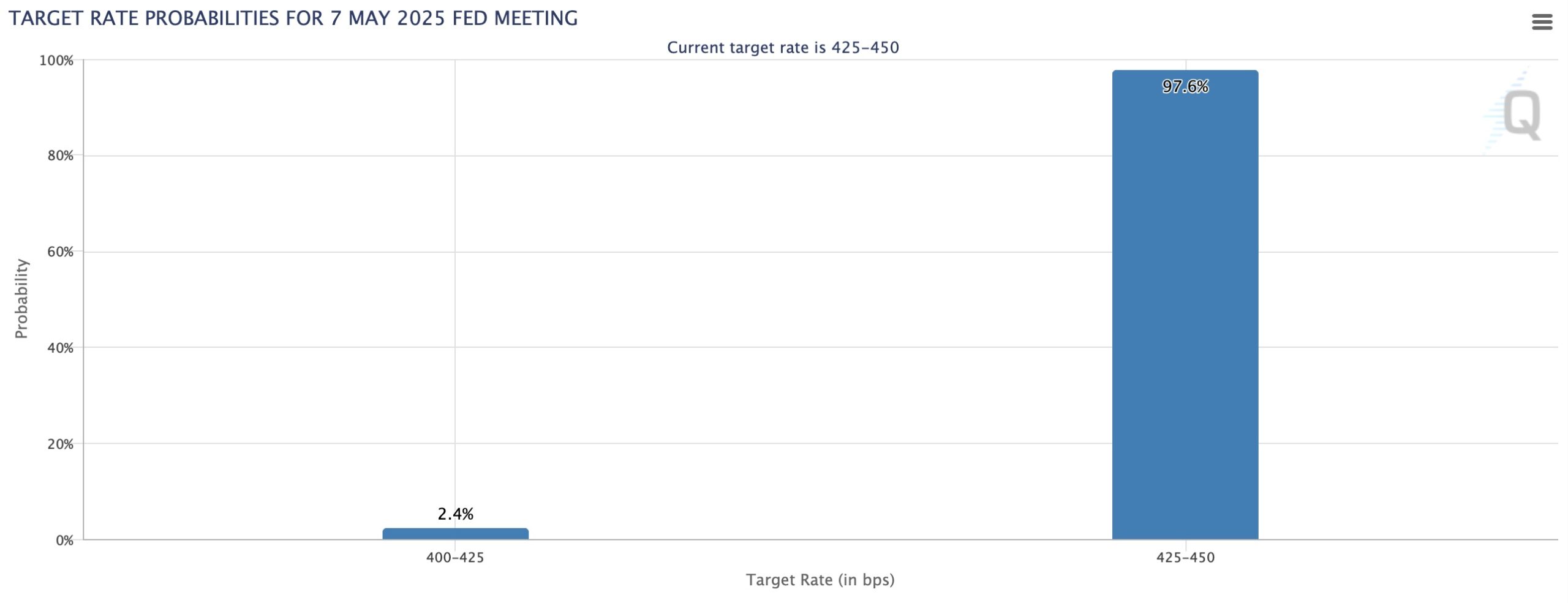

Federal ReserveThe FOMC meeting, which will be held on May 7, 2025, has settled in the top of the agenda of crypto currency investors. Interest decision and president at the meeting Jerome PowellBitcoin $94,235.30 And it brings concern that Altcoins may cause harsh fluctuations in prices. Following the aggressive interest rate hikes in the 2022 – 2023 period, the FED was reduced in the last quarter of 2024 and fixed its interest in a band of 4.25 percent to 4.50 percent. Currently, market participants predict that interest rates will remain constant by 97 percent.

Possible Effects of the FED decision on Bitcoin and potential scenarios

Inflation in the United States is currently a little high. Strong employment data FedIt makes the next steps uncertain. Additional discounts may come later in the year, but a clear roadmap is still not drawn.

If some analysts give “hawk” messages by talking in a harsh tone Bitcoin‘s 91 thousand 500 – 92 thousand dollars to the support area of the support area is emphasizing. The price of the price under the support zone in question may open the door to a deeper improvement.

On the other hand, Powell’s “pigeon” gives new interest rates signals in a short term in a tone Bitcoin priceIt can carry it again to the target of 100 thousand dollars. Although the core PCE inflation is 2.6 percent, every “pigeon” from the Fed can be interpreted as an opportunity to purchase in the markets. Therefore, investors are preparing to read Powell’s statements carefully and react quickly.

Possible reflections of Powell’s speech on the crypto money market

Political pressure is on the table. Donald Trump‘s interest for interest cuts flared up discussions on the independence of the Fed. The FED is expected to focus on inflation control rather than political messages. This makes the tone of the speech critical.

Leading crypto currency analyst Michael van also poppea surprise interest rate reduction decision from the meeting is a low probability, he said. Because the stagnation in inflation pushes the Fed to be cautious. Such a surprise is both traditional and Crypto Money MarketIt may have a shock effect.

Currently, consultants warn investors to avoid short -term leverage use and be prepared for harsh price movements. Counter cautious strategies may limit the risk in harsh price movements during periods of high volatility. There is a calm expectation until the expectations become clear.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.