Bitcoin (BTC) $98,847.0 price At the time of the article, the new daily bottom declined to $ 95,676 and the subcoins in a new decline tour. The decline in crypto currencies is now psychologically forcing the boundaries. Sales that started in the middle of December brought many crypto money to their bottoms last year. Which subcoins are at the purchase level?

Which subcoins at the purchase level

USA Crypto Coins He began to break the legal pressure for him, but there was no Altcoin receiver in the stock exchanges. Liquidity melting and BTC decreases cause greater losses in subcoins. For BTC, those waiting for the bottom of 90 thousand dollars to watch on the edge and not to take risks in subcoins. Despite a large number of good news, the risk appetite does not increase, the price of BTC is also related to the ongoing closes below the six -digit levels.

As you can see above, the average RSI of the 24 -hour popular subcoins fell to 28. Normally, when RSI levels decrease to these points, return from the bottom is now expected. In a few weeks, we should see that the crypto currencies you see at the point of sale are much higher than the prices they are today. OM and waist exception and subcoin such as XMR, Ban did not experience such great over sales.

Important data in crypto currencies

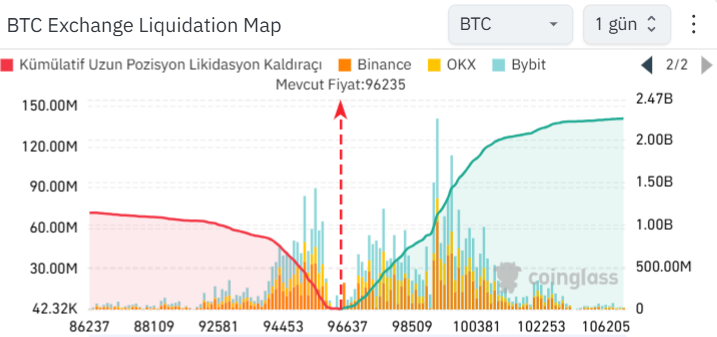

The potential liquidation amount accumulates at higher levels. BTC If the price decreases below $ 94,000, the Long position of $ 838 million is expected to be liquidated. However, when 100,000 dollars are returned, the potential Short position liquidation target is close to $ 2 billion. However, these figures are usually lower because investors who are accustomed to wavy graphics are down when the price is mobilized. The above condensation of the liquidity that opens appetite is positive for those who expect to rise.

Eth There is a Long liquidation potential of $ 277 million in a decrease to $ 2,630, while there is a $ 1.1 billion -dollar Short -position liquidation potential for $ 2,936. CME BTC -term transaction open positions continue to decrease and $ 22.7 billion in December has decreased below $ 16 billion today.

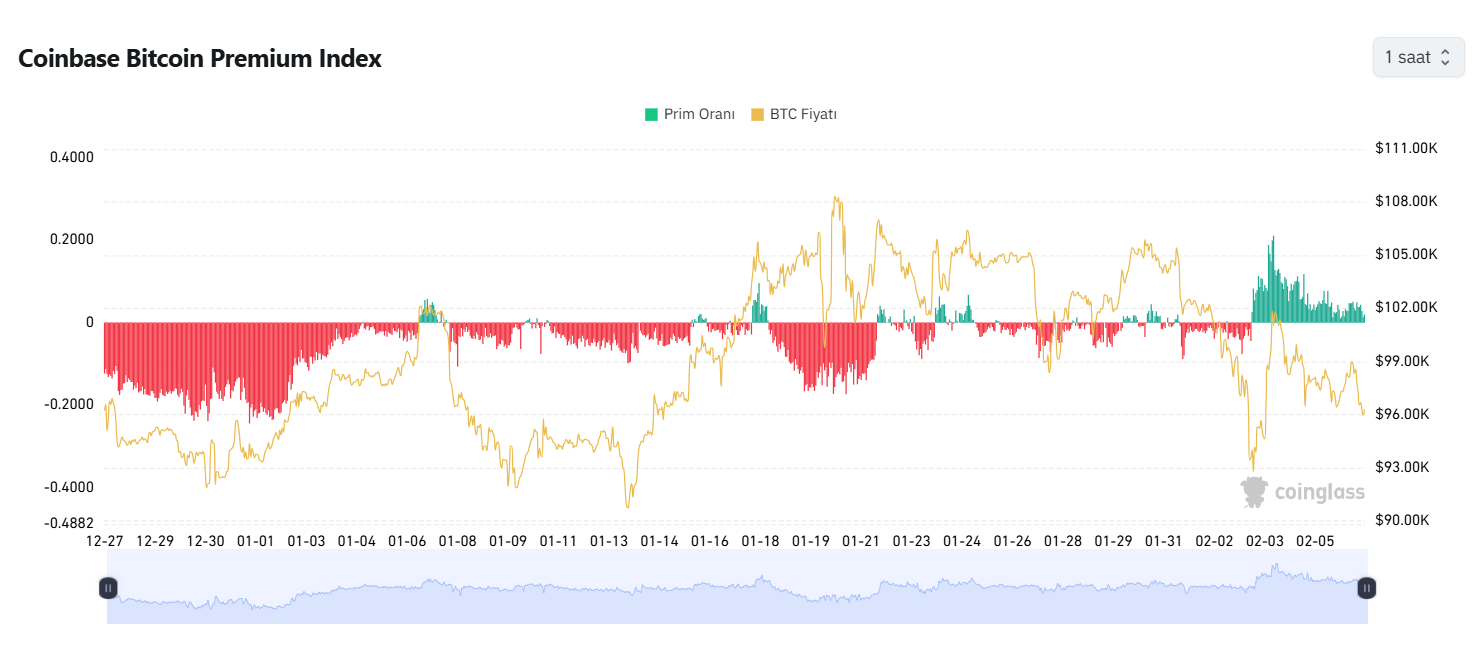

Coinbase Premium Index Positive since February 3. In other words, the BTC demand on the US side decreases day by day, but more powerful than global demand, the US is buyers. However, even if this gradually decreases, the price of the price on the US side is extremely interesting.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.