- BRETT soared 108% this month, suggesting momentum is still alive despite a slight dip today.

- RSI is closing in on the historical rejection zone (79–81) that triggered two past sell-offs

- A rising MACD supports continued upside, but history says momentum could stall near $0.074–$0.082 resistance.

- If momentum weakens, $0.054–$0.057 offers a likely support zone. But if BRETT pushes through $0.074–$0.082, it could set off the next major leg up.

The recent hype surrounding the Brett Carnival in Dubai for Token 2049 (May 1, 2025) has brought fresh attention and volume to the BRETT coin. The event, promoted by the official Brett account and partners like m3taweb3, served as a bullish catalyst that pushed prices upward in late April.

Following the announcement on April 18, BRETT’s price jumped from $0.029 to $0.057 by April 23, a 96.5% rally in just five days that reignited bullish momentum. BRETT is trading at $0.06502, up 2.46% in the past 24 hours, with a market cap of $644.43 million and a 24-hour trading volume of $49.28 million.

To rejoin the $1 billion market cap club, a milestone it lost on January 19, 2025, BRETT would need to climb to approximately $0.10, reflecting a 55% upside from current levels..

BRETT/USD Sits Critical At RSI And Key Resistance Levels

Looking at the BRETTUSD chart and on-chain metrics, the asset is showing signs of a maturing rally backed by strong short-term momentum. Over the past month, BRETT has gained 108%, supported by a consistent increase in volume (+17.95%) and renewed social buzz following its Token 2049 presence and Brett Carnival event in Dubai.

Technically, RSI is currently at 69, just below the historical rejection zone (79–81) — which previously marked two sharp sell-offs, including one from its all-time high at $0.26 in DEC1 2024. In those cases, RSI crossing 79 led to immediate reversals within a few sessions.

If RSI reaches that same zone again, traders should expect a test of the $0.074–$0.082 resistance, with a potential extension to $0.09–$0.10 if momentum strengthens. A push toward $0.10–$0.11, the estimated price needed for BRETT to reclaim a $1 billion market cap, would mark a psychological and technical milestone.

Meanwhile, the MACD remains in bullish territory, with the signal line crossover intact, confirming upward bias. However, histogram bars are beginning to flatten, signalling slowing acceleration — a potential early warning for trend exhaustion.

If buyers fail to push through the $0.074–$0.082 band, price may pull back toward support at $0.057, with deeper cushions near $0.045, where the previous breakout began.

Whale Silence, Retail Surge: Chart Signals Maturing BRETT Rally Backed by Organic Momentum

