Ki Young Ju, who announced the beginning of bear markets early last year and then apologized, is on the scene again. Historical signals of on-chain data may not work as accurately as before, but the evaluations of Ki Young Ju, one of the most competent names in this field, are still important. So what is his expectation? What are their reasons?

Is the Decline Over? What is the reason?

Bitcoin price When it enters bear markets, it experiences huge declines from its ATH level. Ki Young Ju said that the dynamics for cryptocurrencies have changed in today’s conditions and that what we saw in previous bear markets will not repeat. The situation with 3 questions and 3 answers is as follows;

What does Ki Young Ju see as the reason for the decline?

Answer: No new capital inflow.

Have bear markets started?

Answer: We cannot talk about bull markets when there is no capital inflow.

Has Bitcoin bottomed out?

Answer: The selling pressure is not over yet and a different bear market structure may occur where we will see long-term consolidation.

There Will Be No 70% Drop in Crypto

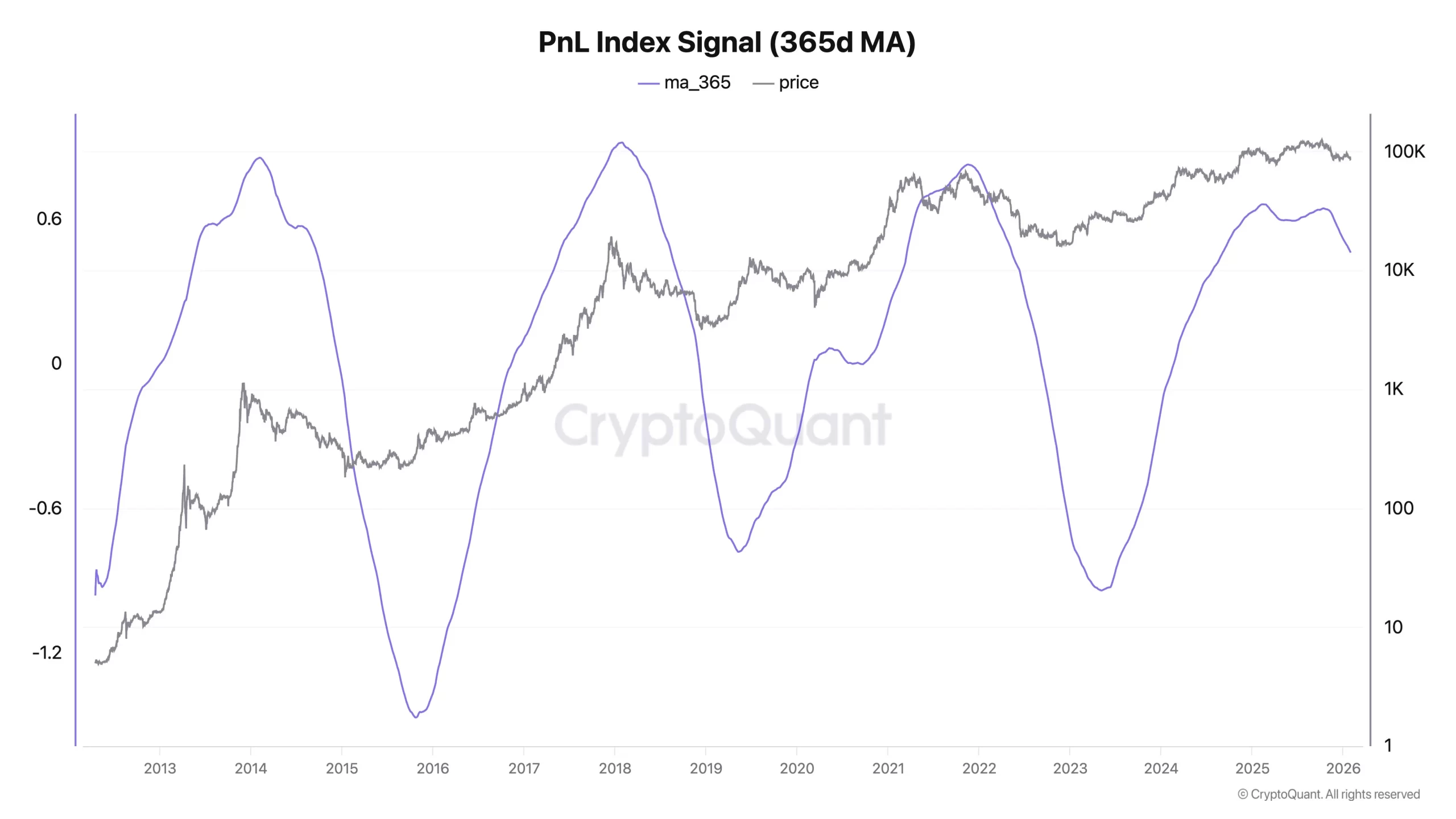

Ki Young Ju, founder of CryptoQuant, one of the largest on-chain analysis platforms, shared the chart below. to Strategy he pointed out.

“Bitcoin is in decline as selling pressure continues and there is no new capital inflow.

The realized market value remained constant, meaning no new capital inflows. When market value declines in this environment, it is not a bull market.

Early stage investors, ETFs and MSTR It has large unrealized gains thanks to its acquisitions. They have been realizing profits since the beginning of last year, but strong capital inflows have kept Bitcoin around $100,000. Now this capital flow has dried up.

MSTR was the main driver of this rise. Unless Saylor sells its holdings significantly, we will not see a 70% crash like previous cycles.

“Selling pressure is still ongoing, so the bottom is not yet clear, but this bear market will likely create a broad horizontal consolidation.”

Saylor is not in favor of selling, and at the time of writing, it had only been 55 minutes since he announced his new purchase.

When Michael Saylor made the above post, it was actually an acquisition announcement, as the company announced more acquisitions on Monday.