The largest subcoin according to market value Ethereum (ETH) $2,641.32 He began to rise with last month’s reconciliation. For a while, we see that interest in the ETF front has begun to revive again. Moreover, there are other developments. Let’s take a look at the latest comments on the rise of Ethereum, which is extremely important for the general of the Altcoins.

Ethereum (ETH) will rise

When the article was prepared Eth It continues to find buyers over $ 2,600. Jae-Myung won the South Korean elections and Crypto Coins There is also the construction of the constructive regulation. ADP data showed that the danger bells stolen in employment today, and Trump immediately shared “download interests now”. There is a meeting with Xi on Friday and many trade agreements are expected to be signed within 2 weeks.

There are many reasons for the rise. Ethereum is much more suitable for rising after the negative market conditions he has lived for over a thousand days. Moreover, Vitalic Botter said that the improvement that will accelerate the main network 10 times within 1 year will come into play. This detail feeds the expectations that Ethereum, which is exploited by Layer2 solutions, and the weakened ETH price will be strengthened.

Everything is great and the only problem is discussions about tariffs. When they disappear, the FED will return to interest rate cuts and increase the liquidity such as the EU, China, Canada, England and others and take the necessary steps to take the crypto currencies up.

ETH estimates

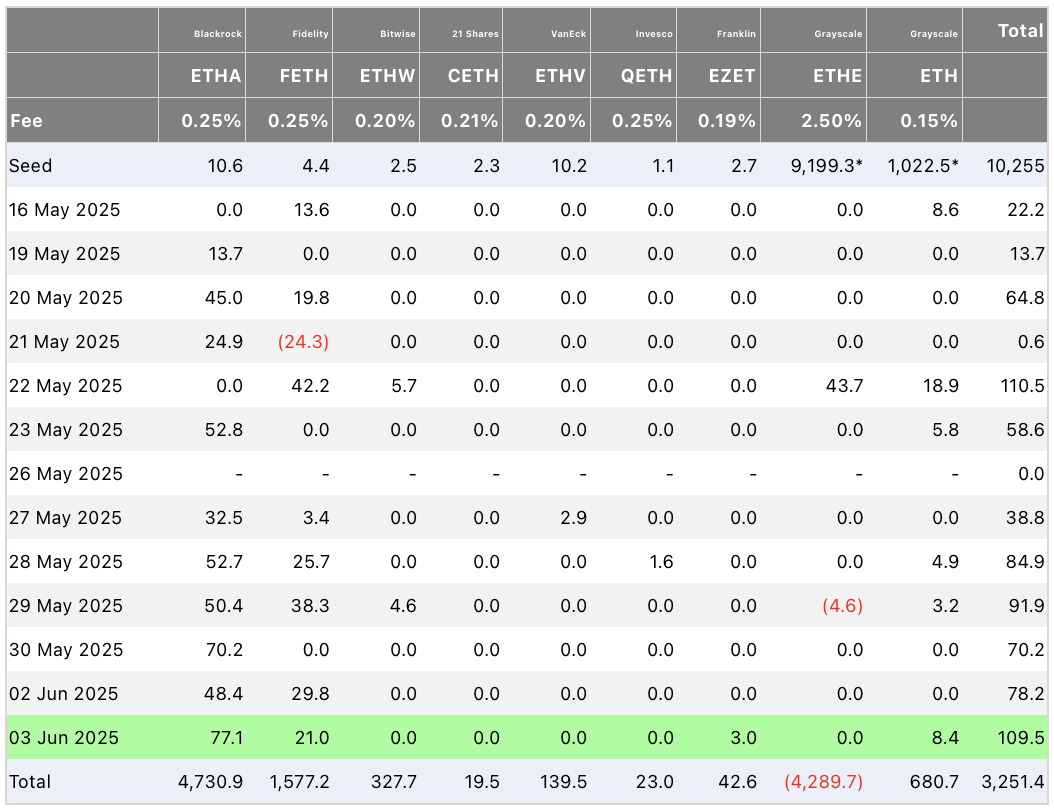

BTC ETF Even though the net entries that last 10 working days on the channel, things are great on the ETH front. ETH ETF products, which have continued to enter net for weeks, have not disrupted the series. Although Grayscale’s ETHE’s ETHE’s output of $ 4.6 million on May 29 BlackrockThe entrances in the product of the product neutralized it.

So why when selling BTC ETF professional investors ETH ETF accumulating? The reasons we described in the first part were probably adopted by them and a great detail for the general of these subcoins.

XO shared the following graph and wrote for ETH;

“Previous date range: 2024 August – November, 90 days.

Current Date December: 25 days and a few more weeks can remain this way – I think do not force this issue. If there is a correction, this will be an opportunity to take this position, if there is a break, the subcoins probably follow him. ”

What needs to be upward fracture closes over $ 2,762 and $ 2,848. If the possible decline, the $ 2,175 and $ 2,082 should be preserved.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.