Key Highlights

- PYTH will unlock 2.13 billion tokens (~$1.24B) on May 20, doubling its circulating supply.

- Optimism (OP) will unlock 386 million tokens (~$587M) on May 31, also doubling its supply.

- PYTH shows weak On-Balance Volume (OBV) despite a minor price recovery, with $0.12 as critical support and $0.215 as key resistance.

- OP remains under all major EMAs with improving Chaikin Money Flow (CMF), but faces strong overhead resistance at $1.071 and $1.4.

- Both tokens face sell pressure, with rebound hinging on volume; PYTH OI drops while OP shorts rise, signaling market caution.

Pyth Builds Bearish Momentum Before Unlock

Pyth Technical Analysis: Mild Recovery, but Caution Prevails

Currently, PYTH Coin is priced at approximately $0.139, which reflects a modest rise since yesterday. Following months of decline from late December, when it was trading near $0.55, the upcoming unlock of more than $86M presents additional volatility risk.

Of importance, the support zone at $0.12 has held thus far; this is pivotal. The next key resistances are:

$0.215 (23.6% Fibonacci) → key breakout area

$0.275 (38.2% Fibonacci) → observe for new momentum

The RSI is to ~45.28, indicating a modestly stronger momentum, but still beneath the neutral 50. The CMF (~+0.08–0.12) indicates steady inflow of capital, which is encouraging. That said, the OBV at ~1.07B is still beneath it’s high (~1.2B) indicating still soft buying pressure.

The price is still under all major EMAs (20/50/100/200) which still reinforces the bearish broader trend. If $0.12 breaks, next critical level to the downside is $0.10, which could initiate some more selling pressure.

Overall the bias remains bearish leading into the unlock, unless PYTH can break above $0.215 soon, if discounting any potential momentum flip/catalyst. Just watch most possibly for short squeezes, if sentiment turns.

Optimism (OP) Shows Bearish Trend and Critical Support Test

Presently, Optimism OP Coin is trading near the $0.632 level, having suffered a long and slow decline down from its peak of $2.773 in December 2024. Adding to volatility perceptions, a large token unlock occurs on May 31 (~386m OP worth ~$587m about to drop into networks).

The RSI indicator on the Daily chart below has nearly fallen to the oversold zone of ~36. This shows sellers are in control but opens OP up to a short term bounce potential should shorts become overcrowded.

The EMA 20/50/100/200 stack shows OP remaining in a down trend under all major averages, with bearish slope confirmation. Again, a meaningful recovery will require OP to reclaim at least the $1.071 (23.6% Fibonacci retracement).

On the volume side, our OBV has now made lower lows near |~415m| and deterioration has persisted. CMF has made lower lows as well recently, at around –0.04, which signals continued net capital outflows.

Structurally, OP’s price remains compressing within a descending channel / falling wedge and is testing the critical support zone of $0.545–$0.600. Should we break this level, the next downside risk opens up below the $0.50 range. The first bullish signal we need to see would be reclaiming the $1.071–$1.4 resistance band (23.6–38.2% Fibonacci) which is no doubt going to be predicated on seeing some rotational volume and sentiment shift post the unlock.

Derivatives Insight: PYTH and OP Show Diverging Risks Ahead of Token Unlocks

PYTH Network (PYTH)

