Bitcoin $84,916.31 (BTC) has recently started to enter the agenda with the intense interest of corporate investors. In -chain data and technical analysis indicate that Bitcoin may be preparing for a new wave of ascension. The aggressive purchases of large whale -level investors, the reduction of supply and powerful social discourses stand out as supportive elements for the price of the largest crypto currency. In the light of all these developments, market analysts are united in the opinion that Bitcoin can test new summits in the coming period.

BY BURKS WITH WALLINE GREAT INVESTORS Bitcoin

10 thousand pieces BTC And the “Accumulation Trend Score” value of the wallets with assets increased over 0.5. The rise in this indicator shows that large investors regularly collect Bitcoin from the market. What is interesting is that small investors prefer to sell in this process. According to internal data, large wallets continue to accumulate BTC, while smaller investors are withdrawn from the market.

This table points out that long -term accumulation players are more optimistic about the direction of the market. In recent weeks in whale wallets BTC The increase in the amount shows that the price fluctuates in the short term, but it shows that the medium-long term has the upward potential. Especially if this trend continues with the influence of corporate investors, the supply-demand balance may develop in favor of Bitcoin.

Technical Signals and Social Support give Bitcoin strengthening

Bitcoin’s price Recently, the descending wedge formation gave up the upward signal. This formation, which is common in technical analysis, is usually interpreted as a harbinger of the rise. BTC is currently traded on a threshold of 85 thousand dollars and from this level 88 thousand 745 and 96 thousand 163 dollars of important resistance is expected to be tested.

In addition to technical indicators, strong explanations are made in favor of Bitcoin on social media and public opinion. DC Blockchain Summit Speaking at 2025 Cynthia lummisBitcoin may play an important role in reducing national debt in the long run. Founder of Strategy (formerly Microstrategy) Michael Saylor by defining Bitcoin as a “modern digital gold mine ,, the largest crypto currencyHe stressed how critical role he played for the global economy.

The explanations of names like Lummis and Saylor increase market confidence and strengthen Bitcoin’s perception of corporate investors. Increased social sensitivity can pave the way for a more fundamental and sustainable price movement rather than speculative movements.

Bitcoin supply is decreasing rapidly

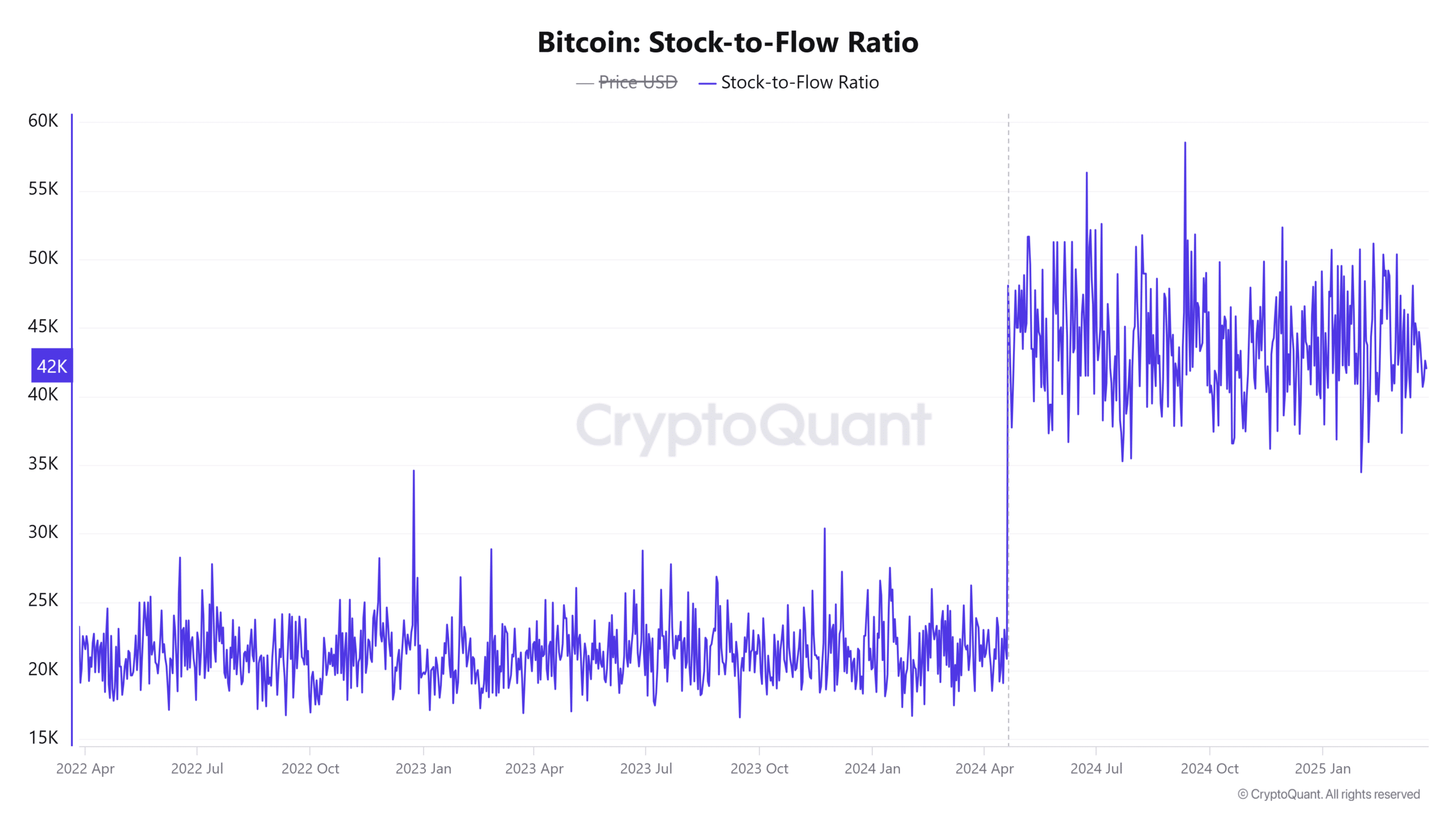

Bitcoin’s Stock-to-flow (S2F) ratio is currently 907 thousand. The ratio is one of the important metrics used to assess Bitcoin’s supply scarcity. According to the latest data, this value fell by 42.86 percent. This decrease shows that the amount of newly produced coins is reduced and therefore less BTC is in circulation in the market.

The decreasing supply may create upward pressure on the price, especially when demand remains constant or increases. When evaluated with whale purchases and corporate interest, the probability of value of BTC in the future is very strong. This may be the beginning of a new expected new rise period for long -term investors.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.