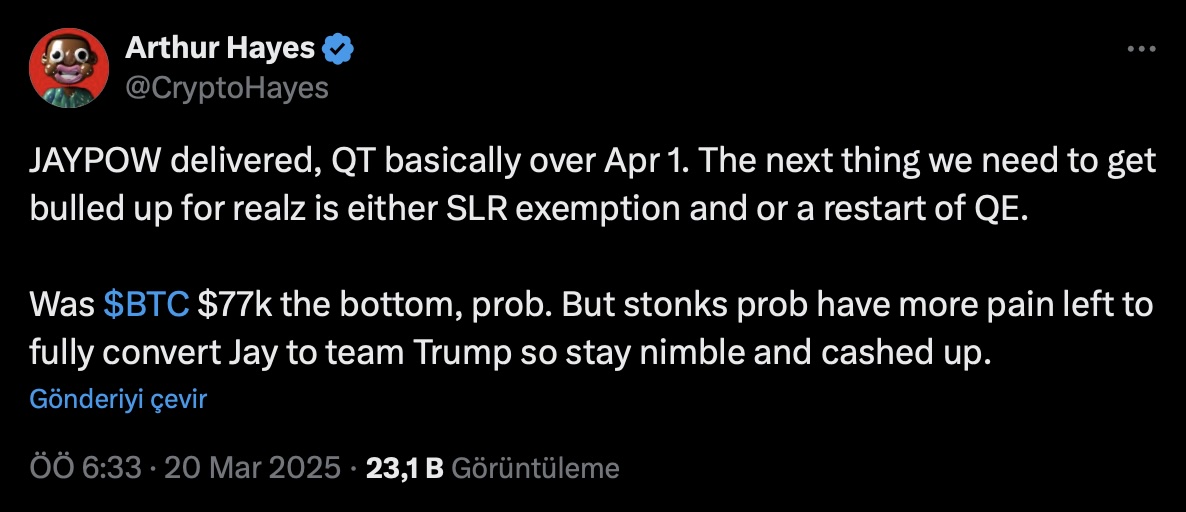

The founding partner and former CEO of the Bitmex Stock Exchange, known for the realization of his predictions Arthur Hayesmade evaluations about the crypto currency market through the social media platform X. Hayes, from personal x account US central bank (FED) President Jerome Powell drew attention to his statements on March 19, and at the beginning of April, the Fed will slow down quantitative tightening (QT). He also stressed that the markets need more powerful signals to enter a new rise trend. Bitcoin (BTC) $85,190.76 Stating that the 77 thousand dollar level may be a bottom threshold, Hayes claimed that the stocks were at the door.

Could the 77 thousand dollars of level be a bottom threshold for Bitcoin?

Hayes, Bitcoin’s price may have hit the bottom in the current table, he said. Crypto Money MarketWhile the fluctuations continued, the possibility that Bitcoin could create a support of $ 77,000 with this output of Hayes. He underlined that the markets could enter a new era with the slowdown of the former endingx CEO FED in April.

According to Hayes, Bitcoin needs more important factors except QT to make a new rise trend. at this point Banking system leverage ratio (SLR) Returning the exemption or quantitative expansion(QE) stressed the necessity of restarting. He added that the steps that will not be taken in this direction will continue to continue the uncertainty in the markets.

As it is known, the Fed’s policies Crypto Money MarketIt plays a critical role in determining the direction of its direction. For this reason, Fed’s announcement that they will slow down QT as of April was interpreted as a positive signal in the markets. However, as Hayes pointed out, it will be the main elements that determine the future course of the market.

According to Hayes, more decreases in stocks at the door

Hayes, on the other hand, if he assigned that Bitcoin’s price may have hit the bottom, stock marketsHe announced that he expected more decreases. He said Powell could reorganize his economic policies in order to support Trump administration more.

US stock exchanges have recently been following a wavy course due to economic uncertainties and interest policies. According to Hayes, the Fed may need to have further decline in stocks in order to fully change the current policy. This means that fluctuations will continue for a while in the market.

The crypto currency market, on the other hand, may show an earlier recovery, unlike stock markets. At this point, Bitcoin should not go under the threshold of $ 77,000. This scenario is a critical support point for investors.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.