The UK -based financial service company is well known for its estimates for crypto currencies. With over $ 14 billion, decades of decades of institutions have updated their forecast for crypto currencies. What is the 2025 Altcoin price estimation in what direction was he revised?

2025 Altcoin price estimation

Institution crypto currency Ethereum today $1,912.51 updated the estimation for. With its new report entitled Ethereum – Midlife Crisis, Layer2 solutions will make huge gains from the Ethereum ecosystem. Base said Kendrick, who said that he pulled the value of close to $ 50 billion alone from the main network;

“The solution would be to tax Layer2 super profits, as governments sometimes demand super taxes for foreign -capital mining companies that make excessive profit. ETH-BTC will continue to fall as long as this does not happen. ”

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

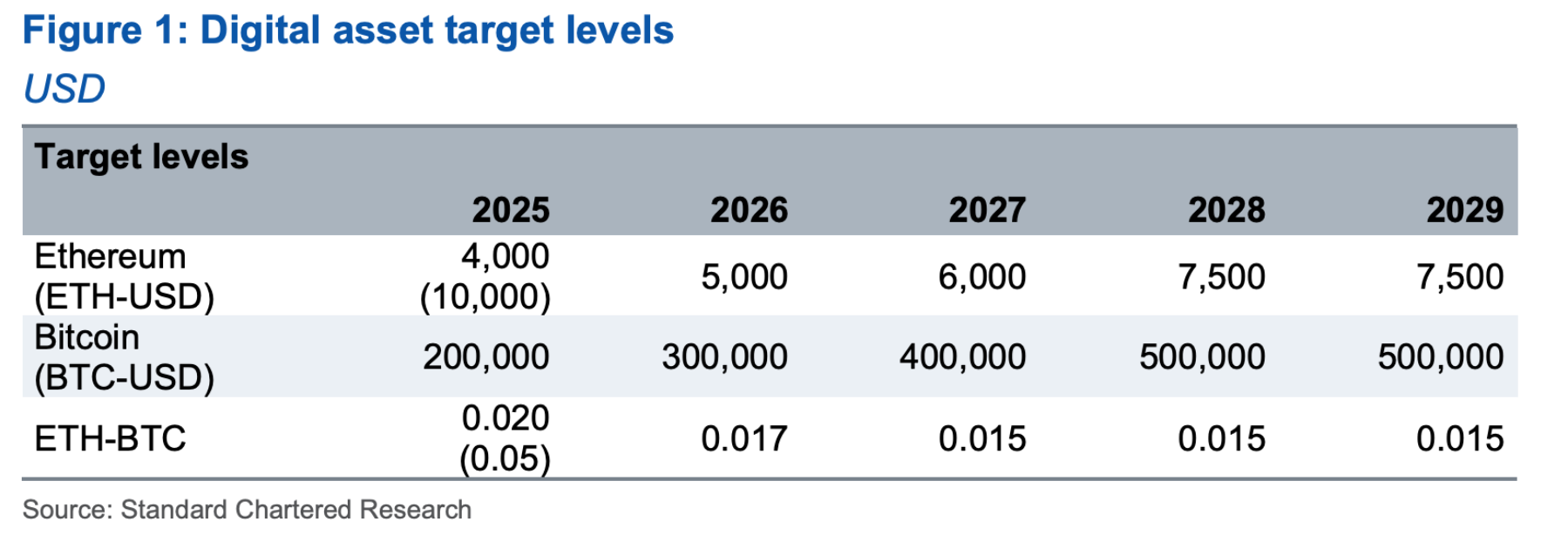

The result you have taken from the part up here ETH PRICE If he revised his prediction in the lower direction, yes you guessed correctly. For this year, ETH revised its target 60 %down and pulled it to $ 4,000. This is not pleasant for the overall of the subcoins.

Although the expectation between 2028 and 2029 is $ 7,500, the expectation for ETHBTC parity is negative. According to him, if the current weakness continues, the 0.015BTC region, which has not been seen since 2017, will be tested in ETHBTC parity.

You see the estimation details above.

Ethereum (ETH) Future

Kendrick mentions that the changes in the network seem to be compulsory or destructive results are correct. The Merge, which has eliminated business evidence, is one of the leading Dencun, who distributes the power of the network to free layer2 solutions and strengthens the Layer 2 and gives rise to “super profits için for them.

Especially the fact that the Base network moves to the coinbase company does not strengthen the Ethereum network. Even though Coinbase took a big step to diversify his income, the value he exploited and the cash he brought out.

“Layer 2s result in lower GDP in the main network of Ethereum and at least lower wages in the near term. However, it is to develop long -term target scalability and make wages more competitive; This will lead to a more sustainable market share for Ethereum (and potentially increasing the future GDP and wages). ”

The TVL power in the field is still over 50 %of the Ethereum stablecoins, which are still over 50 %, and hosts 80 %of the token assets. Nevertheless, the dominant power is weakened and standard Chartered argues that a solution should be considered for long -term ETH growth.

According to Kendrick, Ethereum needs to maintain its strong growth in the RWA area, where it has a market share of 80 %. This network gives rise to regular demand. If the upcoming technical upgrades such as Pectra can improve scalability and wage dynamics in “main network”, this is also supportive for Ether.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.