Bitcoin $103,267.87 price On May 9, it reached a new summit by exceeding $ 104,000. Behind this rise is the relevant increase of corporate investors, intense demands for ETFs, and the increase in the tendency of companies to adopt Bitcoin as a reserve asset. In recent years, important developments have created a remarkable acceleration for the crypto currency market.

Corporate Crypto Investments

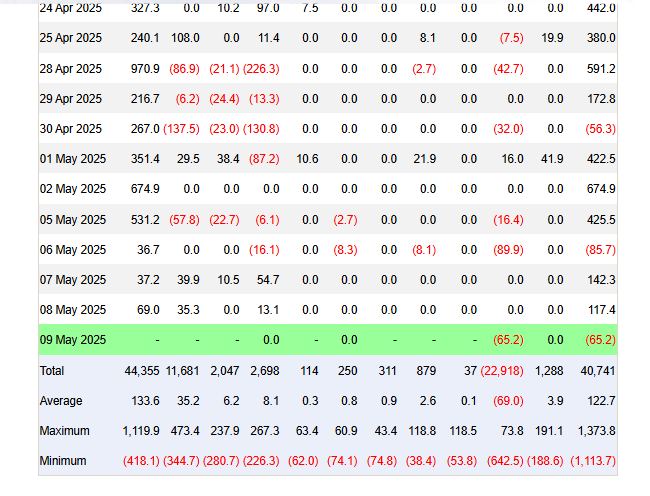

Banks, asset management companies and various organizations have started to show more relevance to Bitcoin. Most of the demand comes through BTC and ETH Spot ETFs. These funds, which are indexed to the performance of one -to -one crypto assets, keep BTC and ETH in their reserves. According to James Seyffart from the Bloomberg ETF unit, the total entries in Spot Bitcoin ETFs have reached a record level with $ 40.33 billion. This figure points to a great recovery despite the decrease in the beginning of the year.

Bloomberg Senior ETF analyst Eric Balchunas emphasized the importance of net entries in ETFs.

Eric Balchunas: “Net entrances are the most important metric to be followed. It is an impressive success for them to reach such a quick new summit.”

It is reported that the resistant attitude in ETFs enables investors not to panic during market corrections and even increased purchases during these periods. The data reveals that many investors tend to protect their long -term positions instead of short -term earnings.

Bitcoin Reserve Strategy

At the macro level, the process of adopting Bitcoin as a reserve asset is accelerating. Speaking at the Strategy World 2025 event, Strategy Chairman Michael Saylor said that companies holding Bitcoin reserves have gained strength.

Michael Saylor: “Companies that hold Bitcoin reserves become increasingly stronger.”

Simon Gerovich, CEO of Japanese Metaplanet, believes that many companies will add Bitcoin to their reserves in the coming period.

Strategy CEO Phong Le estimated that the number of companies that hold Bitcoin on a company basis next year may increase from 70 to 700.

Phong Le: “The number of companies holding Bitcoin as a company may increase very quickly.”

This prediction shows that if the institutional demand continues, Bitcoin may be a popular reserve asset for companies.

