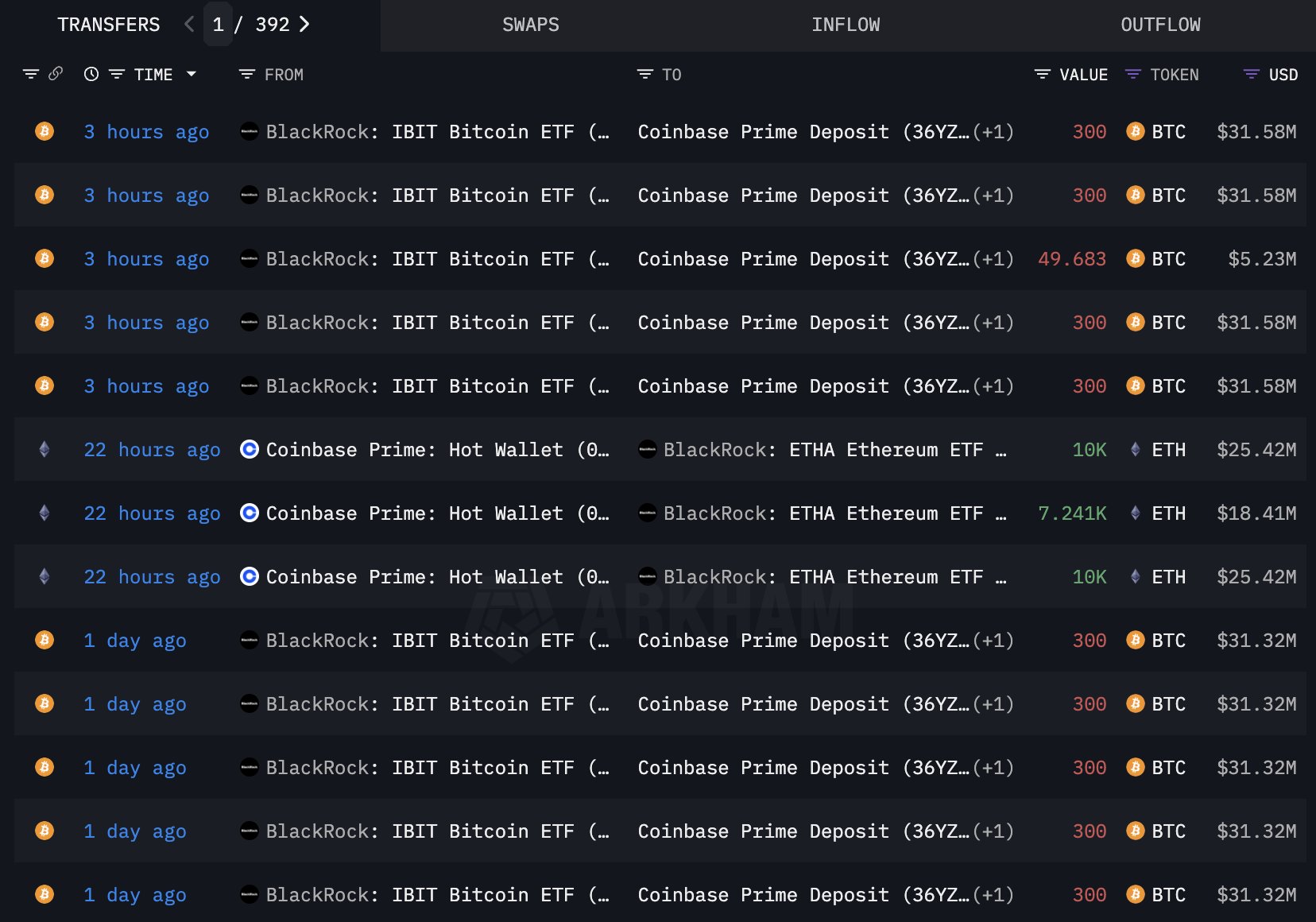

In the last few days, Blackrock has made significant changes in portfolio management. Betcoin worth approximately $ 130 million between 30 May and 2 June of the Global Asset Management Company $105,346.51It was learned that he had disposed of. In the same period, the company’s Ethereum  $2,613.45 Increased assets has been observed and a total investment of $ 69 million in Ethereum is remarkable.

$2,613.45 Increased assets has been observed and a total investment of $ 69 million in Ethereum is remarkable.

Altcoin bull signal

On-Chain data show that Blackrock transferred 5,362 Bitcoin to Coinbase Prime platform. The timing of this transfer is in parallel with the recent major outlets from the company’s Ishares Bitcoin Trust fund. Experts, these outputs, Blackrock’s customers re -evaluating Bitcoin positions, he said.

Customers to shrink in Bitcoin assets during this period, and to increase in Ethereum assets in return Altcoin bull An important signal for.

Blackrock’s output from Bitcoin and his orientation to Ethereum are also associated with the company’s portfolio balancing processes through ETFs. In particular, the important outlets in the Bitcoin Trust fund of Ishares is estimated to have the need to reorganize in portfolio distributions.

Ethereum ETF interest

Sector representatives say that Blackrock’s current strategy takes into account the long -term potential of crypto assets. Furthermore, it is clear that the adjustments made in the company’s portfolio are affected by factors such as global economic developments, regulation debates and market volatility.

Blackrock Spokesman: “We regularly re -evaluate our portfolio in line with market conditions and investor demands.”

After the hope that the tariffs have come to an end and the recovery in the ETHBTC parity, the ongoing consolidation shows that ETH can return to the long -longing days of ETH for the Altcoin bull. Since Blackrock trades on behalf of its customers, this change in strategy should be interpreted as the differentiation of the view of tens of thousands of investments on the market.

Blackrock’s turn to Ethereum by going to decrease in Bitcoin assets is considered as an important signal for the future of portfolio diversification strategies and corporate investment behaviors. It is thought that such movements of the company may have short and medium -term effects on the market. It is among the main elements that will determine the course of the future market movements whether the interest of corporate investors’ interest in crypto assets.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.