Bitcoin price has entered a make-or-break phase. After months of sustained strength and a rally to fresh highs above $126K, BTC is now retracing toward a major long-term support zone—one that previously defined cycle bottoms in 2018, 2020, and 2022. As price cools, signs of distribution are emerging: profit-taking has increased, whale wallets are moving coins to exchanges, and higher-timeframe momentum is beginning to fade.

With volatility compressing and sentiment turning cautious, the market is approaching a critical turning point. The BTC price behavior around $65,000 and $68,000 is pretty important that may set the tone for the next price action.

What’s next for the Bitcoin (BTC) price? Has the crypto reached the bottom, or is there more pain ahead?

Bitcoin Approaches Long-Term Ascending Support

Bitcoin’s chart is now highlighting a crucial consolidation period after having been on a bullish tear that saw it hit brand new highs above $126K. The price is starting to pull back & tighten up towards a historically significant support zone that’s roughly between $68K and $70K, a spot that’s been the place where the cycle bottoms have been marked previously.

Things are getting a bit more serious as we see a retracement going on at the moment, & this is happening alongside the higher time frame momentum starting to fade out—which suggests the rally is losing steam rather than suddenly turning on a dime.

The volume & on-chain indicators are also showing us that the large holders are taking profits & getting a bit cautious at the same time. Still, though, structurally speaking, BTC is still holding above its long-term support lines, keeping the broader trend picture looking pretty good. However, a decisive reaction at this zone will be super important—because if it holds up, it could be a real kick in the pants for the price to go even higher—whereas a breakdown here may actually trigger a deeper pullback before the trend actually starts to continue back upwards.

