After the crash in the charts Bitcoin The decline has stopped for now. James Bull expects 78 percent probability that BTC will close the CME gap within 3 weeks at the latest. If BTC falls further, this could lead to bigger losses in altcoins as CME hopes fade. Let’s take a look at the current predictions of different analysts.

Bitcoin Price Prediction with 78 Percent Probability

historical data CME price He says the gaps were closed within 3 weeks. Of course, this isn’t necessary, but 78% is a large percentage and we should see a recovery after January’s overselling, even if it’s before a further decline. Generally, even though losses continue after sharp declines, there is an intermediate rise before that. This is exactly why James Bull says that the BTC price may reach better levels than it is now in the coming days.

“It is time to close the 2 CME gaps at $83,000 and $95,000. 78% of them are closed within 3 weeks.

These are like magnets. How?

The end of the government shutdown, which will most likely happen next week. This will cause extreme activity in altcoins, with many coins gaining 20 times in value, from $20,000 to $4 million. Yes, most of them will drop to 0, but 20 of them may drop to 0 for 1 winner. (I invested in crypto, it is not investment advice.)”

James, who also shared the chart above, has spent the last 7 years of BTC He wrote that he has not experienced a bearish period (4+ red candles) for more than 4 months and that Bitcoin will probably close at better levels than its current level in February. But 2022 FTX In its collapse, BTC lost even though it never lost the previous ATH level as support. So historical data may be misleading, but they are usually right.

Says Sell Your Altcoins

Miles Deutscher reminded the FTX crash and the May 2022 LUNA event to explain how big the size of the weekend decline was. 1.75 in FTX crash and LUNAIn the /UST incident, we saw $1.5 billion in liquidations. This last crash was over $2.5 billion, and billion-dollar liquidations have been going on for days. Miles says that the markets are disrupted, especially after the $19 billion liquidation on October 10, and that we are in the most exhausting period of crypto.

Ran Neuner says something assertive. According to him, selling altcoins may be the best option. Generally, such periods of extreme pessimism occur before major rallies, but at the extremes of extreme pessimism. If he is wrong tomorrow and people get hurt because they listened to him, he will get a lot of reaction.

“YOUR ALTCOINS BUY. HERE’S WHY.

Altcoins look “cheap” as they have lost 70-90% of their value.

But being cheap is not the same as being undervalued. So I went back to the data. In the last full cycle, less than 20% of the top 200 altcoins reached a new high again. Most of them could not recover. They slowly lost value against Bitcoin.

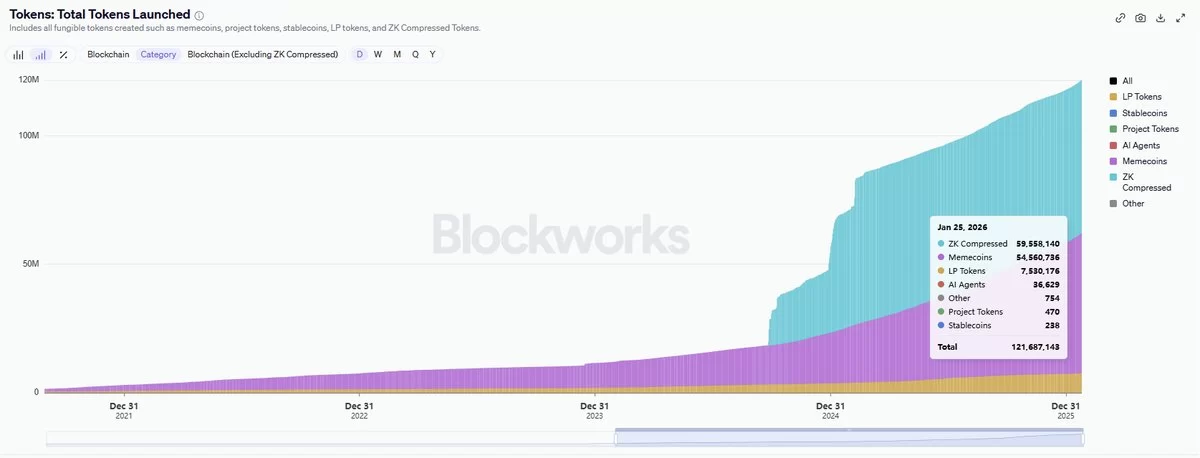

Now let’s take an overview of this cycle. In 2017, there were thousands of tokens in cryptocurrencies. Today, there are more than 120 million tokens. Recovery is no longer the baseline scenario. Extinction is the basic scenario.

That’s why people say: “I’ll wait for him to come back.” This is usually said just before capital is stuck for years.

This cycle is not about holding on longer. It’s about keeping the less important thing.”