Bitcoin (BTC) $96,344.93 The price fell by 1.7 percent on Thursday, February 13 to 96 thousand 218 dollars. The decline is associated with the US PPI data, which is higher than expected, because the data that exceeds expectations signal that interest may not fall in the short term. However, despite the market uncertainty, the high amounts of BTC reinforces the possibility of a new rally.

Whales collected BTC of 3.8 billion dollars

In the last three weeks Bitcoin price109 thousand 365 dollars decreased to 96 thousand 399 dollars fell by 11.88 percent. This correction is considered part of the consolidation trend in the last three months. Despite the decrease in the price, whales are observed to evaluate market opportunities and buy a high amount of BTC.

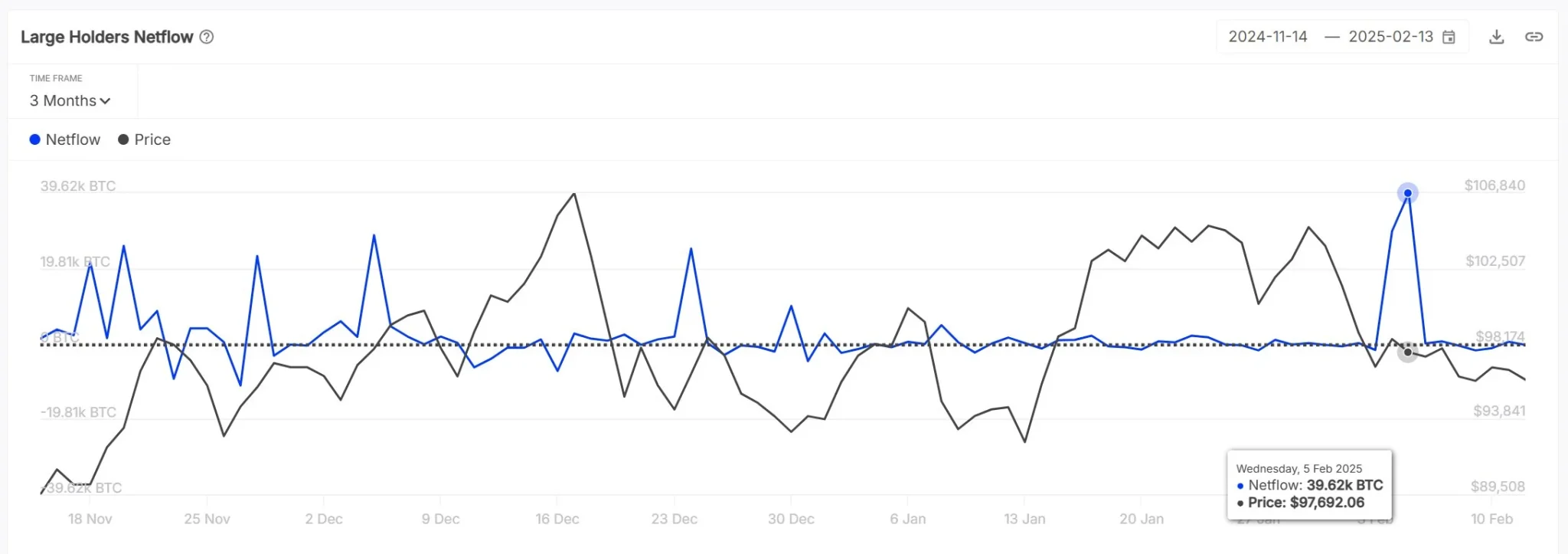

According to the data of the crypto analysis company Intotheblock, there was a net entry of approximately 40,000 BTC on February 5th to the large wallet addresses. This attracts attention as one of the biggest recruitment movements in recent months.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

According to historical data, the collective BTC purchases of whales generally create a positive atmosphere in the market, increasing corporate demand and reduce sales pressure. This is in the short term BTC priceIt may be a harbinger of upward movements.

Bitcoin Price Analysis, Comment

Bitcoin followed a horizontal course with a low volatility of $ 95,000 during the last week. The price movement was shaped with long -wick neutral candles showing that there was no clear direction between buyers and sellers.

If this horizontal movement continues crypto currencyThe price of the price of 5.3 percent further can test the support of 91 thousand 175 dollars. Historical data show that this level works as a strong support and that buyers return to the market in each test. Such movements may trigger the recovery of 12 percent to 20 percent of the price.

Market participants should closely monitor the price movement of $ 91 thousand 175. A possible recovery can signal a new peak movement, while falling below this level may be a harbinger of a greater decline trend.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.