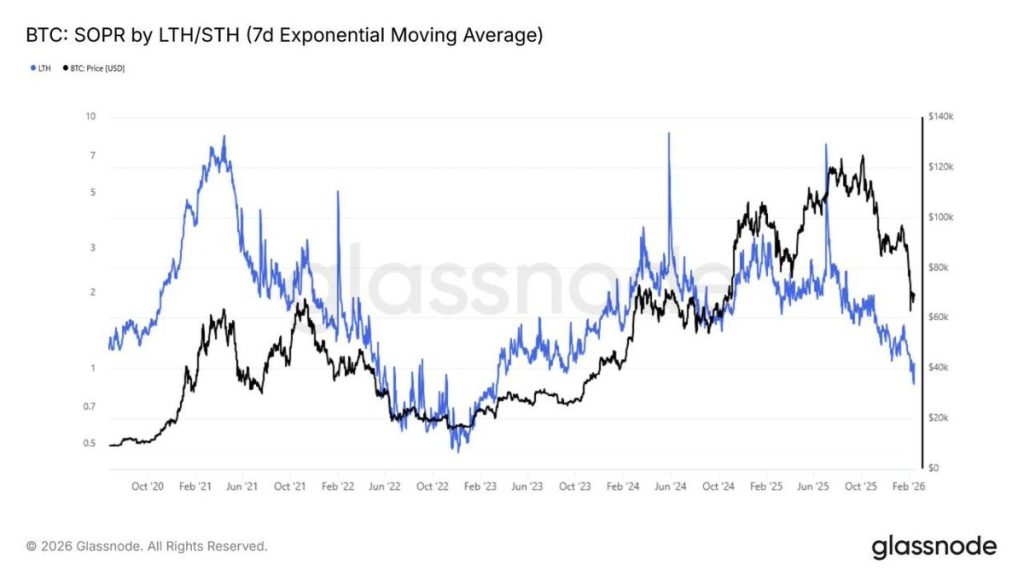

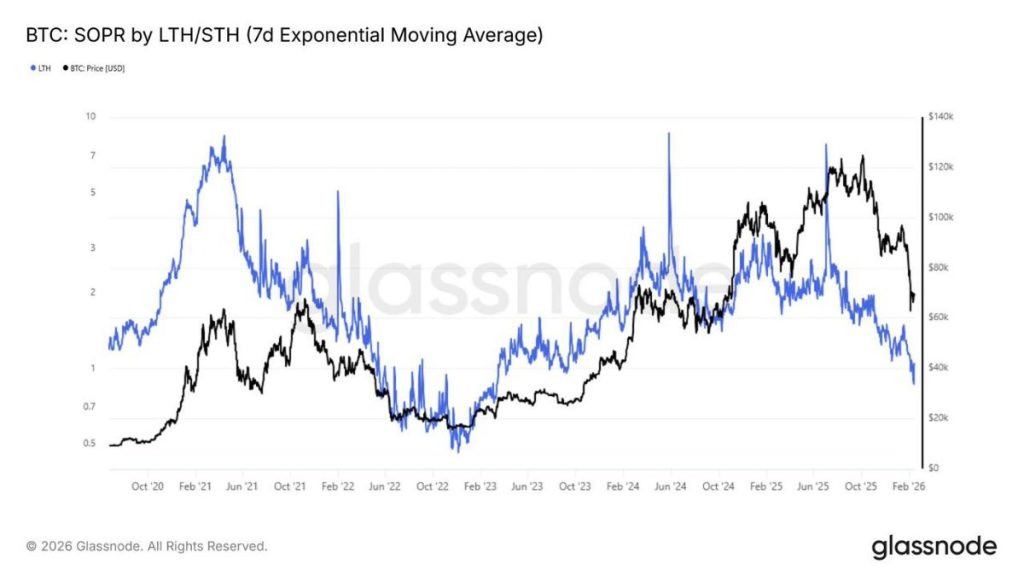

SOPR Signals Profit Compression and Holder Stress

On-chain data is reinforcing the idea that the market is entering a stress phase. The Spent Output Profit Ratio (SOPR), particularly when analyzed across long-term and short-term holders, is trending lower toward the neutral 1.0 zone. SOPR near 1 indicates coins are being spent close to their cost basis. In simple terms, profitability is compressing.

Historically, deep corrections often see SOPR reset toward this level before a new upward expansion begins. It reflects:

- Reduced profit-taking

- Diminished speculative excess

- Holder reset conditions

However, sustained movement below 1 would indicate widespread capitulation, where coins are being sold at a loss. At present, SOPR is compressing but not yet signaling full capitulation. That leaves Bitcoin in a transitional phase rather than a confirmed bottom.

