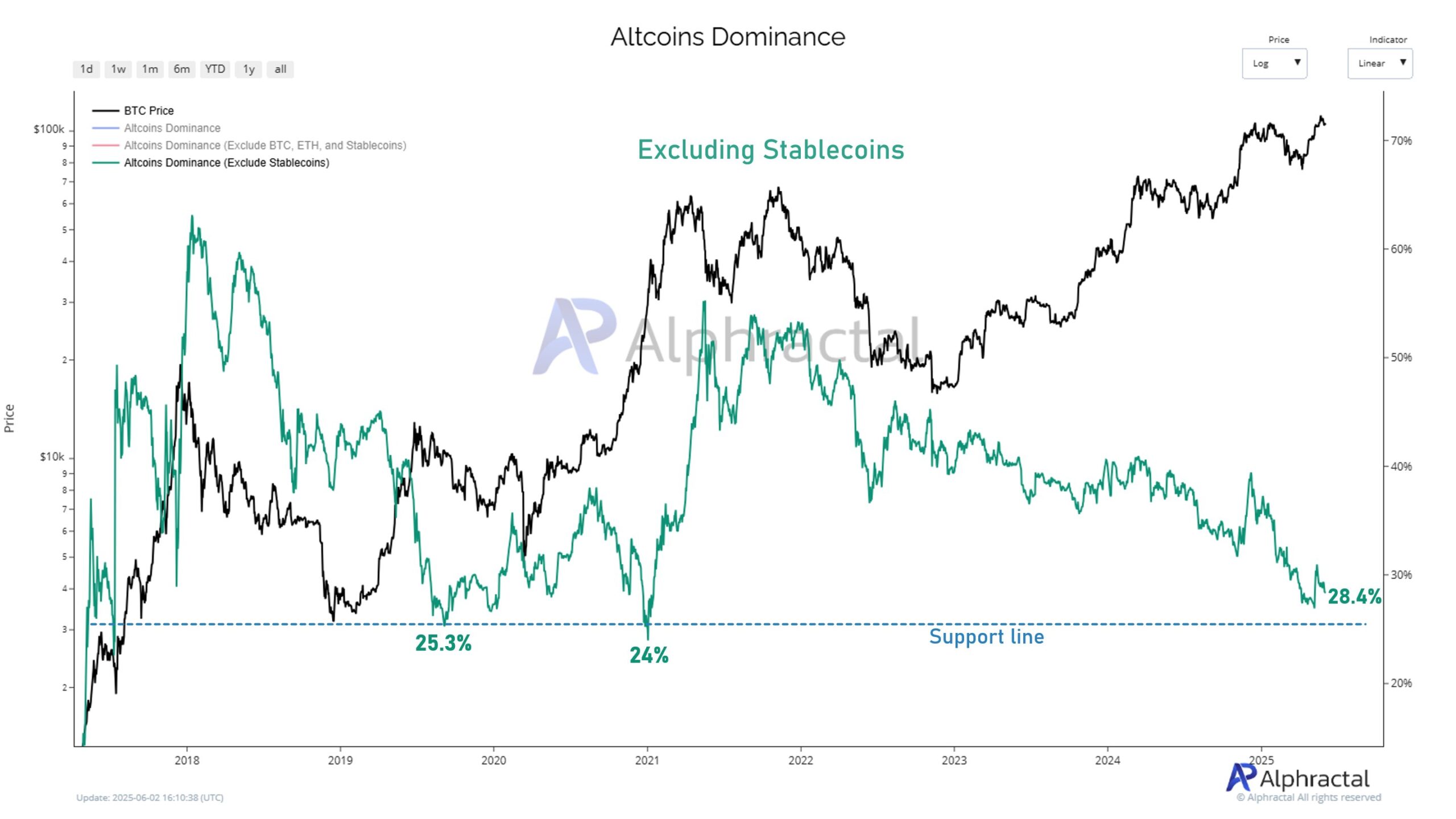

The biggest crypto currency Bitcoin $104,365.15While the market share of (BTC) has once again climbed to 64 percent, the fact that Altcoin dominance approached the historical support zone for a breathless approach to the “big turn”. According to Alphractal data, the market share of Altcoins, except Stablecoins, fell to 28.4 percent. This ratio is only a few points away from the threshold that fires the wick of the subcoin rally in previous loops. Ethereum  $2,486.93‘U (ETH) also shows 18.92 percent of the measurement in the table. This level, just above the 18 percent band that has not broken for years, had harshly rejected Bitcoin dominance and carried the Altcoins to the stage. On the other hand Altcoin season index Only 22 points. So there is still a wide margin for the start of the season.

$2,486.93‘U (ETH) also shows 18.92 percent of the measurement in the table. This level, just above the 18 percent band that has not broken for years, had harshly rejected Bitcoin dominance and carried the Altcoins to the stage. On the other hand Altcoin season index Only 22 points. So there is still a wide margin for the start of the season.

Altcoin domination is approaching the critical region of the date

Alphractal’s series spread over the years altcoin After every period, where the dominance fell to the range of 24-25.3 percent, it reveals that there are hard recovers. At that time, while Bitcoin and Stablecoins dominated the market, the “forgotten” subcoins were quickly recovered and launched the first wave.

Today, the level of 28.4 percent is dangerous to the range in question. Although thousands of new projects in the market increase competition compared to previous cycles, past data show that the main dynamics have not changed. In other words, capital migrates to the point of return. As long as investor’s psychology maintains the formula il Snow in Bitcoin, excitement in Altcoin ”, these rates can still be critical triggering.

The alternative graphic that excludes Ethereum and Stablecoins Altcoin marketHe shows the rest of the naked. It is seen that the 18 percent threshold works here as a strong support. Bitcoin dominance quickly loses altitude and returns every time this threshold is tested. The explosions in 2019 and 2021 have started from this region. Some Altcoins offered exceeding 50 times of returns during this period. Today, 18.92 percent of the level of miles of downward printing may be laying the foundation of a similar scenario.

What do the Altcoins do if Bitcoin dominance falls from the summit?

Bitcoin’s 64 percent market share in 2019 and 2021 reminds the “hard ceiling”. In those years, BTC’s market share brakes at the same point, and then the Altcoins took over the stage with price and volume increases. He implies that the main player of the current graphic crypto money market, shared by Cryptoelites, is once again subjected to pressure.

When the purchase appetite reaches saturation in Bitcoin, the search for return naturally shifts to high -beta assets. Procurement of profit in the traditional cycle of the market BTCLiquidity multiplier grows as you move from ‘to subcoins. Even projects resistant to volatility can write the rise of “double -digit” rise in a few days.

The Altcoin Season Index is stuck in 22 points. The fact that the index over 75 will be the official approval of the “Altcoin season .. Past data says that the process of up to the threshold lasted on average for several weeks. On the other hand, factors such as macro climate, ETF inputs and uncertainties of regulation can feed volatility. However, the technical signals emphasizes that the support-reasons balance is ready to break in favor of Altcoins. Even if shock sales are seen in the short term, the circular picture remains positive on a wide scale.

In short, soon Altcoin dominance Contacts the support band, Bitcoin’s market share goes down on the date of the historical hill, and if the Altcoin season index rises, the door of a new Altcoin season can be opened.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.