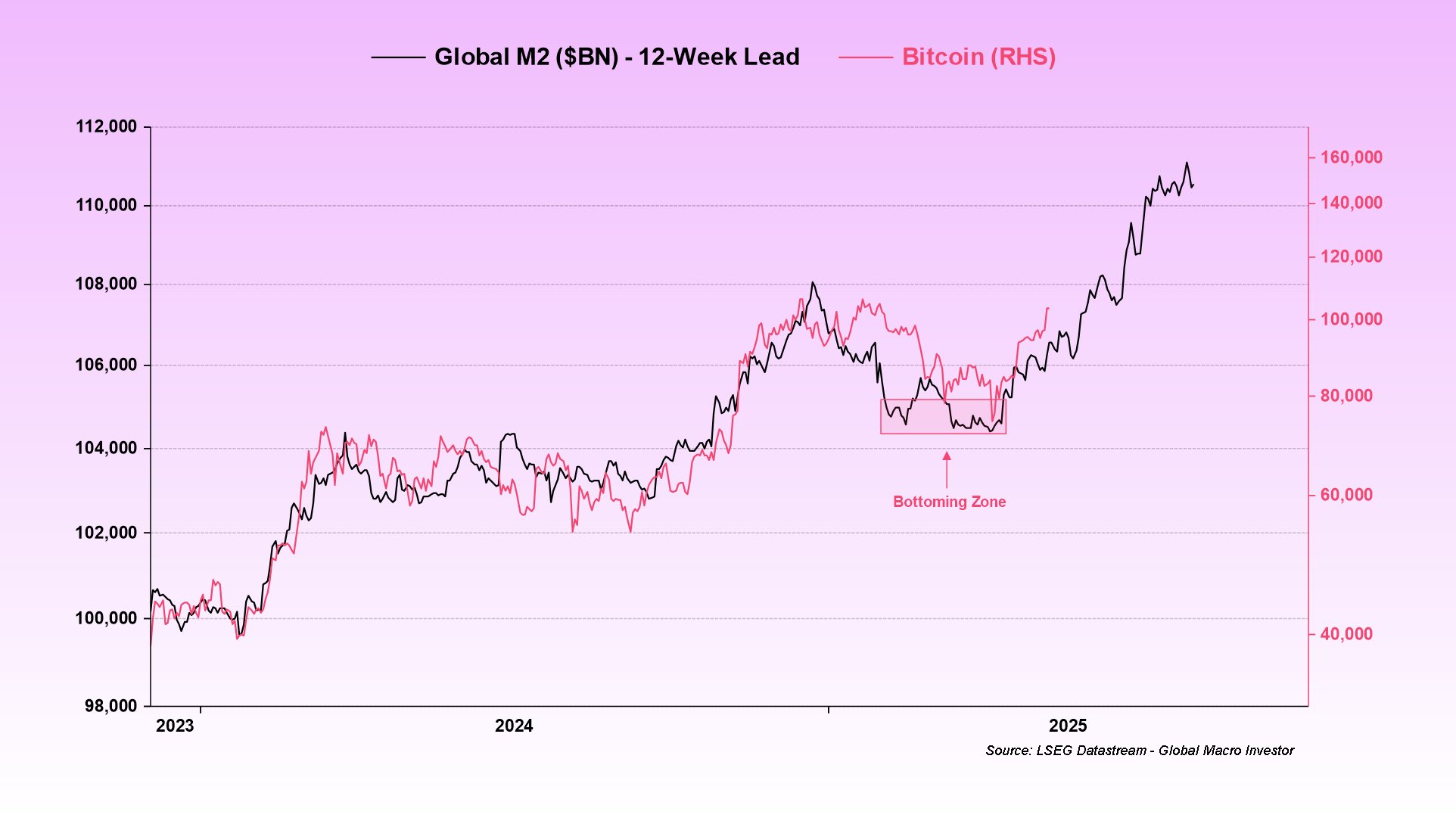

Money supply and crypto rise

According to the data shared by Julien Bittel of Global Macro Investor, Bitcoin price There is a strong relationship between global M2 money supply.

Julien Bittel: “Many of you wanted updated global M2 and Bitcoin graph. Here… and yes – still tells the same story: we are rising…”

Inflation concerns and concerns about the US dollar are among the influential factors in investors’ orientation to Bitcoin, but we have seen negative performance in uncertainty. Now, BTC is rising because uncertainty is reduced. In other words, we cannot say that BTC is a safe port in this minval. However, it is an undeniable fact that the average annual growth rate is high for many shares, which provides strong protection against inflation in the long term. Of course, this does not mean that you put your money in your pocket by breaking your BTCs in a profitable way when you need it. BTC rises when you want, and your money protected from inflation (more than 70 %melting during the fall during the fall) returns to your pocket at the 4 -year loop summit.

Recent developments reveal that Bitcoin is increasingly adopted as a means of asset protection for both corporate and individual investors. The serious strengthening of ETFs, diversifying the reserve strategies of large companies with crypto assets, and macroeconomic dynamics support the upward movement of prices. Investors tend to evaluate Bitcoin long -term due to liquidity and market confidence. When all these elements come together, it is seen that the basis of the rise in the market has a multi -faceted and stable demand structure.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.