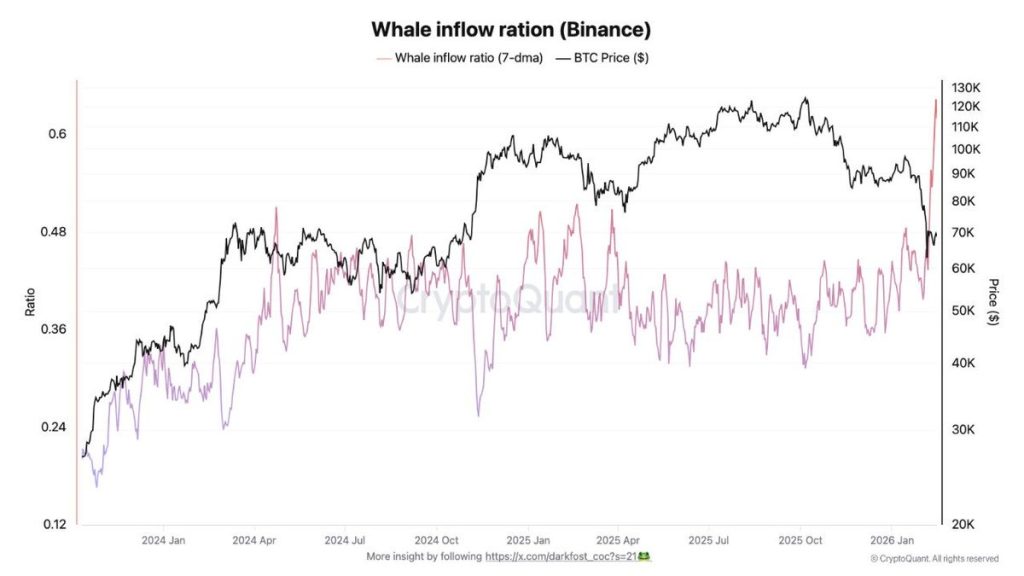

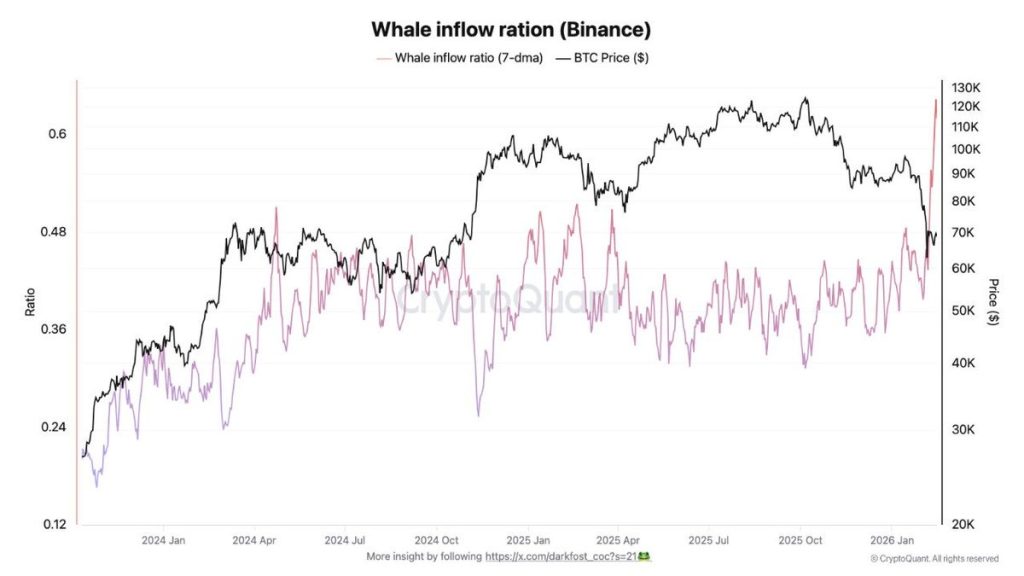

Whale Inflow Ratio Raises Volatility Risk

Another important metric is the whale inflow ratio on Binance. Recent data shows elevated whale inflows to exchanges while price declines. This typically suggests that large holders are transferring BTC to trading platforms, increasing the potential for sell-side liquidity.

Whale inflow spikes often occur during:

- Distribution phases

- Volatility expansions

- Pre-capitulation events

Such spikes can precede local breakdowns, but they also appear during final flushes before reversals. The key is whether inflows remain persistently elevated or normalize as support holds. Right now, whale behavior is adding uncertainty rather than confirming a direction.

What’s Next for the Bitcoin Price Rally?

Currently, the Bitcoin price has not confirmed a bottom, nor has it confirmed a breakdown either. It is just compressing. The profitability is tightening, and momentum is cooling, but large players are pretty active. The upcoming breakout may have a deep impact on the rally, as if the price stabalises above $70,000, it could form another macro higher low and keep the broader bull structure intact.

Besides, a decisive breakdown below the range may drag the SOPR below 1. Besides, the whale inflow may remain elevated, which may raise the possibility of visiting the lower support range between $55,000 and $60,000. Here is when the crypto market reset may occur, initiating a strong recovery phase for the Bitcoin price rally.

FAQs

Not yet. BTC is in a transitional phase with compressed momentum and profit-taking, awaiting confirmation of either a rebound or breakdown.

Whale inflow ratios have recently spiked, meaning large holders are transferring BTC to trading platforms. This often happens during distribution phases or before volatility expands, adding sell-side pressure and uncertainty to the market.

Yes, if price stabilizes above $70,000 and forms a macro higher low, the broader bull structure remains intact. A decisive reclaim of momentum could fuel the next leg up, while a breakdown would likely require a deeper reset first.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.