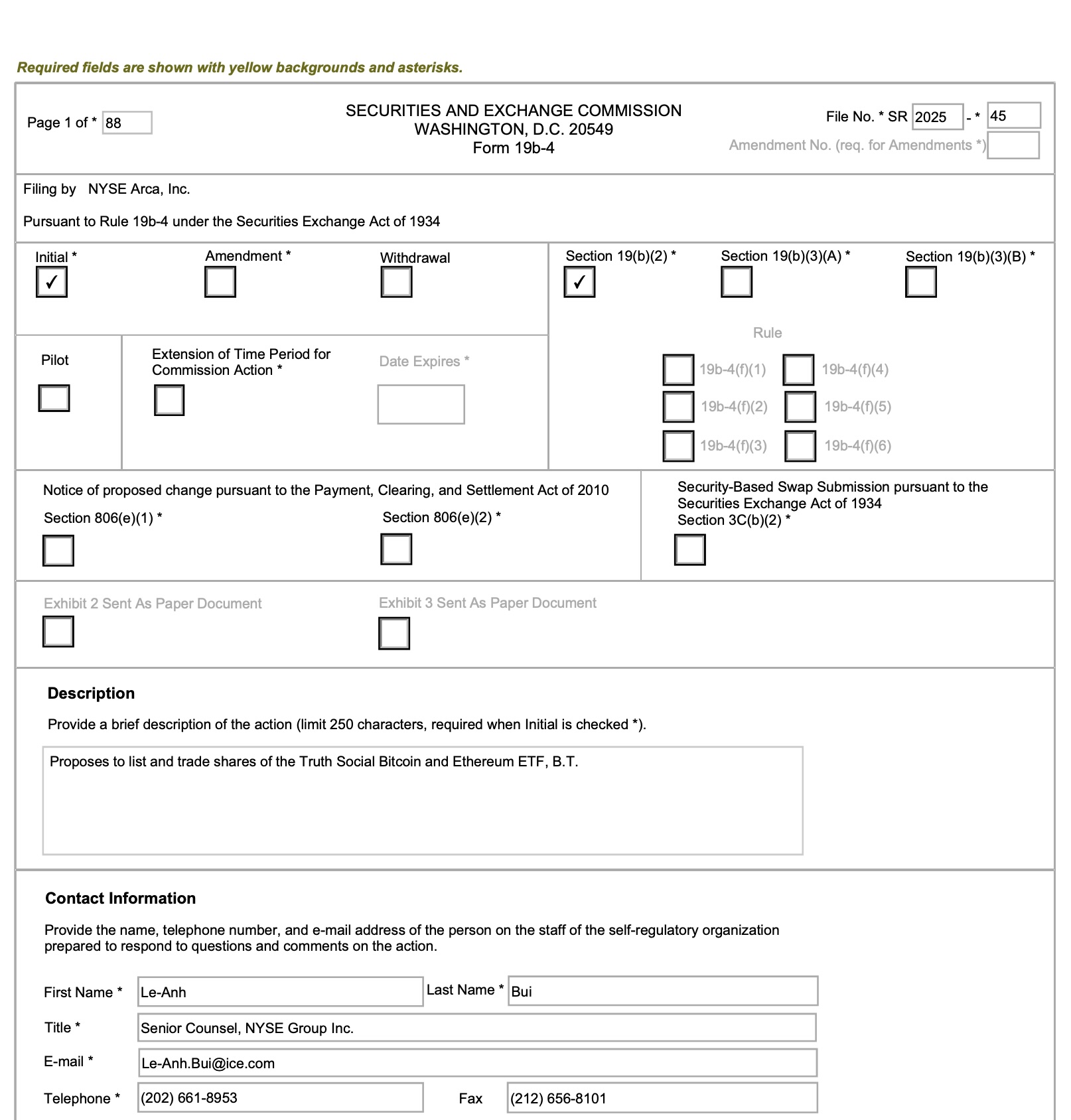

New York Stock Exchange (NYSE), on Tuesday, June 24, 2025 to the US Securities and the Stock Exchange Commission (SEC) with the 19b-4 forms with the majority shares belonging to US President Donald Trump Trump Media & Technology Groupwill be expelled by Truth Social, the social media platform Bitcoin $107,044.36 and Ethereum  $2,422.44 Stock Exchange Investment FundHe demanded a change of rule for the quotation of (ETF). Passive fund aims to reflect the prices of Bitcoin and Ethereum. According to the prospectus conveyed last week, the portfolio initially BTC In terms of value, 3: 1 ratio Eth handle. Yorkville America Digital, the sponsor of the fund, will be the storage service foris Dax Trust Company.

$2,422.44 Stock Exchange Investment FundHe demanded a change of rule for the quotation of (ETF). Passive fund aims to reflect the prices of Bitcoin and Ethereum. According to the prospectus conveyed last week, the portfolio initially BTC In terms of value, 3: 1 ratio Eth handle. Yorkville America Digital, the sponsor of the fund, will be the storage service foris Dax Trust Company.

Details of Truth Social’s new ETF application

New ETF, Truth SocialHe follows the similar application that focuses only on Bitcoin. Thus, the company’s product range is two separate crypto currency It expands with focused funds. 3: 1 Bitcoin-Ethereum ratio aims to balance price volatility, while offering investors access the market’s largest crypto money under the same roof. Yorkville America Digitalsupports the passive character of the fund by undertaking all operational expenses other than the management fee.

Trump Media announced that it plans to establish a “Bitcoin Treasury ıyla with a special share of $ 2,32 billion announced this month. The company also reported that it can recruit stocks up to $ 400 million. All these planning aims to make the Truth Social brand beyond political identity and make it a powerful crypto currency finance center.

SEC has 45 days to decide

19b-4 form Crypto Money ETFIt is the last step of the two -stage application process for si. SEC usually needs to decide within 45 days to confirm the change of rule. Since the file set was completed with the prospectus (S-1) presented the previous week, the first response of the SEC may come to the end of July.

In case of approved, ETF will be traded in the spot market in NYSE Arca and BTC and ETH assets of the fund directly Foris Dax Trust Companywill be held in the wallets of the wallet. A Trump -linked exporter passing through the regulatory test may also lead to new controversy in the sector by bringing the political dimension of crypto monetary policy in Washington.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.