Silver is below triple digit prices and Bitcoin can still find justified reasons for the decline. Fed Minutes will come at 22:00 and we will see 2 important data announced on Friday. Although BTC seems unstable, it is more inclined to decline as it cannot protect $69,000 as support. So what does historical data say?

Long Term Crypto Investors

LTH (Long-Term Investors) are patient investors who hold their Bitcoins without moving for at least 155 days and are considered “smart money” in the market. Darkfost says long-term investors are increasing their entries into the Binance exchange.

While this prolonged correction is putting pressure on a wide swath of investors, even the LTH group is now feeling the pressure. Long-term investors are now losing money on their sales, and it is not a good thing that these investors, who have been historically considered resilient, are feeling more financial stress.

“The chart highlights periods when daily inflows reached approximately double the annual average, indicating exceptionally high flows and a clear change in behaviour.

These increases in activity indicate that some of the LTHs are actively repositioning in response to current market conditions. This trend has been observed since the recent high and has accelerated in recent weeks. For several days in a row, inflows well above typical levels have been recorded, indicating a sustainable growth in LTH activity on the platform.

significant amount BTC “Given their moving capacity, it is not surprising that these participants choose Binance for its market depth and liquidity.”

So what should you make of all this? What does the long-term investor signal tell us? Rising LTH inflows are a sign that selling pressure is intensifying, even if the broader correction continues. So the decline may not be over yet.

In summary, it may not be a surprise that we will see deeper bottoms for Bitcoin in the coming weeks or even months. The selling motivation for long-term investors is fed by reasons such as the Fed management change in May, tariffs, geopolitical risks, and historical data promising bear markets for 2026.

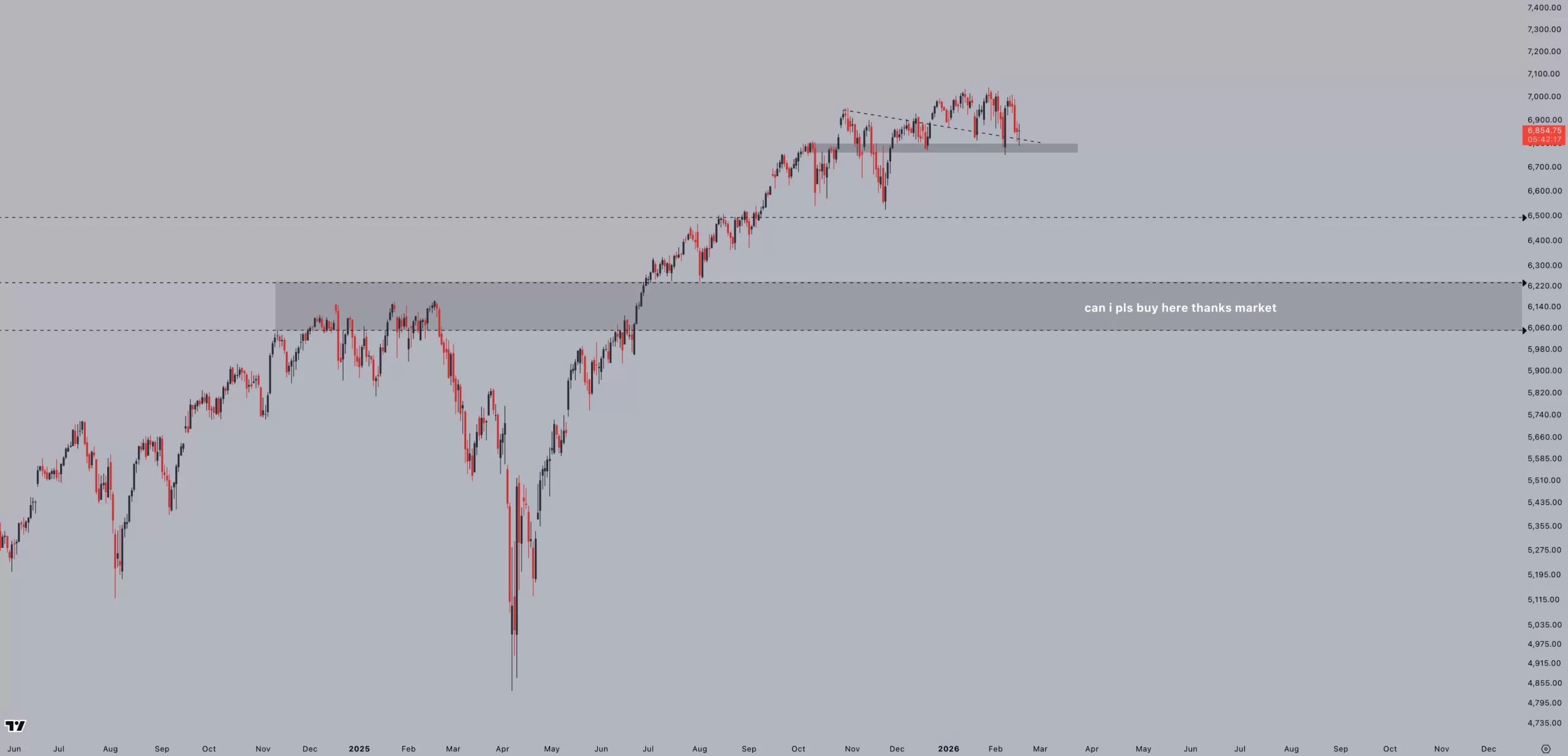

Jelle says that sales in US stock markets may accelerate in the coming days. The February 17 weakness was partly due to this, and if the stock market is to fall, BTC will follow.

“It’s increasingly likely that the S&P will decline in the coming weeks, which means great entry opportunities are coming. Stocks are at a discount, which means an even bigger discount for $BTC.”

If Silver Falls, Will Crypto Rise?

Michael Poppe, with his usual optimism, points to the weakness in the silver price and says that the capital has turned to crypto and may turn. But while he is optimistic, Poppe may be proven wrong as long-term investors vote for the continuation of the decline, causing more oversupply on the sell side (causing the decline beyond waiting for the decline).

“Silver’s bearish trend is quite clear. The peak has been reached, we will experience consolidation for a longer period of time. This is completely normal, as we will then be able to purchase silver at cheaper levels in preparation for the next rally.”

Now; At this point, the rotation towards other assets such as crypto begins.”