Bitcoin Cash has begun to regain traction as the broader crypto market shows early signs of stabilization. With Bitcoin steadying and sentiment cooling from recent extremes, BCH has quietly pushed back toward the $570–$575 region, posting steady intraday gains while maintaining structural support near $540. The recovery is not explosive, but it is calculated. Beneath the surface, leverage remains elevated and positioning is building near resistance, creating conditions that could define the next major move. The key question now is whether $570 gives way and unlocks a squeeze toward $600.

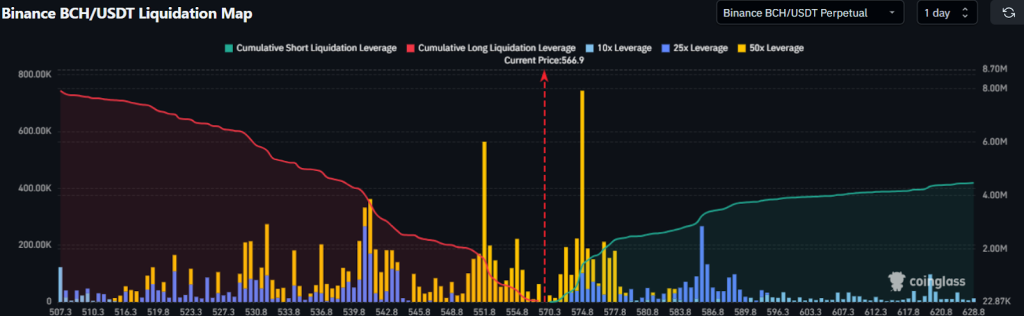

Liquidation Map Data Reveals a Potential Squeeze Zone

The Binance BCH/USDT liquidation map provides a clear picture of the imbalance forming above current price levels. At approximately $566–$568, BCH price sits just below a dense cluster of short liquidations stacked between $575 and $600, with the heaviest concentration near the $590–$600 region. These represent leveraged short positions that would be forcibly closed if price breaks higher, effectively creating automatic buy pressure.

Below current price, liquidation liquidity is thinner, particularly under $550, which reduces the likelihood of a cascading downside event unless support decisively fails. When liquidity pools cluster above resistance while open interest rises, markets often gravitate toward those zones. If BCH reclaims $580 with sustained volume and momentum, the probability of a short squeeze accelerates materially as forced buy orders stack on top of organic demand.

BCH Price Structure Tilts Toward Breakout Attempt

As the broader market exhibits a recovery, Bitcoin Cash price bounced off from the range’s support zone of $540 and retested the 50 day EMA hurdle. It has been trading within a narrow range, where buyers are gradually stepping in earlier on each pullback. The $590-$600 region remains the critical resistance band. BCH price is now coiling within a tightening range between the support near $550 and horizontal resistance at $600.

A decisive daily close above $600 would invalidate the short-term lower-high structure and open the path toward $640 first, followed by the $675–$700 liquidity pocket where prior distribution occurred. Failure to hold $550 would weaken the setup and reintroduce downside risk toward $510. For now, the structure favors a breakout attempt, but confirmation still requires a sustained push above resistance.

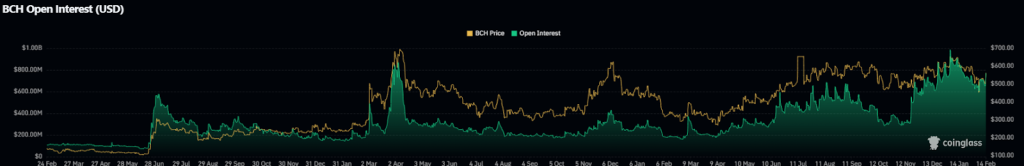

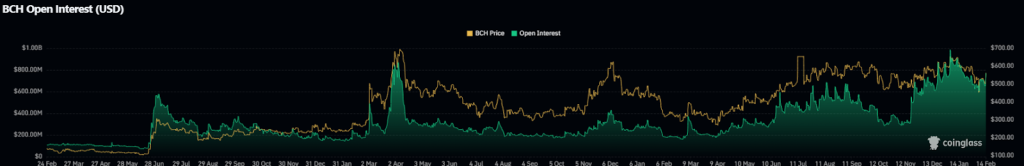

Futures Market Activity Signals Growing Conviction

Recent derivatives data shows a sharp rise in trading activity. The 24-hour futures volume has climbed to $905.22 million, while spot volume remains comparatively modest at $91.64 million, signaling that speculative positioning rather than passive spot accumulation is driving the current move.

At the same time, open interest has increased 11.60% to $771.89 million, and total derivatives volume has surged 57.03% to $907.13 million. Rising open interest alongside rising price typically indicates that new positions are entering the market rather than shorts merely covering. This dynamic is important because when price increases while open interest expands, markets often move toward liquidity events. If momentum continues, overleveraged participants can quickly become fuel for acceleration.

Final Thoughts

Bitcoin Cash (BCH) is not simply participating in the broader market recovery, it is approaching a leverage-heavy inflection point. With BCH price at $566.84, futures volume exceeding $900 million, and open interest nearing $772 million, speculative positioning is elevated enough to create volatility once resistance is tested. If BCH clears $600 with sustained volume, the concentration of short liquidations above that level could trigger a rapid expansion phase. If resistance holds, the range remains intact and consolidation may continue.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.