Bitcoin (BTC) $104,887.63despite increasing geopolitical tensions, it was over 104,500 dollars. With this Cryptoquantdated June 19, 2025 report It gives an alarm for the crypto money market. According to the report, the flows to ETFs have fallen more than 60 percent since April and whale accumulation decreased by half. The demand momentum indicator reached a historical bottom level. Analysts warn that Bitcoin may fall up to 92 thousand dollars or even 81,000 dollars if the demand is weakened. On the other hand Glassnode While interpreting this silence as a natural transition of the market towards institutionalization, FlowDesk He said that the market was stuck and remains uncertain.

In Bitcoin, the demand collapsed before the price

Cryptoquant’s latest data indicates a serious narrowing of demand for Bitcoin. Especially in the USA Spot Bitcoin ETF ‘There is a significant decrease in the interest of investor. The net flows to these funds have decreased by more than 60 percent since the summits in April.

Whales known as big investors BTC The accumulation rate has also fell by half. These two important indicators reveal that the receiving power in the market is significantly weakened. The company’s “demand momentum” follower is at the lowest level recorded recently.

In the light of these data, Cryptoquant analysts warn that the price of Bitcoin can test significant support levels if the current trend continues. The prescribed objectives are mentioned as $ 92 thousand dollars and a pessimistic scenario respectively as 81 thousand dollars. Such a heavy potential decrease is seen as a result of the weakness of historical demand in the market.

Big moves in corporate players

On the other hand, Glassnode, a Blockchain analysis company, is not completely negative for its current market stagnation. The company considers the decrease in market activity as a natural consequence of the increasingly dominance of the crypto currency ecosystem under the domination of more and more corporate investors. Protecting the consistency of large volume money transfers is seen as an indicator that these big players are active in the market.

Another remarkable change in the structure of the market is the size of the derivative markets. The transaction volume of derivative products such as term transactions and options has now exceeded the spot market transaction volume up to 16 times. This ratio suggests that market participants use more complex strategies and risk management tools, so that market behavior deepens.

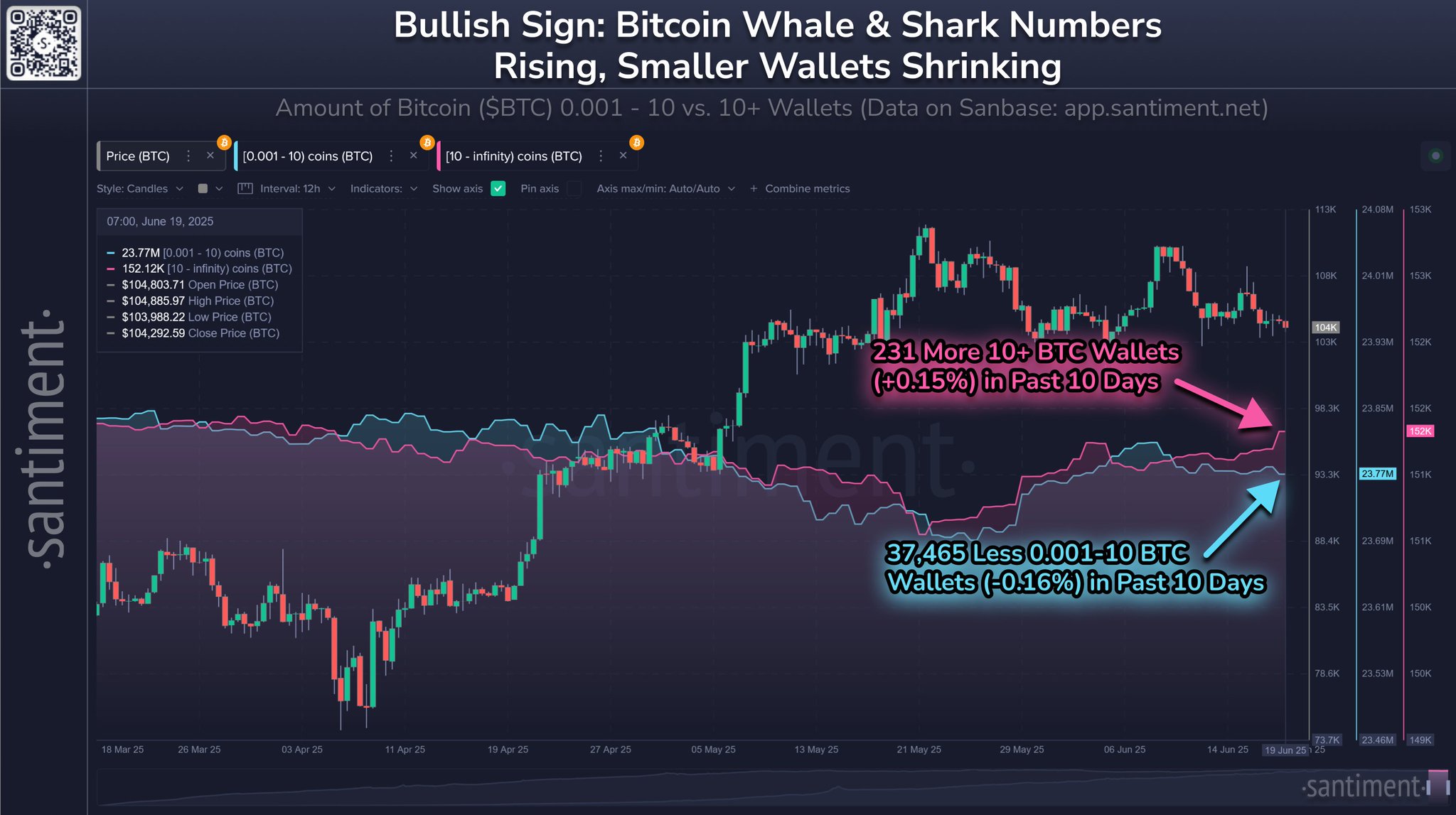

Moreover, the data of Santimement reveals that there is a significant decomposition between small and large investors. In the last 10 days, the number of large wallets with 10 BTC or more increased by 231, while the number of small wallets that hold 0.001 to 10 BTC decreased by over 37,000. Historically, such periods, where individual investors escaped and collected by large investors, were usually harbinger of the upward movement at the price.

Some interpret the fact that Bitcoin is still around 104,500 dollars, as “smart money” has taken a position for the rise. Semler Scientific In the first hours of the day, the company announced that it aims to increase 4 thousand 449 BTCs by financed by stock sales and borrowing by 2027 to 105 thousand BTC.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.