Japanese Investment Company MetaplanetBitcoin $95,701.32 It continues its purchases without slowing down. Finally, the company has invested $ 12.9 million and bought 135 more BTCs. With this move, Metaplanet’s total Bitcoin presence reached 2 thousand 235 BTCs. The company describes the Bitcoin accumulation strategy as one of the basic business lines and aims to reach 10,000 BTCs by the end of 2025.

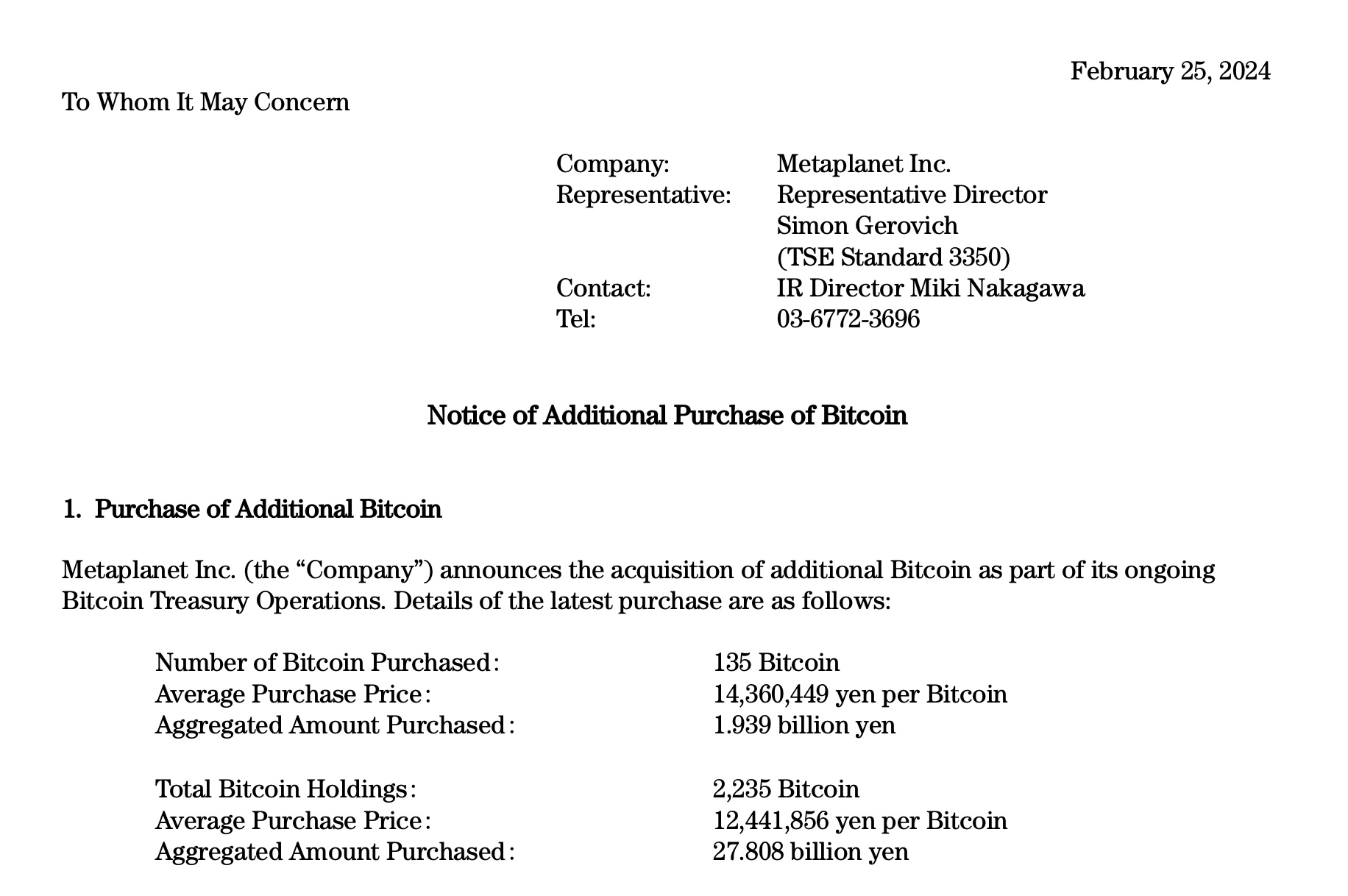

Metaplanet, Bitcoin It continues to adopt as a digital reserve presence by expanding its investments. In the last investment, the company spent 1.9 billion Japanese new (12.9 million dollars) and received 135 BTC. The average purchases were made at 14.3 million Japanese new (95 thousand 951 dollars).

Bitcoin presence of the company at the end of last year, 761 pieces BTC While, in June 2024, it was at the level of 141 BTC. With the latest purchases, this amount rose to 2 thousand 235 BTC. Metaplanet continues to make aggressive purchases within the scope of Bitcoin accumulation strategy announced in April.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

In December, the company officially made Bitcoin investment strategy one of the main business lines. Metaplanet aims to reach 10 thousand BTCs at the end of 2025 and 21 thousand BTC in 2026. This strategy of the Japan -based company increases the interest of many corporate investors on globally.

Metaplanet’s Bitcoin investments also led to fluctuations in the performance of the company’s shares. Tokyo ExchangeCompany shares traded in the last Bitcoin fell 1.3 percent in the morning after the purchase of Bitcoin. However, the long -term rise trend continues.

The company’s share price has increased by 67.5 percent since the beginning of the year. In the last year, the total increase in stock reached 233.7 percent. According to Google Finance data, metaplanet shares continue their afternoon operations.

Metaplanet’s Bitcoin accumulation strategy is seen as one of the important steps that strengthen the interest of corporate investor in the crypto currency market. It is noteworthy to adopt decentralized assets such as Bitcoin in a country where traditional finance such as Japan is strong.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.