The largest subcoin Ethereum (ETH) $2,732.88is going through a different process compared to previous market cycles. Bitcoin (BTC)  $96,565.53 Ethereum has not yet achieved this while continuing its way by refreshing the record on the record. However, some in -chain indicators show that ETH still has a great rise potential. MVRV price bands and mayer multiplier model shows that the price is below the price and the most powerful rise phase has not yet begun.

$96,565.53 Ethereum has not yet achieved this while continuing its way by refreshing the record on the record. However, some in -chain indicators show that ETH still has a great rise potential. MVRV price bands and mayer multiplier model shows that the price is below the price and the most powerful rise phase has not yet begun.

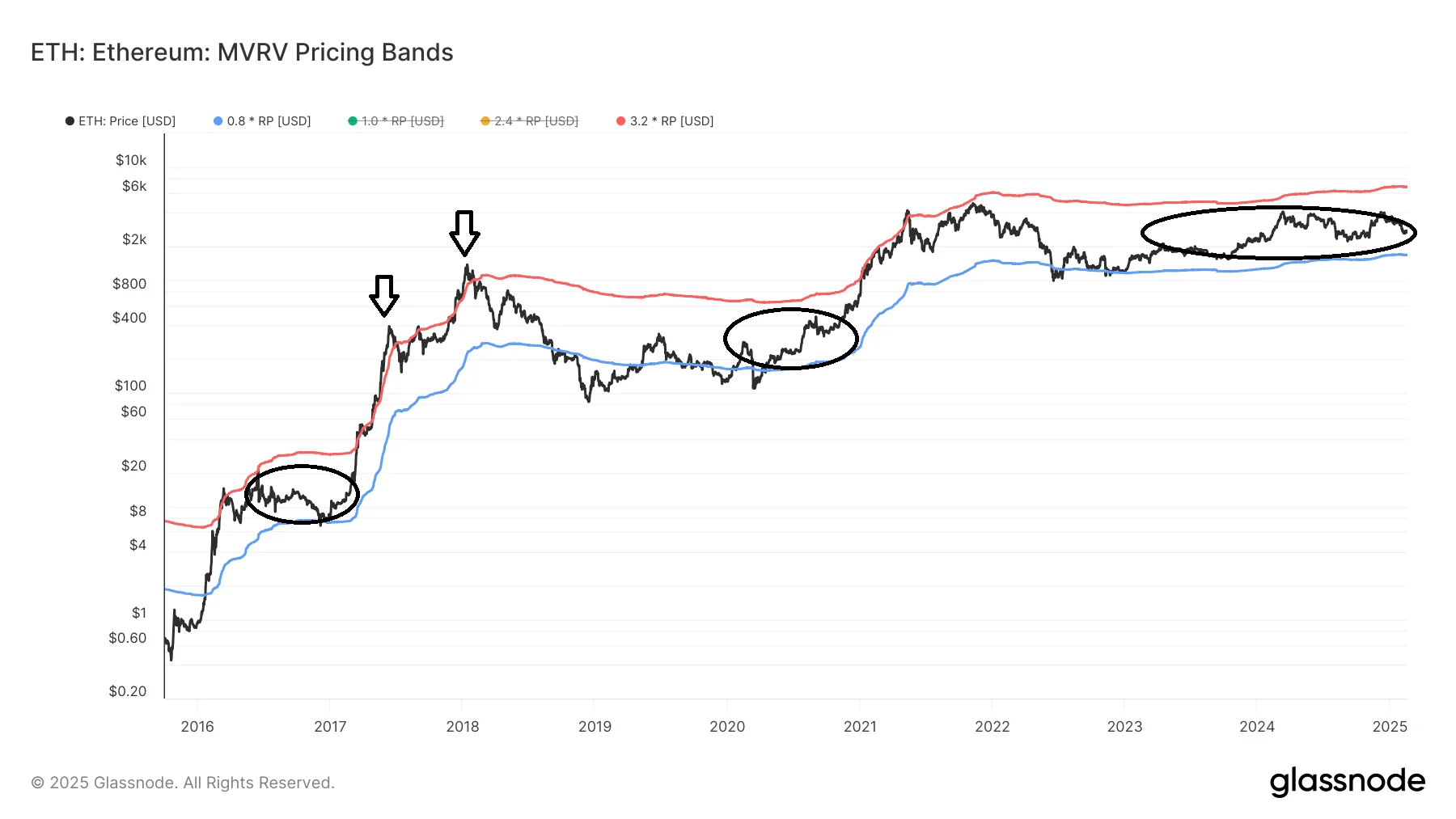

What do MVRV price bands show for Ethereum?

Market value / realized value The (MVRV) indicator helps to determine whether an asset is overly valuable or below its value. This indicator works by comparing the market value to the realized value. The periods when the MVRV fell below 0.8 (blue) indicates that the price is extremely low and the periods above 2.4 (red) are extremely high.

Ethereum has exceeded this level twice in the 2017 – 2018 cycle. In 2021, he was only able to reach the red zone once. In the current cycle Eth has not yet passed this level. However, there is a similarity between consolidation processes in 2017 and 2021 and the current movement. In the previous cycles, these processes prepared the ground for a strong rise of the greatest Altcoin. If the price does not fall below the level of 0.8, the possibility of a similar rise continues.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Mayer multiplier model for ETH points to the rise

Mayer multiplier The model determines the purchase-sale levels according to Ethereum’s 200-day moving average. This model analyzes the relationship between 200 -day moving average (MA) with certain multipliers. Historically, when the price reaches 2.4 times, it reaches the bottom level when it falls below 0.8.

ETH has exceeded 2.4 floors in all previous market cycles. However, the current cycle has not yet exceeded this level. There is a great similarity between the price movements in the 2019 – 2020 period and the current process. ETH fell below the level of 0.8, then went above this level and exceeded the 200 -day moving average. Later, it went down to 0.8 again, but it formed a higher bottom level. If he follows this model, Ethereum needs to have a strong rise in order to start a new bull run.

The price is critical for the price to gain upward acceleration in order to continue the rise process of ETH. Otherwise, the model may be invalid if it once again falls below 0.8.

The Mayer multiplier model shows that ETH is still under its value. The biggest structure similar to the levels seen in 2020 altcoin It may be on the verge of a great rise. On the other hand, some in -chain indicators argue that the current cycle ends. Therefore, although it is difficult to make a definite comment about the future of Ethereum, some models point to a strong rise.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and perform their operations in line with their own research.