bottoming at $60 thousand Bitcoin After excessive sales, it entered the classic bottom-reaction rise phase. No decline or rise is ever vertical and it is too early to say that the decline is over for BTC. We mentioned that the US markets will open with buyers. Now, BTC is preparing to make a good start to the weekend by exceeding $68 thousand. However, the Iran problem has not disappeared.

Bitcoin (BTC)

It is positive that the indirect meeting between the USA and Iran does not open the door to new discussions (judging by the statements received so far). US stock markets are recovering after overselling as buyers come onto the scene. Especially XRP Coin After yesterday’s 25% loss, it continues to be around 1.5 dollars with a 16% gain today.

It is too early to rejoice because the problems between Iran and the USA are still hot. The tariff decision will be announced by the Supreme Court on February 20. Moreover, we will see important US data coming next week. Although it is not surprising that declines caused by overselling pave the way for such a reaction rise, entering all in long positions can be painful in the “new billion-dollar liquidation wave”.

Bitcoin and Cryptocurrency Charts

When extreme points are reached, the normalization phase begins. of Bitcoin Profit-expected purchases come into play after an extreme decline, such as profit sales after reaching the ATH level. If this new wave is strong enough, the price will change direction, at least for a short time.

About half an hour before the US market opened, on-chain analyst Maartunn warned investors.

“SSR RSI Gives Buy Signal.

stablecoin The Supply Rate is relatively high compared to Bitcoin’s market cap. Historically, this structure has indicated positive buy zones.”

Columbus shared the chart above today and said that no matter what, trading less is a better option these days.

“You make money by trading on the right days. When conditions are bad: Reduce volume. Trade less. Protect your capital.

Survive the fluctuations so you’re ready for the trend. Bad markets test discipline. Good markets pay for that.”

The last bottom signal came from Darkfost while BTC was pushing 60 thousand dollars.

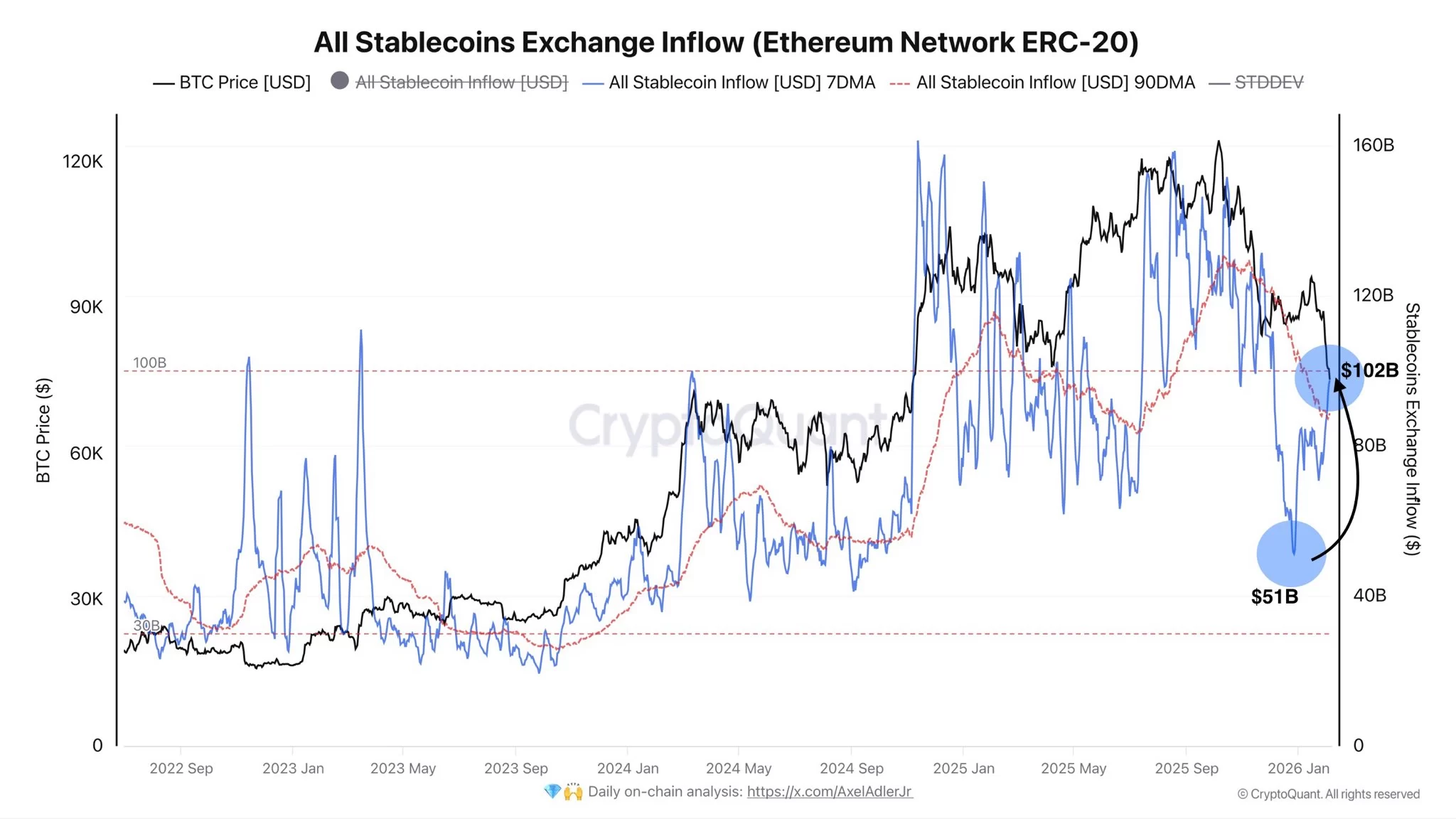

“As BTC gradually approaches a 50% correction from its all-time high in October, we may see increased inflows of stablecoins into exchanges.

By late December 2025, weekly average stablecoin inflows (7-day moving average) had fallen to $51 billion, perfectly reflecting the lack of demand we had been facing for several months.

Today, at $98 billion, those flows have doubled and are above the 90-day average of $89 billion.

This suggests that capital deployment has accelerated in recent weeks and the market clearly needs it. However, selling pressure remains too strong to be fully absorbed. This is still a positive signal as it indicates investors’ interest is gradually returning to this correction level. “This dynamic still needs strengthening, but some participants have already started buying the dip.”