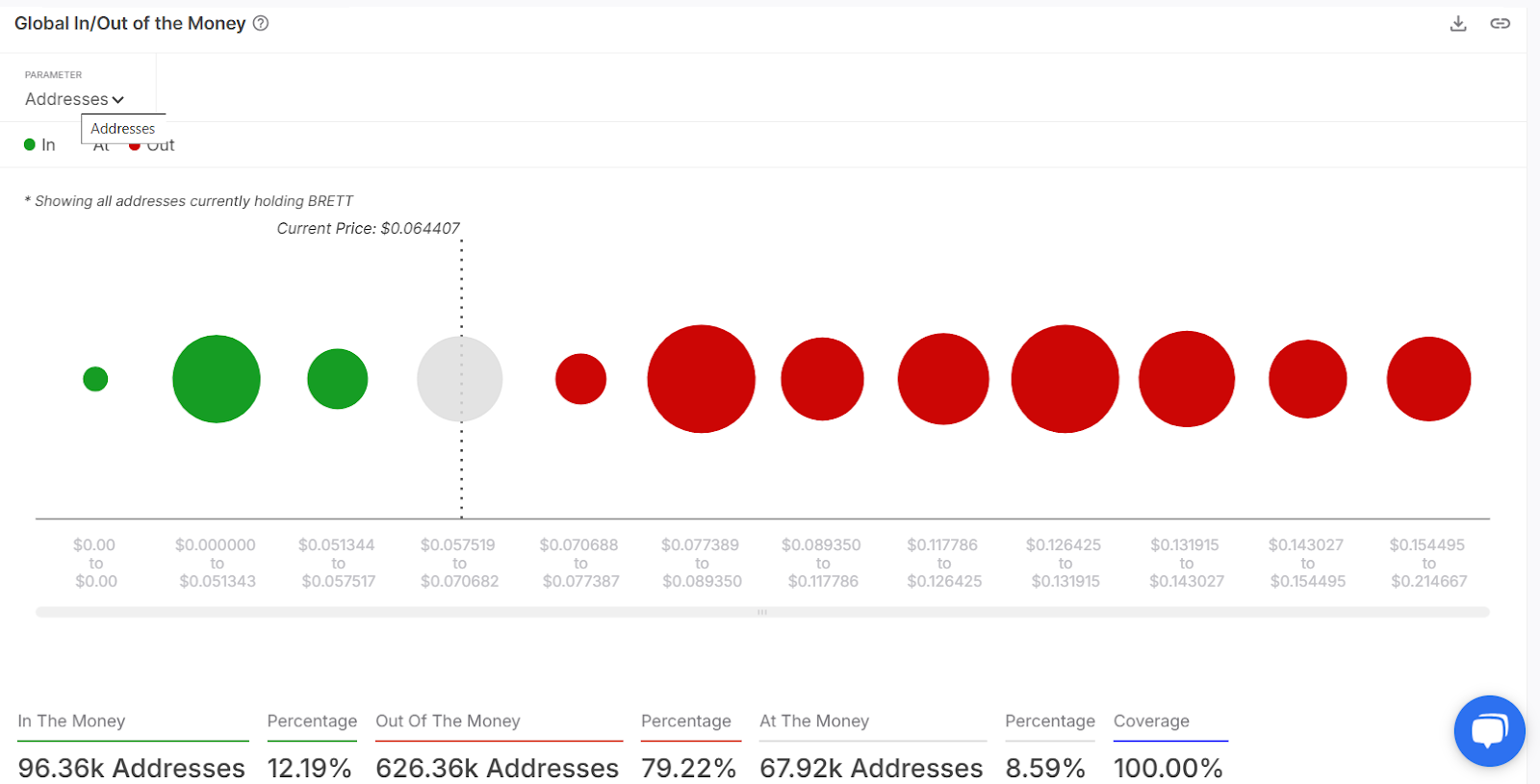

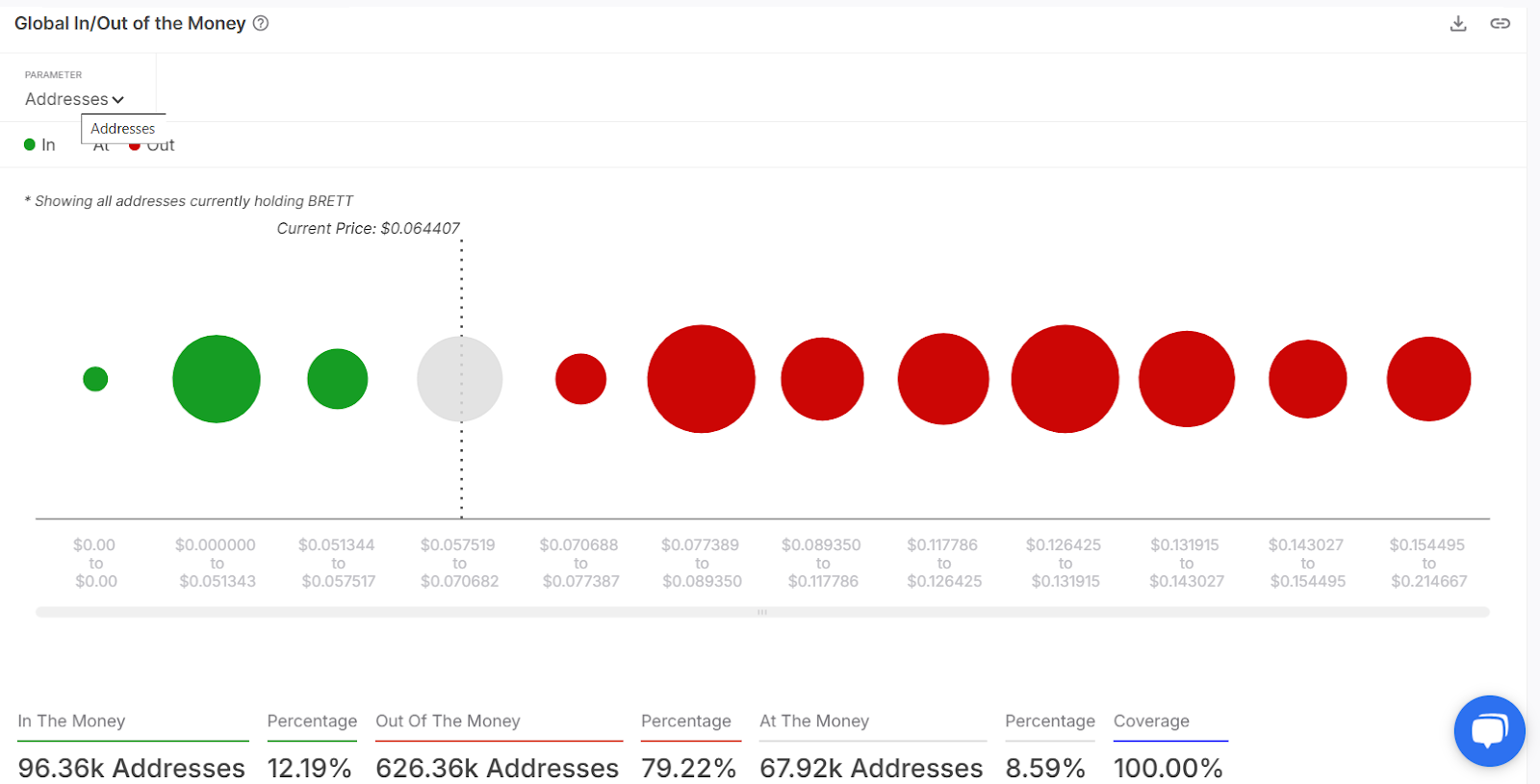

Only 12.19% of holders are in profit, while 79.22% remain at a loss, concentrated between $0.077–$0.13.

If price revisits those zones in the coming 7–10 days, this could trigger aggressive profit-taking or fuel the rally if holders wait for higher prices.