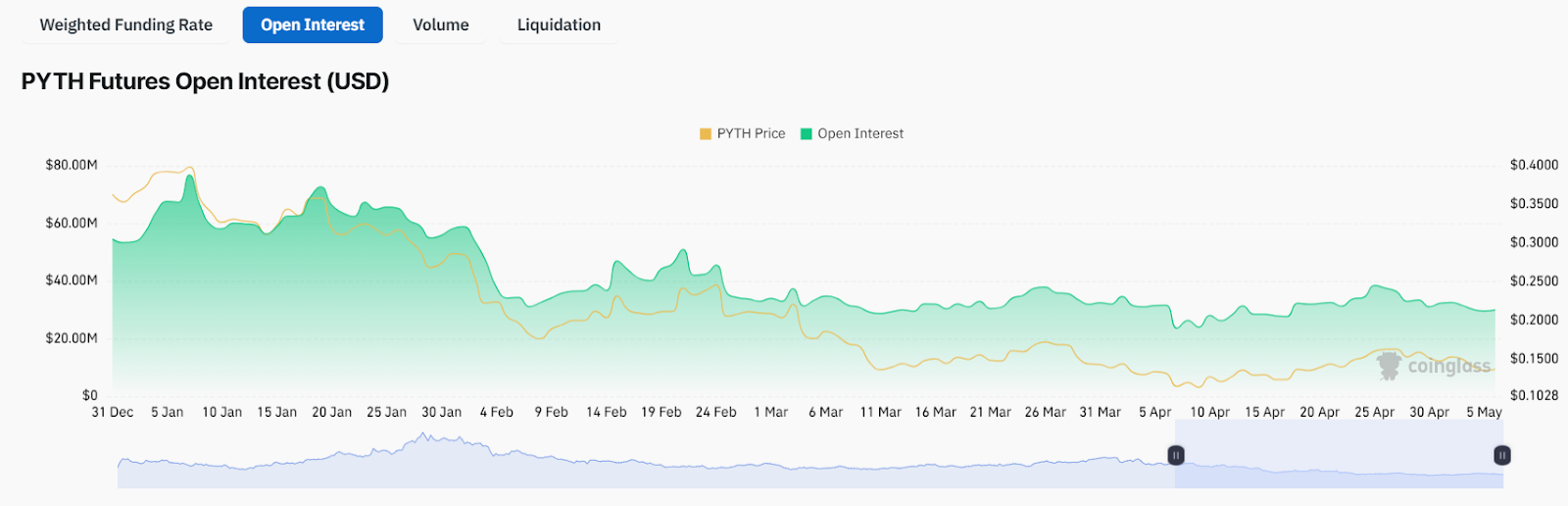

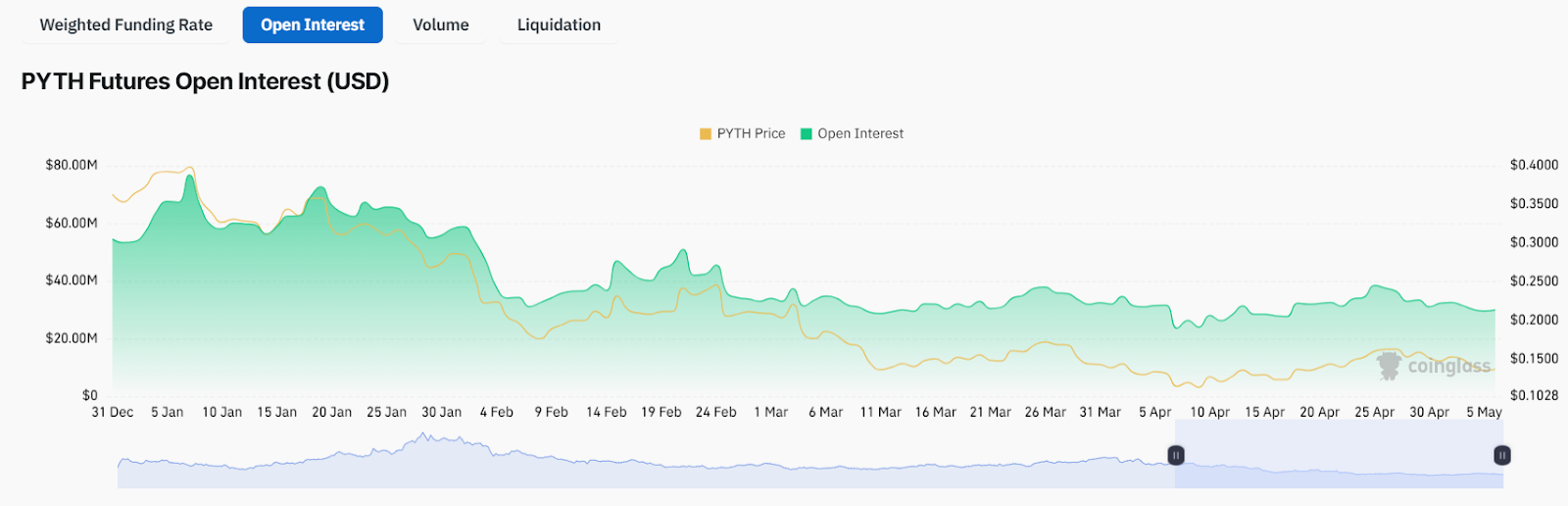

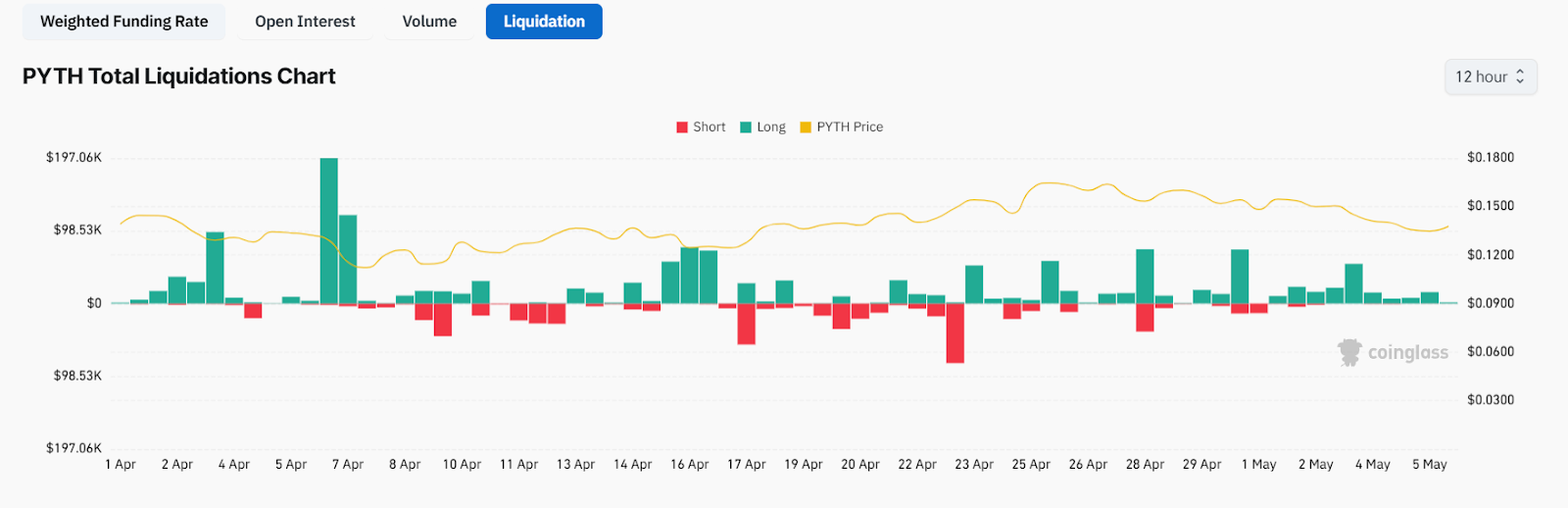

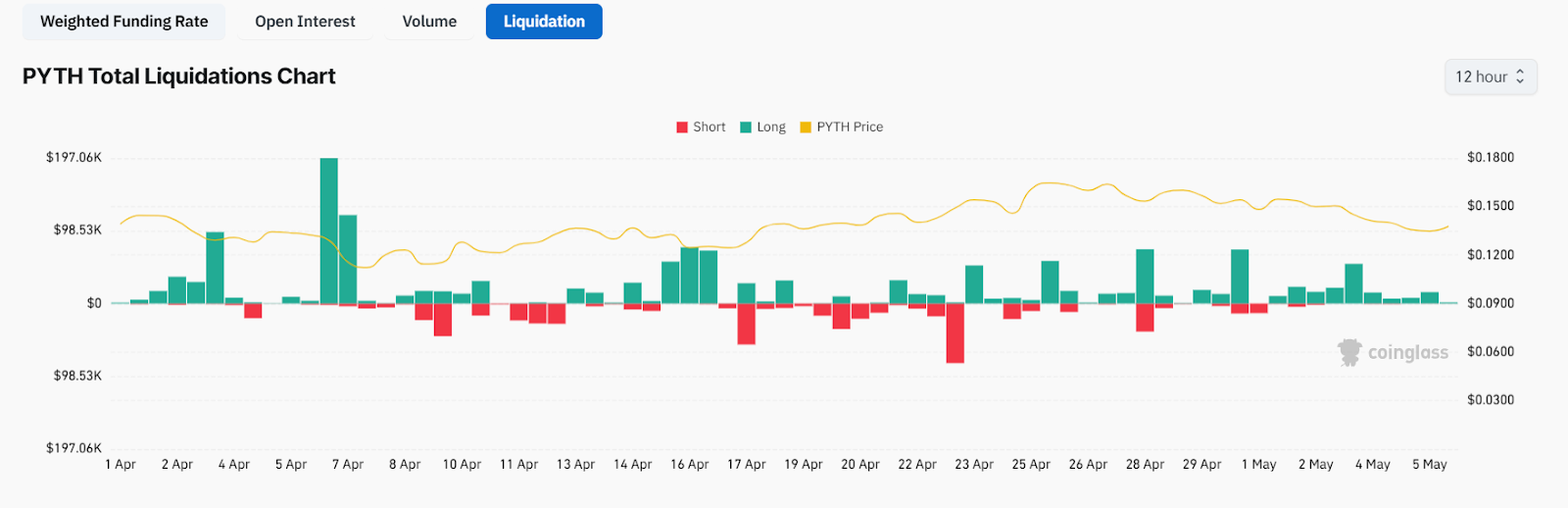

Coinglass data shows that PYTH’s aggregated open interest has fallen sharply from ~$80 million in December to around ~$40–50 million today, signalling that traders are de-risking ahead of the massive May 20 token unlock. Liquidation data shows limited recent action, but the last big wipeout in December led to a sharp crash, highlighting the risk of forced selling if unlock pressure sparks panic. The derivatives market shows caution, low leverage, and minimal buildup, but traders should prepare for a volatility spike when supply hits.

