US President Donald Trump‘s “Liberation Day” celebrated on April 2 (today) is expected to announce new customs tariffs. It reinforces the aggressive stance of the tariffs that are expected to target Japan, China, Canada and the European Union in US trade policies. However, this harsh strategy, which Trump implemented to achieve better agreements, seems to have brought other countries closer to each other, contrary to what is expected for now. After the tariffs, China, Japan and South Korea met yesterday to strengthen regional trade ties. This reveals that the US commercial isolation policies can lead to the frequentness of other countries rather than dividing global trade. Uncertainty in global markets increases, in the short term crypto currencyIt is estimated that risky assets such as s will continue to be under pressure.

Fed stuck between inflation and stagnation

US central bank (Fed), although the interest rate reduction in the year is facing an unstable picture for the time being. While consumer trust in the American economy and weak economic data strengthen the possibility of economic recession for the second quarter, due to new customs tariffs inflation pressureThere is also an increase.

In this typical “Stagflation” environment, the Fed tends to increase instead of downloading interest rates. However, for the time being, the Fed is expected to follow the “wait and see” policy.

Crypto Money Market is fighting uncertainty

The macroeconomic picture and the uncertainty created by the US trade policies are quite high. Crypto Money MarketIt also affects negatively. The biggest crypto currency Bitcoin (BTC) $84,870.96 While performing a weak performance, the King of Altcoin Ethereum (ETH)  $1,872.24 on the other hand, it is trying to maintain critical thousand 800 dollars support level.

$1,872.24 on the other hand, it is trying to maintain critical thousand 800 dollars support level.

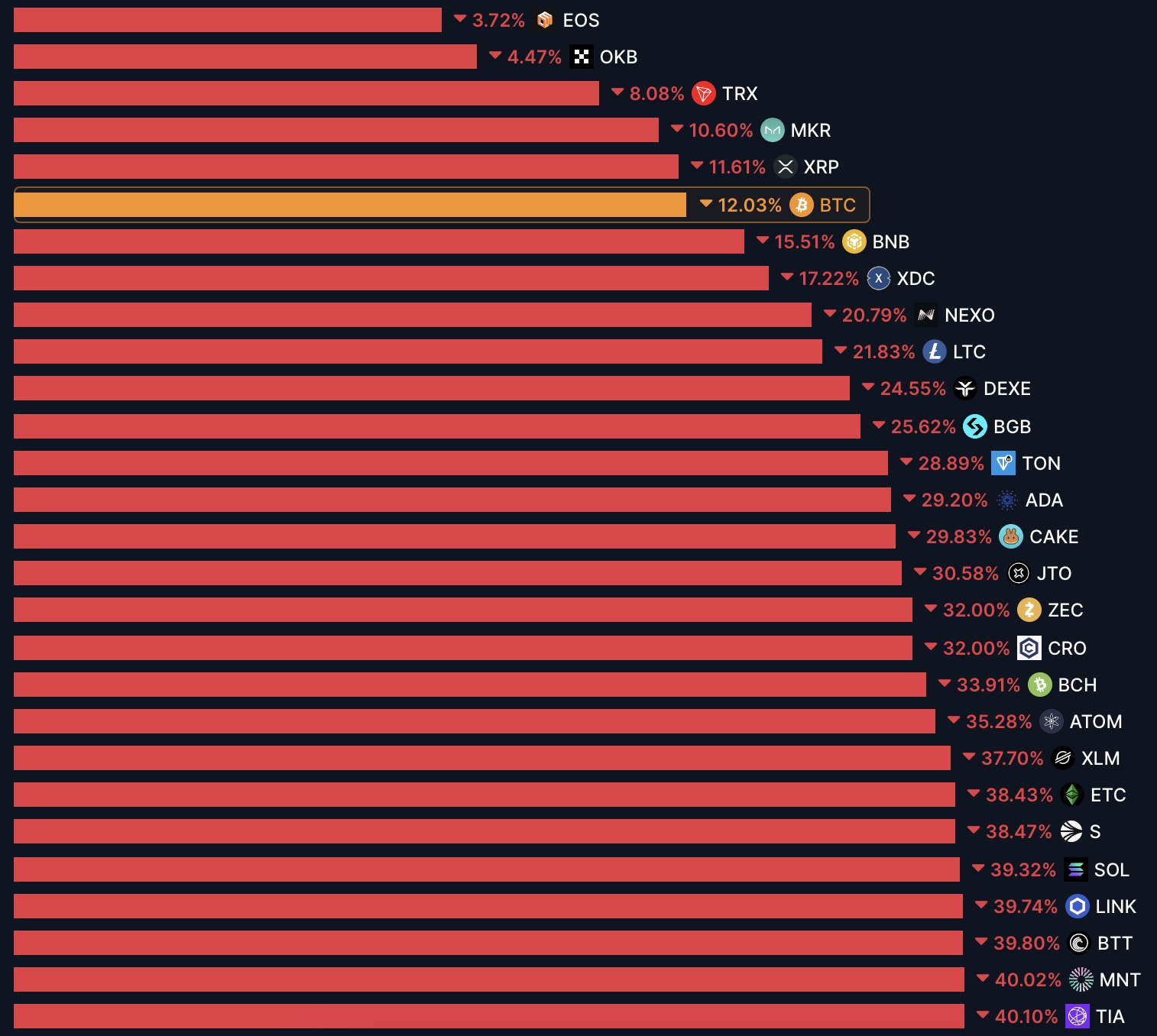

Many compasses of the market except Bitcoin and Ethereum altcoin It has lost 90 percent since the beginning of the year. Data show that most Altcoin has fallen only over 30 percent in the last 7 days. Investors do not expect a significant recovery in the prices of crypto currencies without a global economic appearance improvement and a strong development that will be triggered for rise.

Market analysts warn that short -term low -percentage increases are possible, but should be avoided from taking risks unless there is a wider recovery.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.