Trump seems to be bored with the USMCA talks and things are not going great with Iran either. While US employment figures came in above expectations today, everyone focused on Friday’s inflation data. After a short-term rise, Bitcoin started to fall again after the US market opening. Alright cryptocurrencies Isn’t it still in oversold territory?

Are Cryptocurrencies at the Bottom?

Bitcoin It is stalling at $66,500, and last week the price dropped to $60,000. There was an extremely sharp decline and such rapid losses were not expected. K33 analysts discussed the current situation and said that a promising picture was taking shape according to many metrics.

According to research and brokerage firm K33, Bitcoin’s extreme sell-off last week has marked its local bottom. Pointing out that “capitulation” conditions have occurred in the ETF, spot and derivative markets, K33 Research Head Vetle Lunde talks about “extreme signals”.

- Low funding rates similar to the March 2023 US banking crisis period.

- Option skews increased to levels seen during periods of most intense stress in the 2022 bear market.

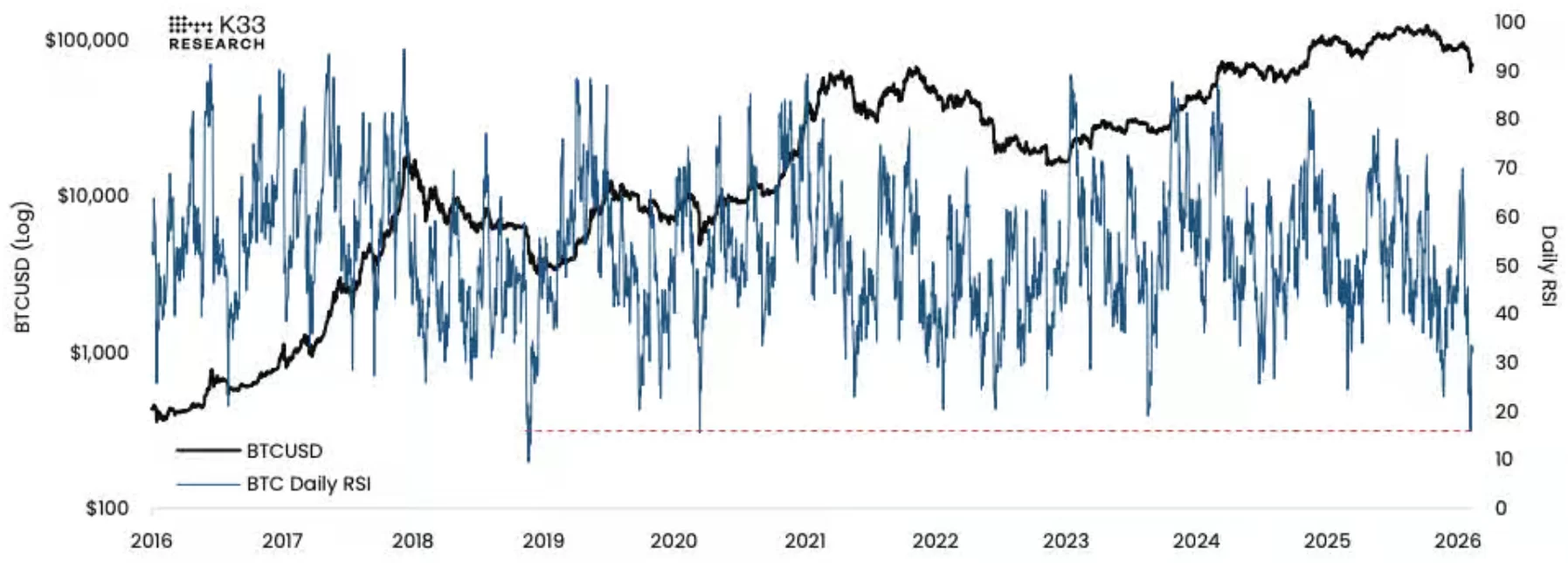

These are some signs that support the bottom prediction. Sales continuing since January 20 are in a daily period BTC RSI It decreased its value to 15.9. It is the sixth largest RSI bottom since 2015, and previous lowers were seen in March 2020 and November 2018.