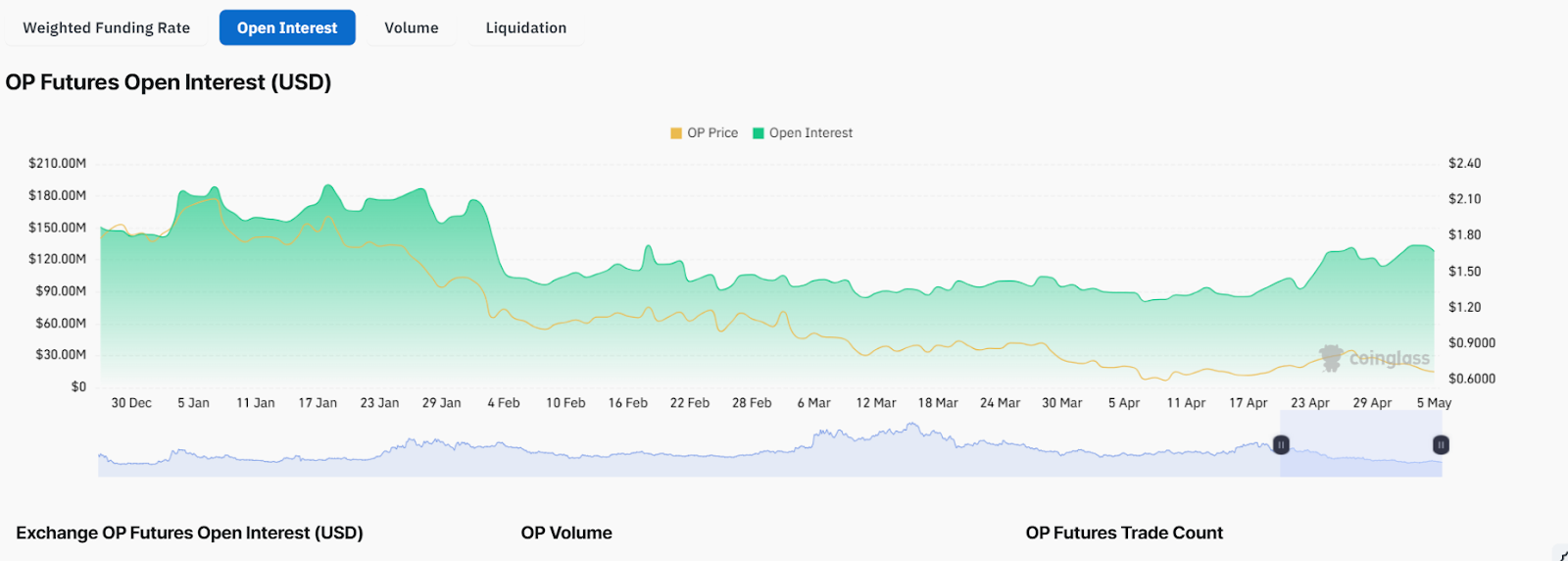

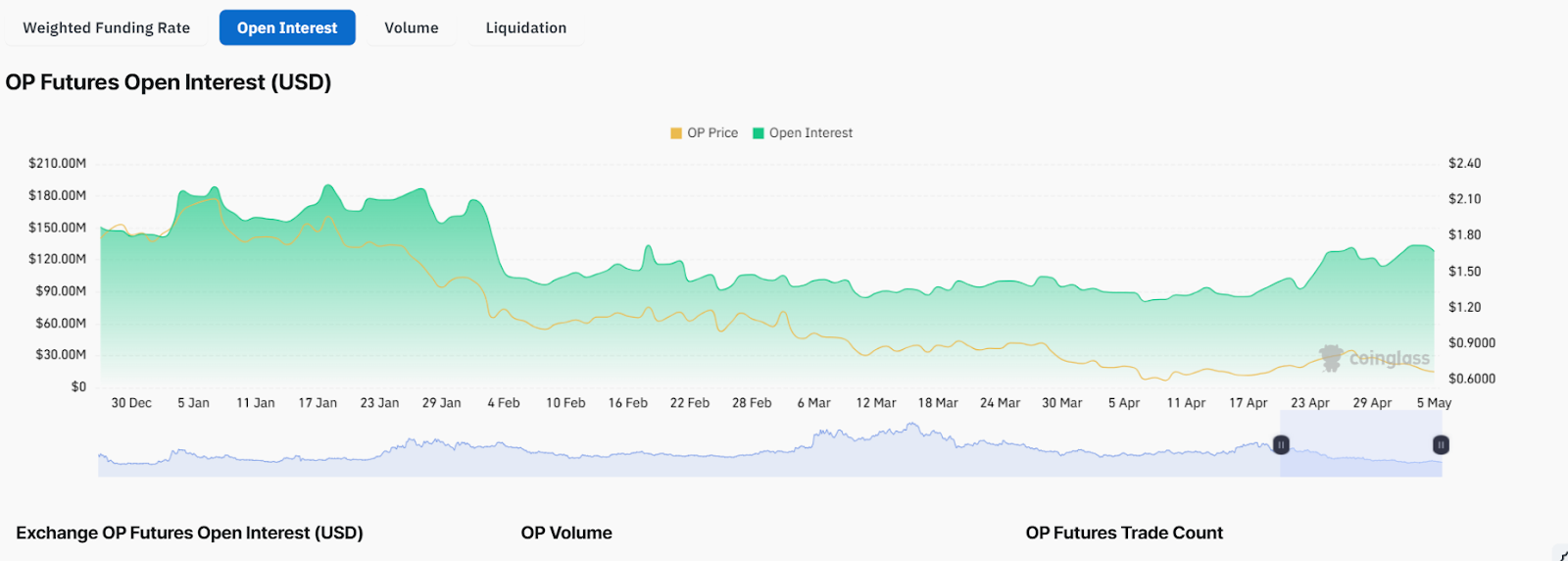

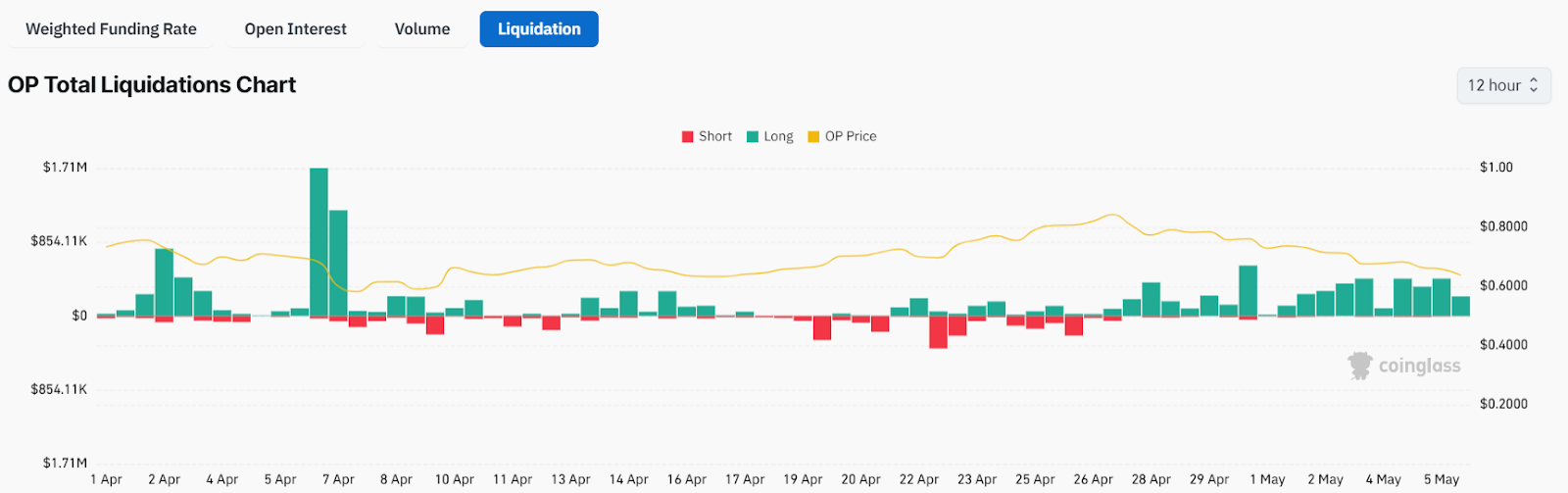

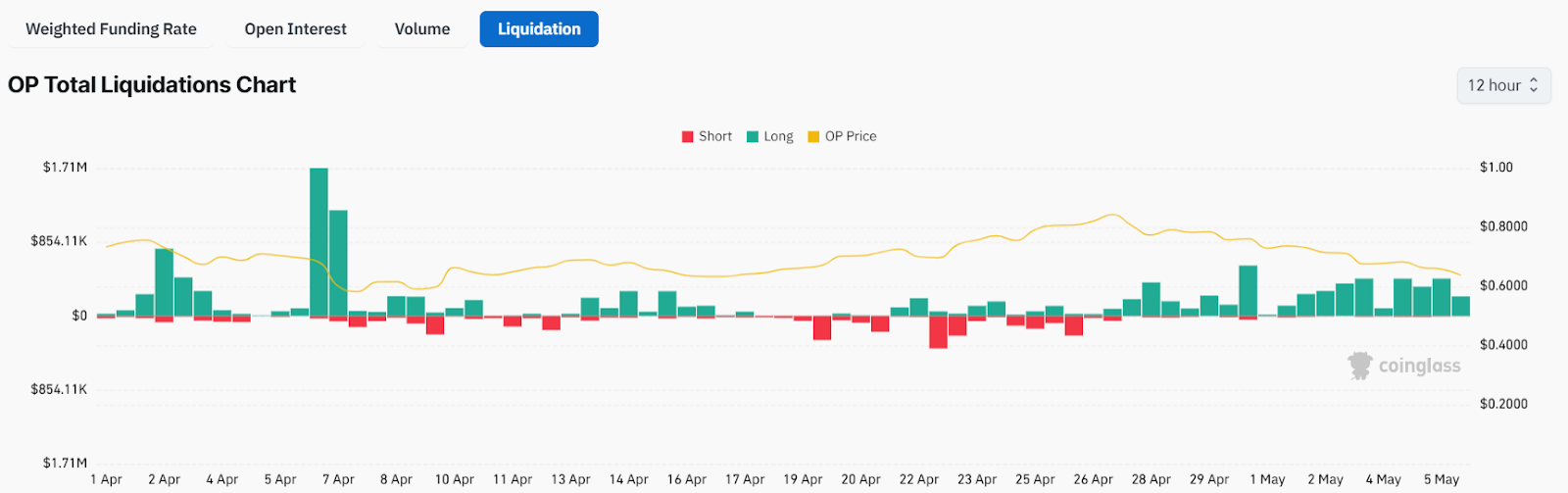

OP aggregated open interest declined from ~$350 million to ~$150–180 million, with a recent uptick signalling rising short positions, but has seen a recent uptick, indicating a rise in short positioning ahead of the May 31 unlock. Coinglass liquidation data shows large long-side liquidations recently, reflecting bearish control. This rising short buildup raises the risk of a short squeeze if sentiment shifts bullish or if the market absorbs the unlock faster than expected. Traders should monitor OI and liquidation trends closely as the unlock date nears.

Key Levels and Caution Ahead

Both PYTH and OP face critical weeks as their massive token unlocks approach, doubling circulating supply and testing market confidence. Technically, both tokens remain in bearish setups, with weak momentum and volume signals, while derivatives data show that traders are either de-risking (PYTH) or building shorts aggressively (OP). Until key resistances are reclaimed — $0.215 for PYTH and $1.071 for OP — the bias stays bearish, and traders should watch support levels closely at $0.12 and $0.545–$0.600, respectively, as the unlock events unfold.