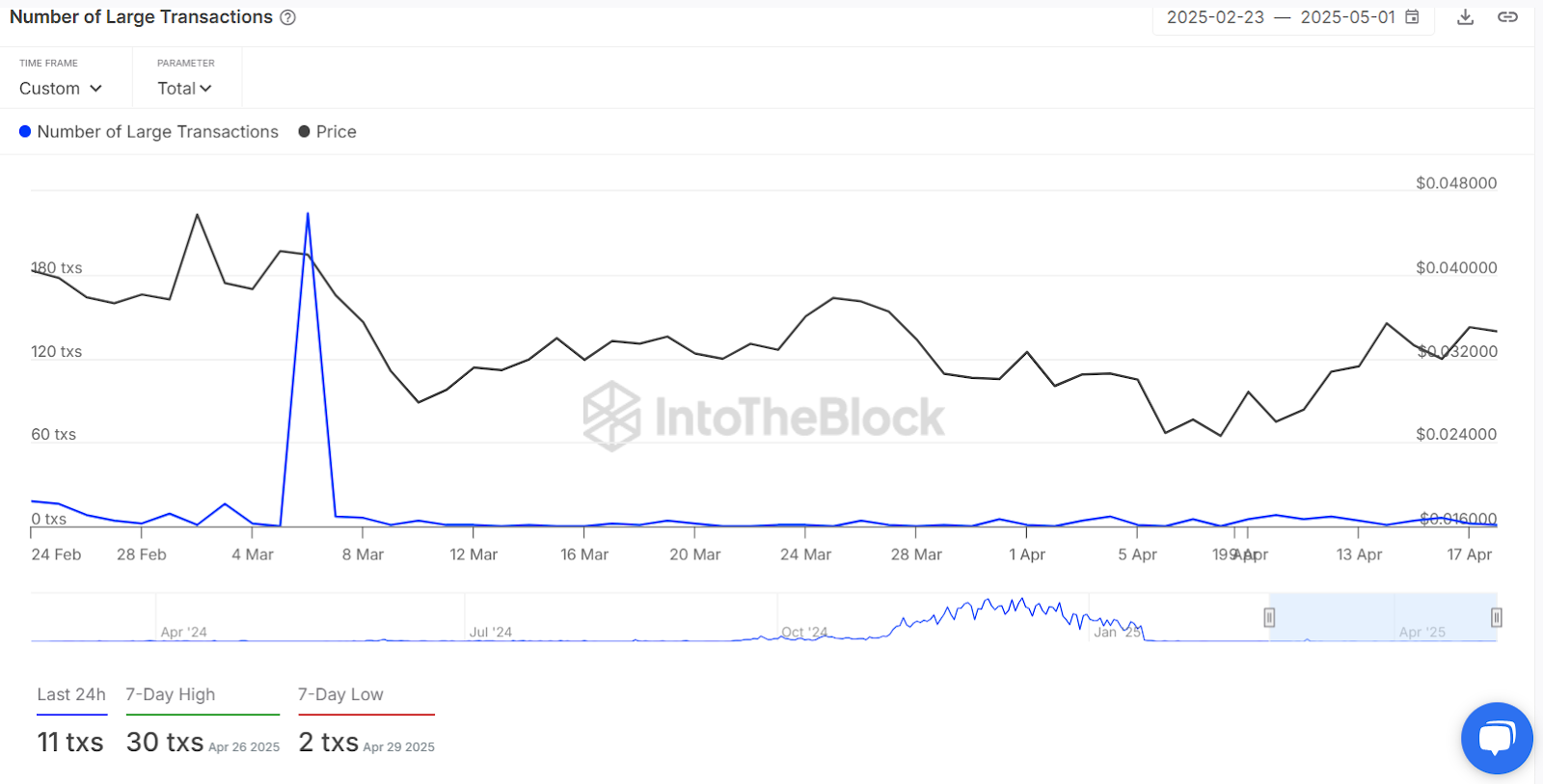

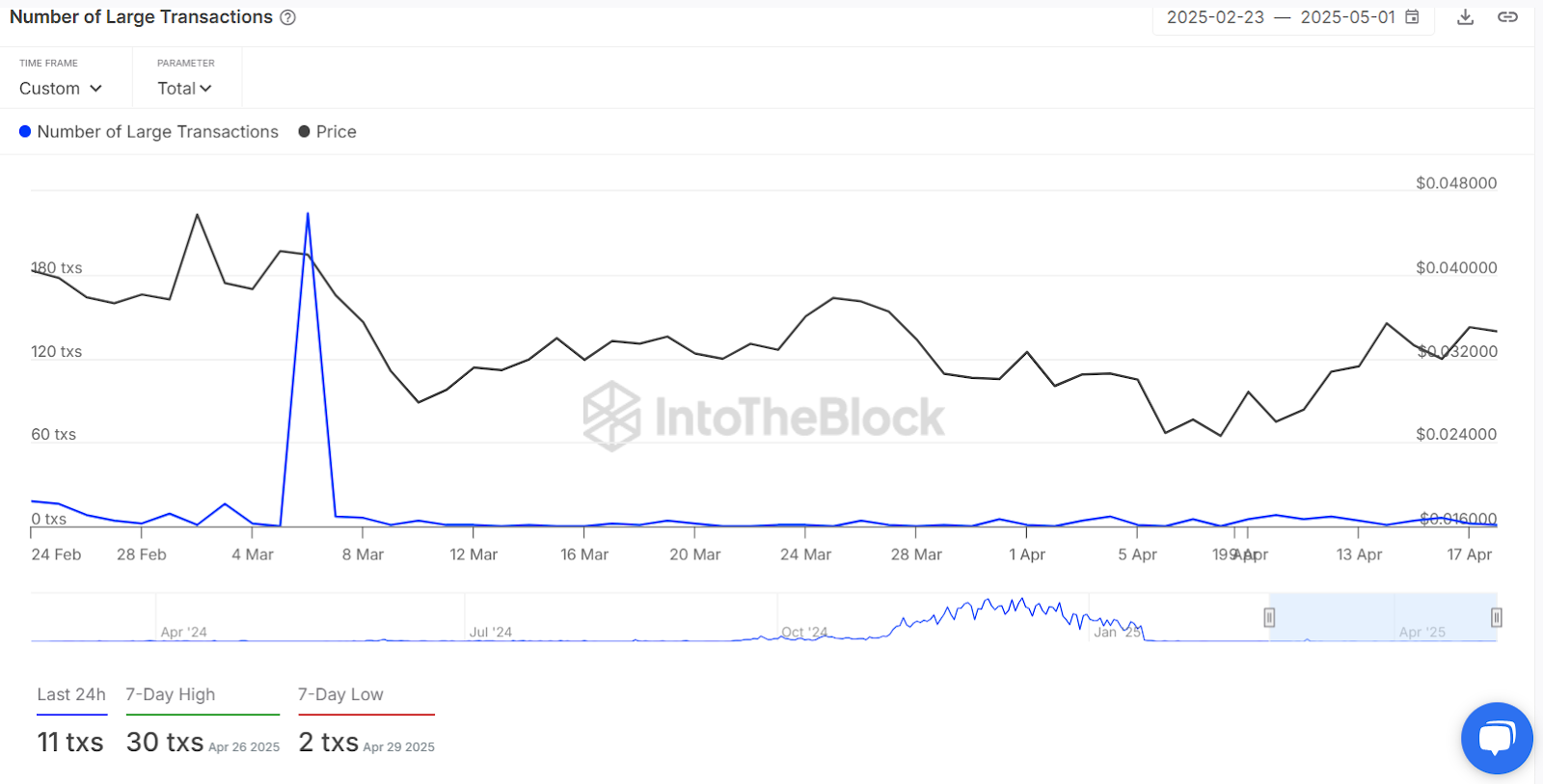

The IntoTheBlock chart reveals a sharp spike in large transactions—hitting nearly 180 txs on March 6—indicating significant whale activity, possibly accumulation or distribution. Post-spike, large transactions dropped sharply, averaging 2–11 txs daily, even as BRETT’s price recovered from a low near $0.024 in early April to around $0.032 by April 30.

This divergence signals a shift from whale-driven moves to retail-led momentum. Notably, the 7-day high of 30 txs on April 26 aligns with renewed buying interest following the Dubai event. For traders, this suggests a maturing rally backed by organic demand, with whale inactivity hinting at untapped upside if momentum continues.

Strategy Insight for Traders

- Expect upside momentum to persist for another 2–5 days, targeting the $0.074–$0.10 zone.

- If RSI reaches 80, be cautious: tighten stops or scale out partially.

- Failure to break $0.074 may result in a quick fade to $0.057, with full cooldown support at $0.045.

- Stay alert to MACD histogram shifts and RSI divergence for reversal signs.