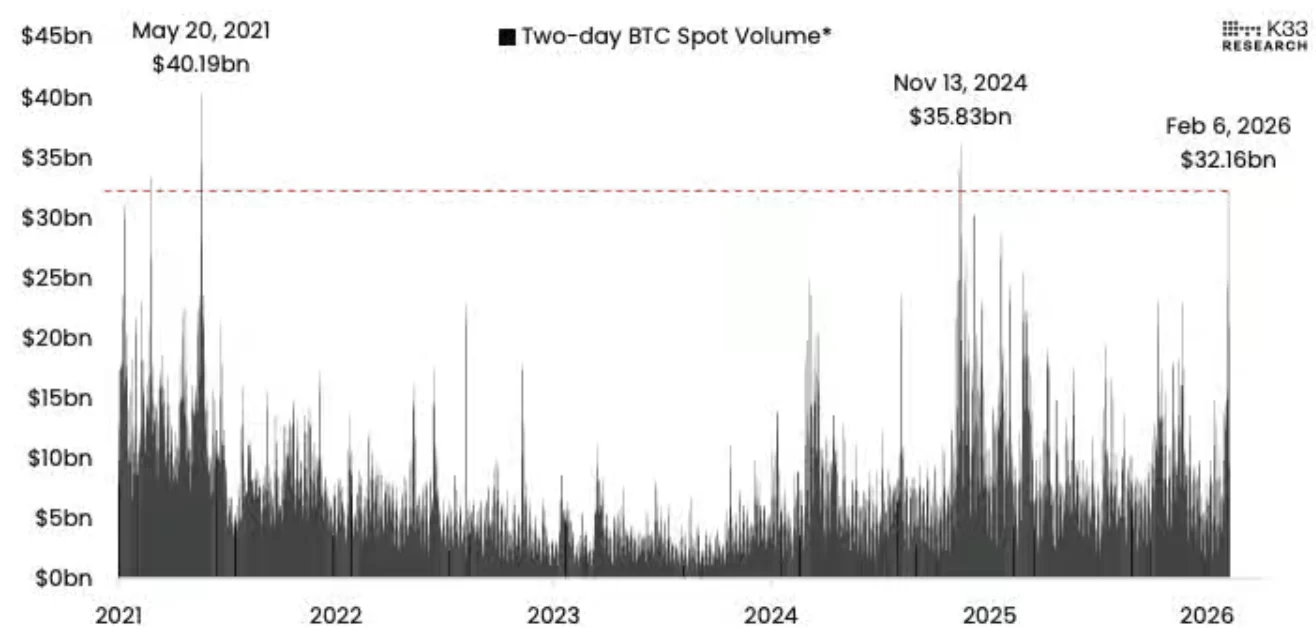

The Crypto Fear & Greed Index dropped to 6, marking the extreme as the selling wave continues. Lunde said the price movement was driven by “hyperactive transactions.” Two-day Bitcoin spot volume reached $32 billion on February 6, the highest levels ever recorded.

Exceptions Say Bottom

K33 Research President Lunde says the data points to an “exceptional period” and argues that many combinations of data combine to identify local bottoms. For example, the Bitcoin perpetual swaps funding rate dropped to -15.46% on February 6. The seven-day average funding rate also fell to minus, falling to -3.5%. The last time such low levels were seen was in September 2024.

Option trends are also in the extreme defensive zone, these levels were last FTX crash was seen during. IBITreached its historical peak on February 5, when it surpassed $10 billion and saw trading volume of 284.4 million shares. On February 5, the fifth largest launch since launch was experienced.

In summary, Lunde says that extreme values across volatility, volume, returns, curves and ETF flows are exceptions and the bottom has arrived. According to K33 analysts, it will linger between $60,000 and $75,000 BTC It may not see a deeper bottom for a while.