Bitcoin (BTC) $87,160.49 He continued to rise by gaining 5 percent in the last week. Although investors continue to behave cautiously, social media data reveals that optimism is increasing in the market. The largest crypto currency up to 88 thousand 500 dollars reached this level after 17 days. The largest subcoin Ethereum (ETH)  $2,071.44 After 14 days, albeit for a short period of 2 thousand 100 dollars by exceeding the level of the rally participated.

$2,071.44 After 14 days, albeit for a short period of 2 thousand 100 dollars by exceeding the level of the rally participated.

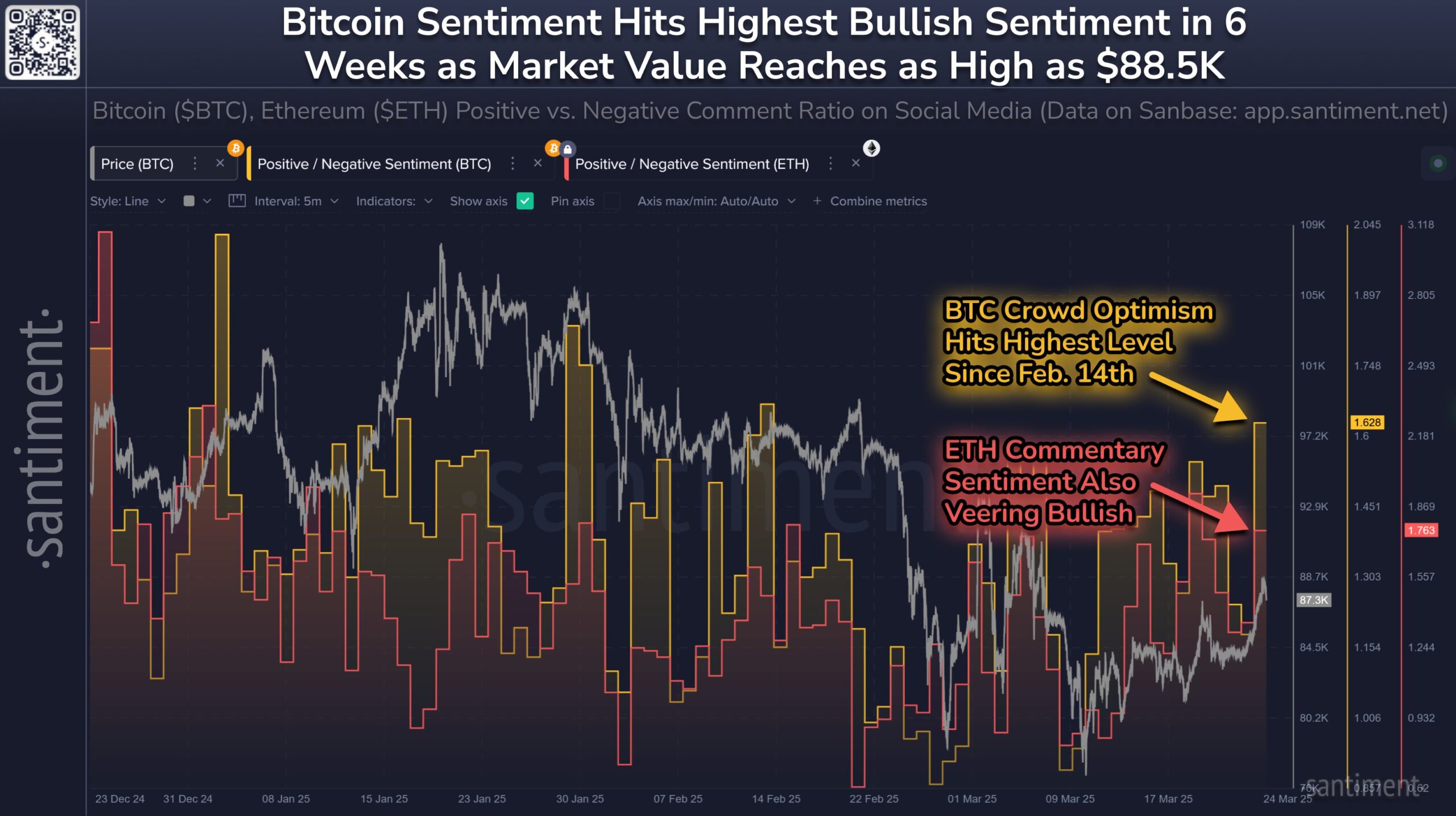

Crypto currency enthusiasm on social media

In -chain analysis platform CentimeterAccording to the positive comments in investors’ social media sharing has increased to the highest level of the last 6 weeks. Social sensitivity for Bitcoin is so positive for the first time since February 14th. There is a similar trend for Ethereum. This indicates that confidence in the crypto currency market is re -occurred.

The sensitivity of investors usually plays a decisive role on price movements. In the past, when a positive social emotion rose, the markets had upward reactions. The current appearance strengthens the possibility that the rise may continue.

Ethereum’s exceeding 2 thousand 100 dollars, albeit for a short period of time, investors are not only Bitcoin, but great altcoin‘s also shows that he shows interest. The rise in both crypto currencies was effective in gaining confidence of investors.

Mixed signals from chain indicators

Bitcoin’s INFLOW-FLOW POSITION (IFP) Metrika gives weak signals despite the rise. The IFP, which is 696 thousand, is below 794,000, which is a 90 -day simple moving average. This shows that a strong rise has not yet been confirmed in the short term. Moreover CQ Bull & Bear Market Cycle The indicator still produces signals in the direction of decrease. The indicator had given similar signals during the past decline. In other words, even though Bitcoin rises in the short term, these metrics show that the market is still cautious.

Bitcoin’s Market Value to Realized Value (MVRV) ratio is also traded below the 365 -day average. In August 2024, a similar picture was formed in the Carry Trade crisis. Currently, similar risks continue.

Net Unrealized Profit/Loss (NUPL) Metricity is also below a average of 365 days. According to this indicator, the rise momentum in the market may be weakened. Nupl’s average is very important because Bitcoin will gain strength.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.