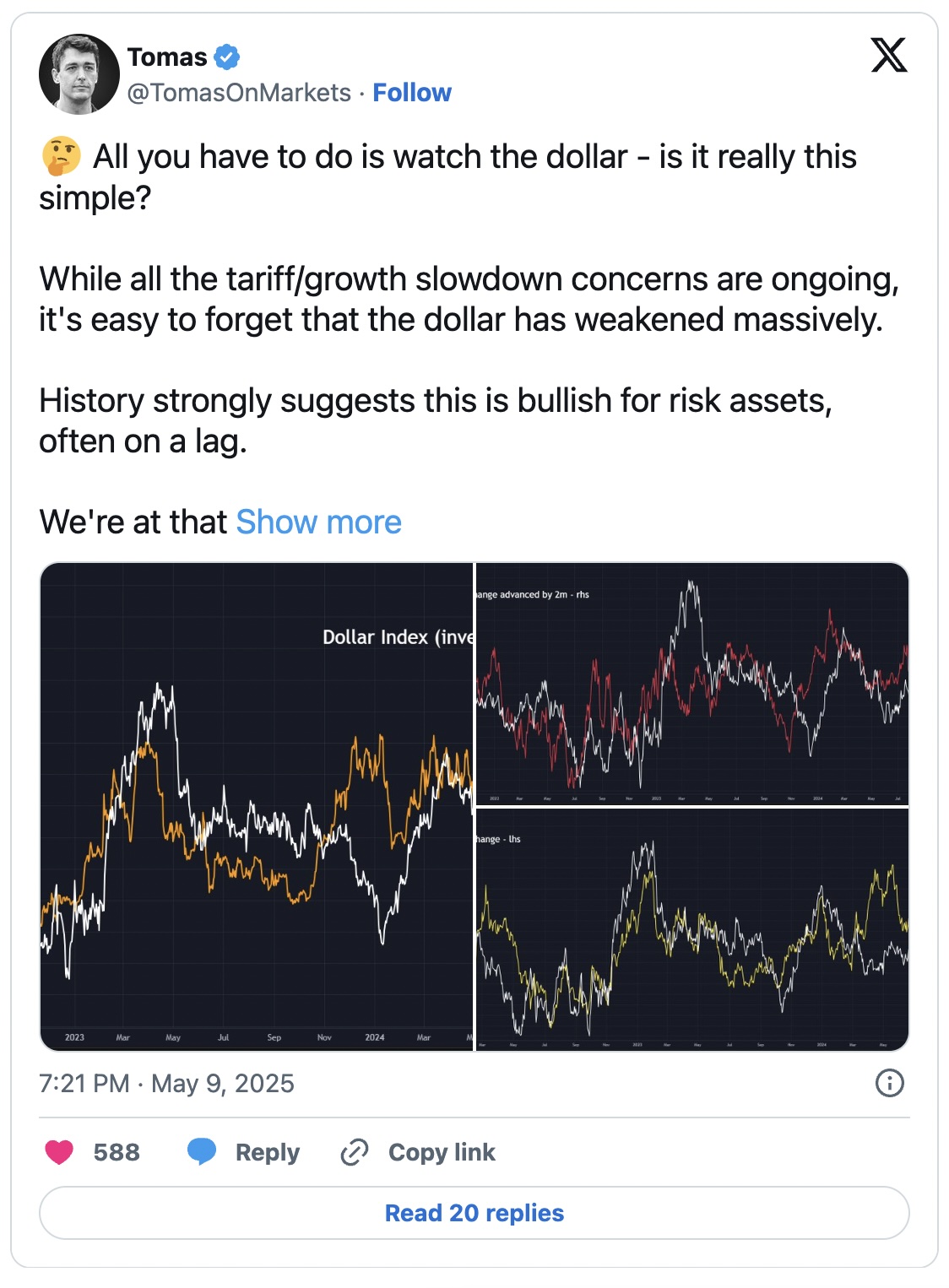

Crypto Money MarketOne of the most important developments in recent days has been the potential impact of the harsh decline in the US Dollar Index. In the analysis shared by Economist Tomas on the X platform, it was emphasized that the decrease of 3.93 percent of the dollar index in the first quarter was drawn into a strong rally from three months behind. Bitcoin (BTC) $104,489.94 He took his share of this dynamics and exceeded the $ 100 thousand dam in the month. If the previous correlations are repeated again, it will not be a surprise that Bitcoin climbs to $ 150,000 to 200 thousand dollars during the summer.

Weakened Dollar Index and Bitcoin Price Dynamics

According to the data compiled by Tomas, 108,512 points at the beginning of the year US Dollar IndexAs of March to 100,424. Particularly in April, the decline approaching 4.36 percent served as a macro catalyst that increased the risk appetite. Historically, especially with the weakening of the dollar crypto currency It is seen that the procurement pressure in the market and stocks gained strength.

Bitcoin also followed a wavy course in the first week of May, but made a premium of over 10 percent between May 1-5. 6.46 percent of the single -day attack on May 8 is the net sign of the three -month delayed rally signal, according to Tomas. Therefore, the weakened dollar index Bitcoin’s priceIt has become one of the main factors that directly feed the acceleration.

150 thousand – 200 thousand dollars expectation in Bitcoin

According to the economist’s prediction, when the three-month delay rule is operated, Bitcoin is likely to rise up to 150 thousand-200 thousand dollars in July-August period. In this scenario, the rise of 10.2 at the end of May is the preliminary harbinger of the great rally that appears on the horizon. Stocks can also react similar, but S&P 500 And NASDAQ 100 The effect of decreases in the indices of around 5 percent is not as clear as Bitcoin.

On the other hand gold In this cycle, it continues to exhibit positive correlation with dollars. The price of gold rising 19.16 percent in the first quarter may have already priced the weakening of the dollar. Tomas pointed out the risk of a possible recovery in the dollar for the sales pressure for gold, and the risk of causing acceleration loss for Bitcoin.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.