Bitcoin (BTC) $102,702.04 price He lost six -digit levels and fell to the $ 98,000 band. The allegations that the Hormuz throat would be closed and the US bombing Iran at night upset the crypto currency markets. In fact, last week, we shared a warning before the decline was so deepening. That analyst was right again and we saw why he insisted on the fall.

Crypto analyst who knows the fall

We shared the previous evaluations of Roman Trading. He predicted the fall correctly and said it would deepen last week. Worst of all, he mentioned the concern that the markets are now a 2021 peak structure. The analyst, who insisted on the fall with an interesting self -confidence, wrote the following with the pride of justifying;

“Again, before falling to 15 thousand dollars in 2021, even in 2021, ignoring the very basic signs of fatigue is amazed. Many of them are about to give up their earnings.”

Analyst He says get rid of it while you’re ready, but there’s a problem. Roman Trading cannot see the future and BTCD How can we talk about a bull summit without experiencing a significant decline trend from the summit, ie the Altcoins have reached the expected rise environment?

China and ETHBTC estimated

China is not directly involved in the war. Russia, on the other hand, talks about hundreds of thousands of Jews in Israel, saying that they will not attack with Iran. But Iran is now threatening the world with the risk of taking everything to afford everything after taking a heavy blow in accordance with the phrase “dead donkey is not afraid of the wolf”. Today’s Hormuz Strait exit and attack signals on US bases were concern. However, the US claimed that nuclear facilities were destroyed. Before the US attack, the negotiation was not given the possibility that “nuclear bases were not hit”. Now there is this possibility. The only problem is whether Iran still wants negotiation.

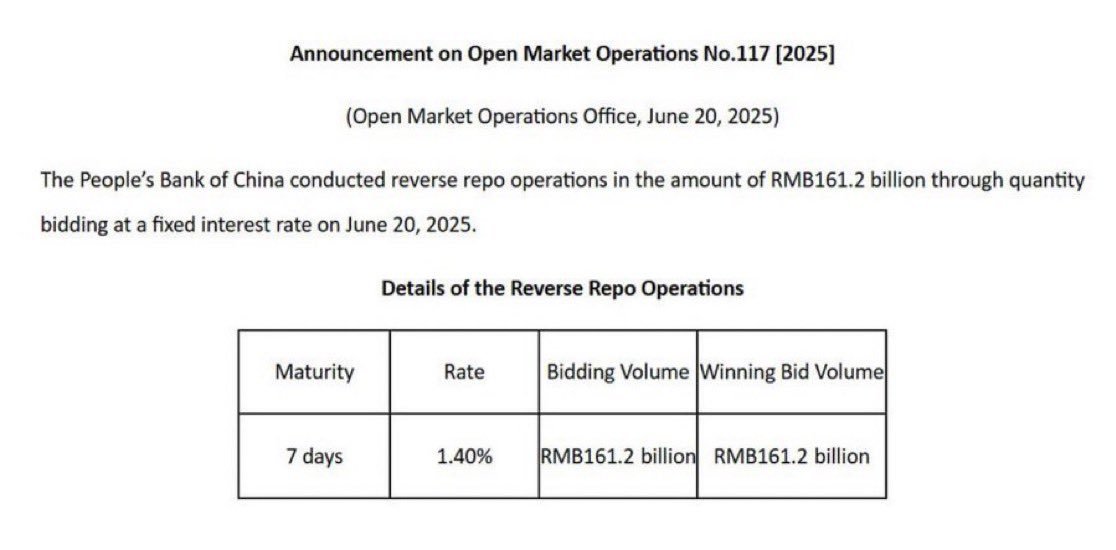

On the other hand Chinese Liquidity continues to pump the market.

“China’s liquidity injections are accelerating. The Central Bank of China provided more $ 22.4 billion liquidity support through reverse repo transactions. Last month, it carried out a huge $ 53 billion liquidity injection.”

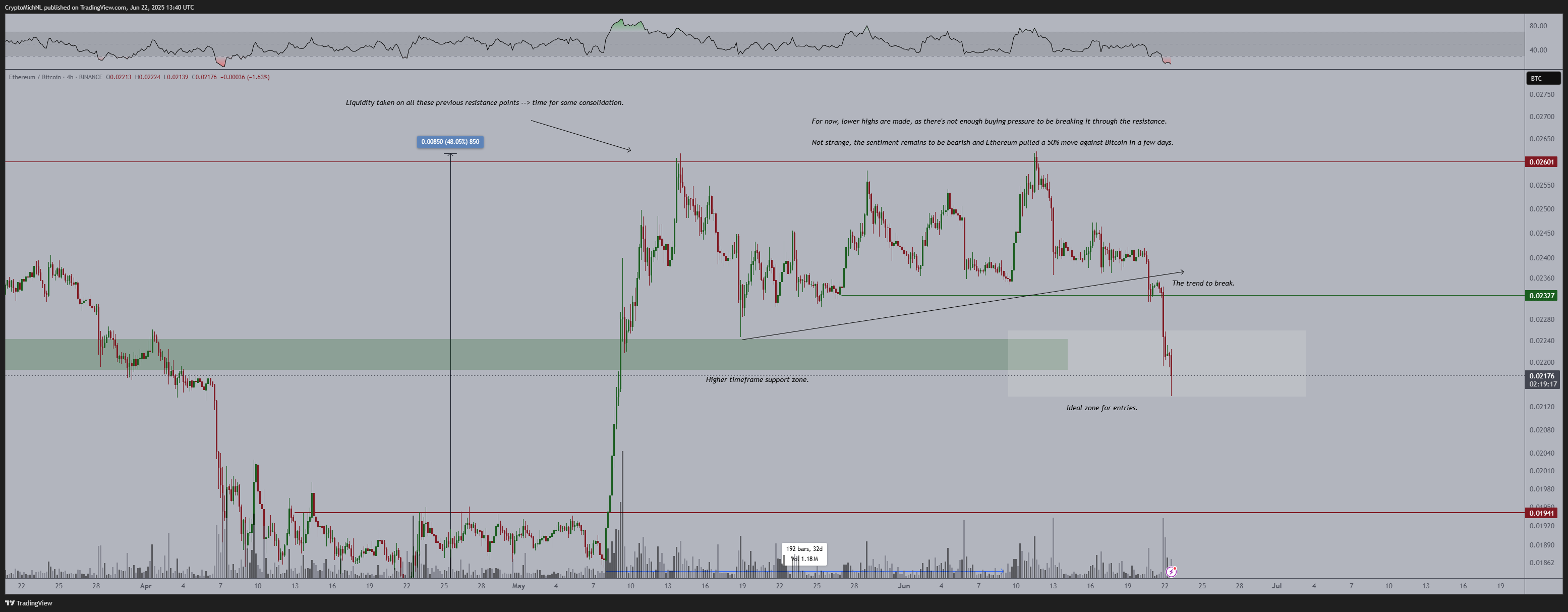

ETHBTC Poppe, who shares the chart, talks about it is a good point for the entrance.

“After starting to lose the trend line, it declined. This situation can be observed in the major volume increase seen during the decline with the introduction of many triggers. These places should be a suitable area for entry.”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.