgages can lead to new fragility by reminding the defaults in housing financing after 2008. In particular, Fannie Mae’nin debtors in the past, the burden of the burden of the burden of the August-October period will be reflected in the balance sheets, indicating that the critics, Pulte’s proposal is part of the search for the market is part of the search for alive. On the other hand, if the regulation is enacted, Bitcoin will win different areas of use in finance.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.