The ongoing sharp fluctuations in the cryptocurrency markets have put especially risky assets under serious pressure. In this process, while the existing vulnerabilities for some tokens became more evident, investor confidence remained hanging by a thread. One of the projects that most clearly reflects this picture is Arbitrum (ARB), the native token of Arbitrum, an Ethereum layer-2 solution.

Liquidity Increase and Fragile Balance of Trust

ARB, which has lost approximately 40 percent of its value since the beginning of 2026, continued its weak performance after a decline of more than 70 percent in 2025. The token fell below the $0.20 level last month, thus falling to the lowest price zone of all time. According to on-chain data, all investors holding ARB are currently in a loss position. This situation further increases the psychological obstacles to a possible recovery.

However, some indicators point to a striking divergence. DeFiLlama data reveals that the stablecoin market value on the Arbitrum network has increased by approximately 2 percent in the last week, reaching around $65 million. In particular, USD Coin (USDC) now accounts for 56.8 percent of the stablecoin supply on the network, with an increase of 3 percent. However, total value locked (TVL) is still at multi-month lows; This suggests that large-scale liquidity has not yet returned.

The increase in stablecoin inflows undermines the perception that on-chain liquidity has completely dried up. However, the fact that TVL remains low indicates that capital commitment on the network is limited. Having fewer assets locked up weakens the buffer mechanism against price fluctuations and leaves the ARB vulnerable to new selling pressures.

Although the technical outlook is weak, signs of improvement in on-chain fundamentals suggest that investors are taking strategic positions. The question at this point is: Is liquidity geared towards long-term structure building rather than short-term price reaction?

Real World Assets Move

The blockchain ecosystem is trying to get rid of speculative cycles and evolve into a more fundamental model. While areas such as artificial intelligence, DeFi and asset tokenization come to the fore, Arbitrum is also trying to adapt to this transformation. The Eurus Aero Token I project, launched by ETHZilla on the Arbitrum network, offers access to the revenue obtained from jet engines leased to a US airline through tokenization. This development demonstrates the potential of real-world assets (RWAs) to increase on-chain activity.

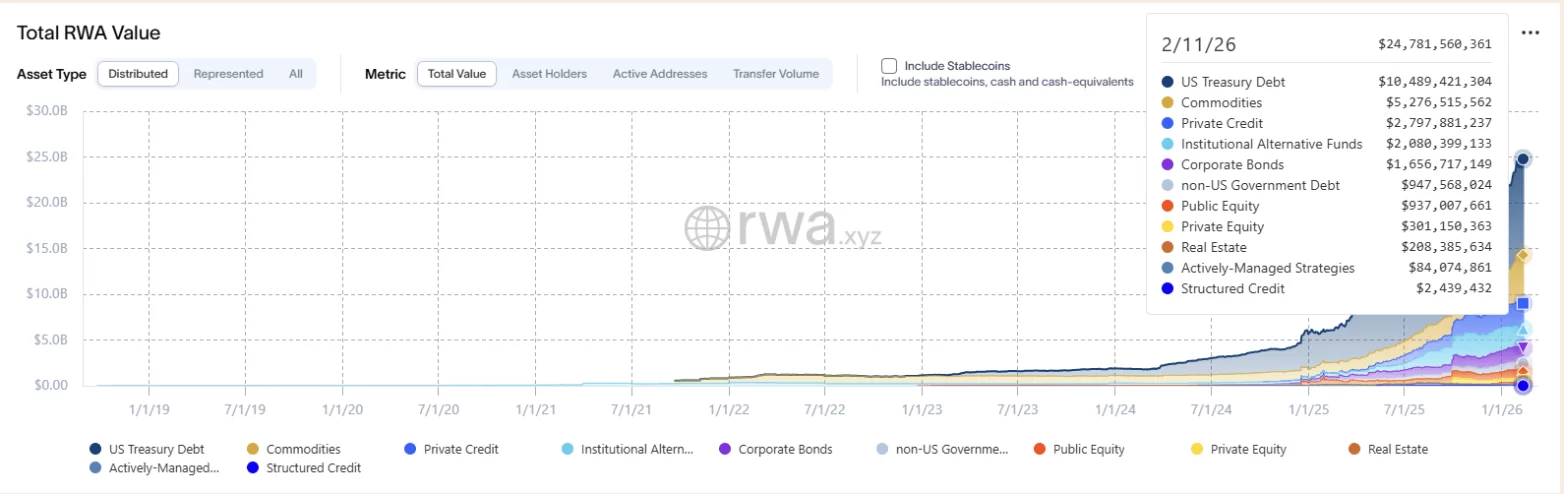

As a matter of fact, the RWA sector recently reached a record level by increasing its total asset size to approximately 24.7 billion dollars. Additionally, gold-based stablecoin Tether Gold (XAUT) surpassed the $6 billion threshold, reinforcing the momentum in this area. Similarly, the acceleration of tokenization projects by major asset management companies at the beginning of 2026 shows that institutional capital’s interest in on-chain solutions has increased.

From a strategic perspective, focusing on the RWA space could create an opportunity for Arbitrum to attract institutional investors. The growth in the stablecoin market and the ETHZilla collaboration support this vision. The most critical element is rebuilding investor confidence. Because all ARB investors are in a loss position, this literally keeps the risk of capitulation alive.

As a result, although Arbitrum has experienced historical weakness on the price front, it is making moves to strengthen its fundamentals. Even if technical pressure persists in the short term, the RWA-focused strategy and increased stablecoin liquidity could underpin a long-term recovery. However, for this process to be successful, both market conditions must improve and actual usage on the network must increase significantly.