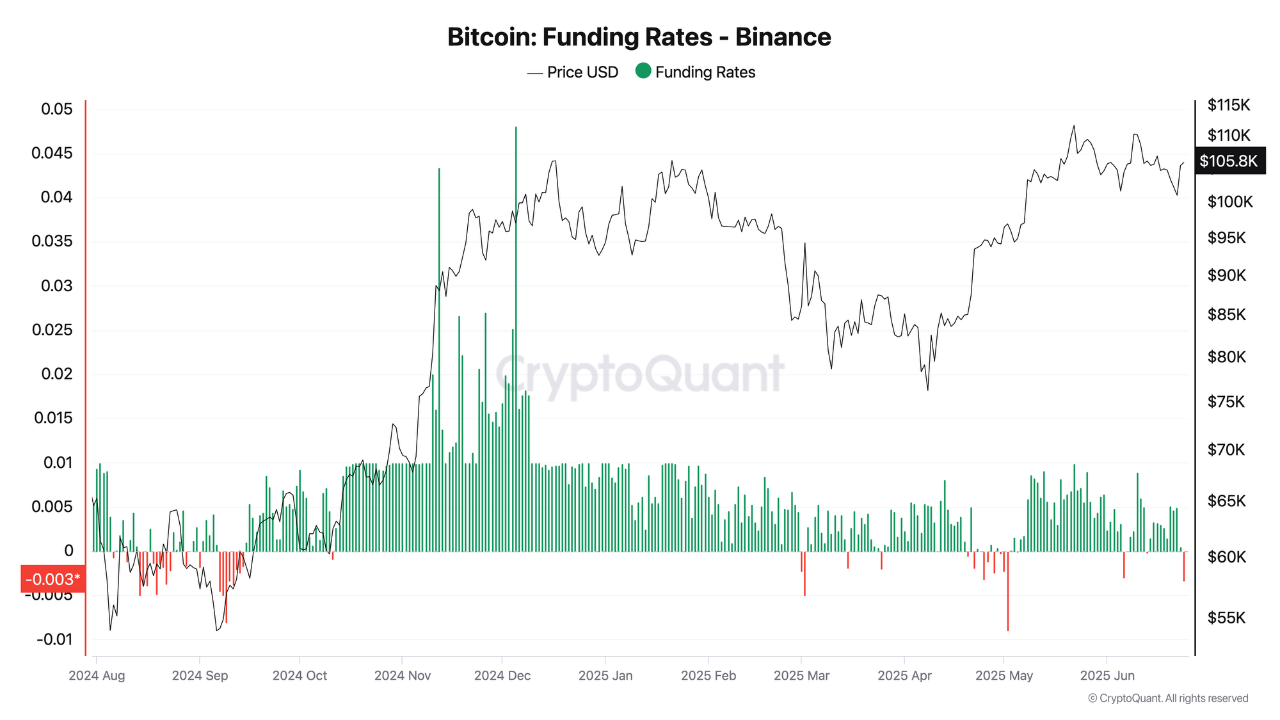

Crypto currency exchange BinancNegative funding rate seen in E Bitcoin $105,439.51‘s (BTC) indicates that the rise, which started from the levels of declining last weekend, may continue. Cryptoquant According to the data shared by the funding rate in the stock market to -0.0033 decreased to the negative area significantly passed. This shows that the majority of open positions are made of short positions that believe that Bitcoin’s recent price rise will not continue. However, analysts emphasize that the market usually moves in contrast to the expectations of the majority, and that this can be a rise signal, especially when the short side becomes overcrowded.

Market dynamics in the context of the funding rate

Funding raterefers to the mechanism that regulates payments between Long and Short position holders in the futures markets. The negative ratio reveals that Short position holders pay to the Long positions and Short positions are dominant in the market.

CryptoquantThe important point that it draws attention is that crypto -term trading market participants are generally more prone to open positions (Long). Considering this general trend, the return of the funding rate in Binance to negative stands out as a remarkable development.

The current negative ratio is a powerful indication that despite the latest strong rise in the price of Bitcoin, a large number of investors still act with the expectation of fall and the market has an extremely pessimistic mood. This is interpreted as a signal that moves opposite to a powerful majority.

Historical Molds and Possible Scenarios

Cryptoquant Analysis offers an important example of how similar situations have concluded in the past. In September 2024, the funding rate in Binance entered the negative region. In almost all of these periods, despite the market pessimistic position, the market soon became rising. The only exception was a short -term macro -economic fluctuation period in connection with the US’s new customs tariff statements.

If this historical pattern is repeated, it is predicted that existing existing short positioning can turn into a repulsive power for the price of Bitcoin. Especially if more investors wait for a price decrease and continue to open a short position, the risk of Short Sort Squeeze () increases. When the price starts to rise unexpectedly in such jams, Short position investors have to quickly close their positions to limit their damages. These compulsory closures further accelerate the rise movement and lead to more severe jumps in the price.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.