The post Stacks (STX) Price Up 20% Today: Is a Trend Reversal Finally Forming? appeared first on Coinpedia Fintech News

STX price staged a sharp intraday recovery, climbing close to 18% after weeks of persistent downside pressure. The rebound unfolded during a session marked by improving risk appetite across select altcoins, but STX stood out as price reacted decisively from a compressed range near recent lows. The move was not gradual, as STX price accelerated higher after absorbing sell orders clustered below the $0.30 region, an area that had repeatedly acted as short-term support. Once that supply was cleared, STX pushed higher in a single directional move, signaling a shift in near-term market control.

The recovery has pulled STX away from its local bottom, placing price back into a technically important zone where prior breakdowns occurred often the first area traders watch to assess whether a bounce has follow-through potential.

STX Price Breakout Retest Keeps Upside Structure Intact

STX price action is now shifting into a post-breakout retest phase, a behaviour typically seen after aggressive trendline breaks. After clearing the descending trendline that capped the token upside for weeks, STX did not extend vertically. Instead, it pulled back in a controlled manner to retest the former resistance as new support, a structurally constructive signal. On the chart, Stacks price is compressing above the reclaimed zone, with higher lows rather than slipping back into the prior range. This suggests sellers are failing to regain control, while buyers are defending the breakout level with reduced volatility.

If STX price continues to hold above this retest area, the structure opens the door for a continuation move toward the $0.45-$0.50 region. A clean push above the local consolidation zone would likely trigger momentum-driven participation, especially given the earlier short-side pressure. Failure of the retest, however, would delay the bullish thesis and push STX back into range-bound behaviour rather than invalidate the broader recovery.

Futures Market Data Outlook

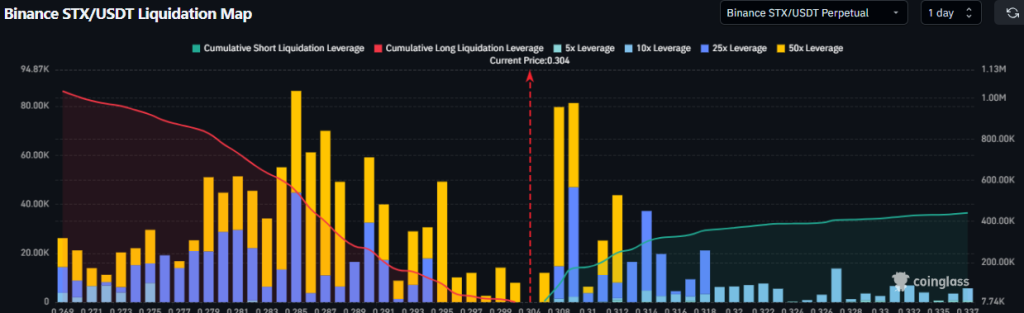

Derivatives positioning played a key role in today’s rally. Liquidation heatmap data shows dense short liquidity stacked between the $0.30 and $0.32 range, levels that were swept as price moved higher. As STX crossed into this zone, forced short exits amplified upside momentum rather than organic spot demand leading the move.

Furthermore, the open interest surged alongside price, indicating fresh positions entering the market instead of leverage being flushed out entirely. This matters. Moreover, exchange data further shows short exposure outweighing longs near the lower range, leaving additional downside protection for price as long as STX holds above reclaimed intraday levels.