Bitcoin (BTC) $107,041.02In April and May, it attracted all the attention with its strong performance. During this period, the largest crypto currency, which made 46.32 percent remarkable output, gained 18.48 percent especially between May 5-22. Price recovery Compound annual growth rate(CAGR) also increased a new wave of optimism in the market by significantly increased. Analysts think that this development may be a harbinger of a big bull run.

What does the hard rise in Bitcoin Cagr mean?

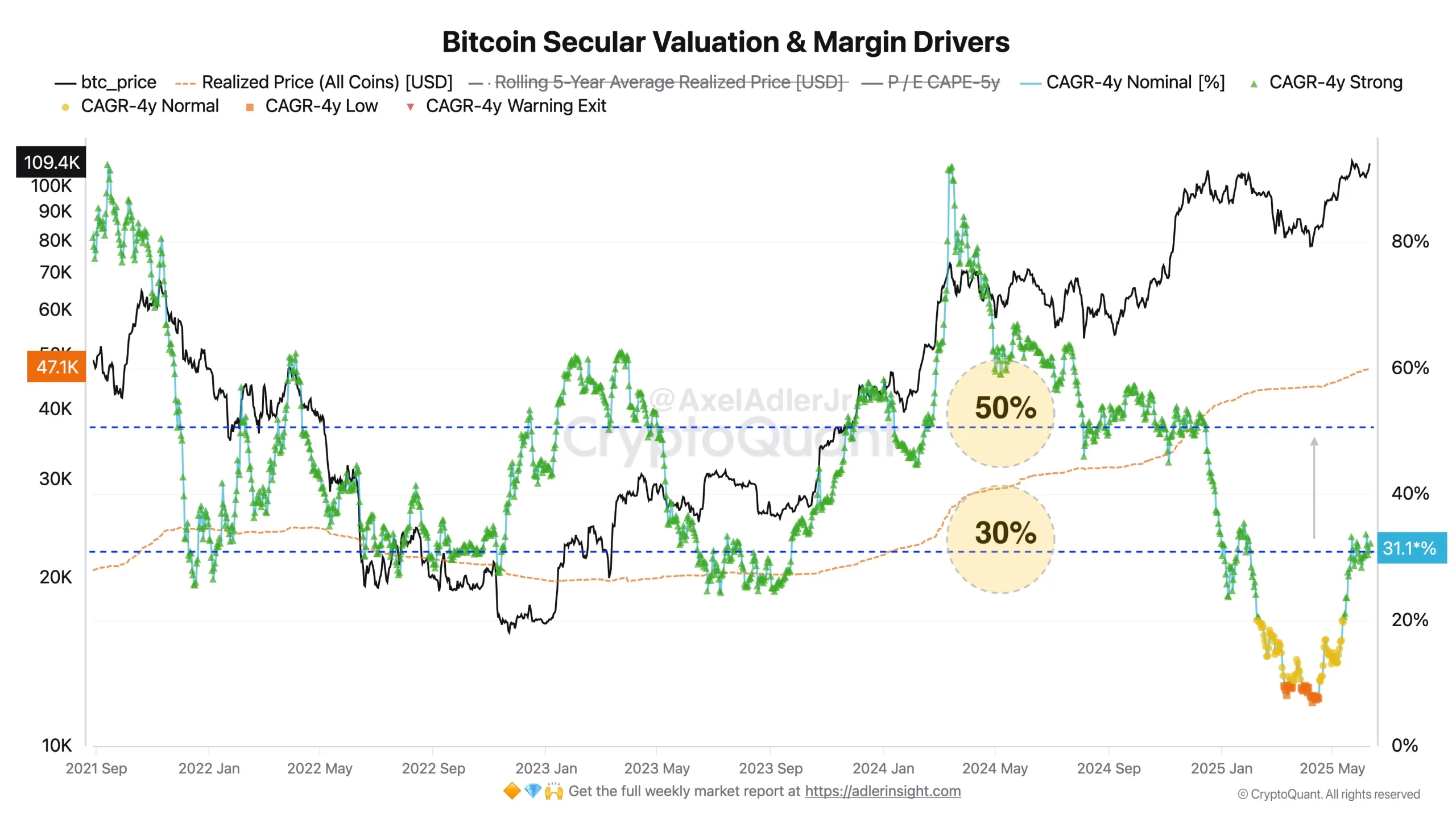

Crypto currency analyst Axel Adler Jr.Bitcoin’s 4 -year CAGR’deki pointed out the significant increase. In April, this rate fell to 7 percent. This is the biggest crypto currencyIt shows that the year started the year with a very strong performance. Bitcoin, which was 9.54 percent growth in January, declined by 17.5 percent in February and 2.19 percent in March. In April, the price saw the bottom of 74 thousand 446 dollars.

However Bitcoin market quickly recovered. According to Adler JR.’s June report, Bitcoin’s Cagr has increased to 31 percent. “This hard recovery shows how fast the long -term trend can change when a strong recipient momentum enters the market,” Adler said. However, he added that the 31 percent Cagr indicator is still below the historical bull market peaks, which points to more rise potential.

168 thousand dollars target for October

ADLER JR., in October Bitcoin’s priceIt predicts that it can reach $ 168 thousand. This price projection is based on the assumption that the momentum in the futures market and leverage use continues.

The analyst’s target of 168 thousand dollars is also based on accelerating growth and historical patterns seen in previous bull runs. Adler Jr. thinks that existing market conditions and increasing optimism can support these levels.

Discussion on Risk Fixing Returns

On the other hand, x user ManuProposed a different approach to interpreting the Cagr indicator. Manu advised CAGR to be divided into a standard deviation to eliminate volatility and highlight risk -corrected returns.

Adler Jr. Although he acknowledges that this approach will show the market performance more clearly, he underlined another critical point and said, “The main turning point comes when investors start their profit purchases based on expected returns”. According to him, Bitcoin’s transaction volume exceeds 1 million BTCs, the risk of the bear market increases. Because large-scale profit purchases disrupt the supply-demand balance.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.