The apparent decline was no surprise to cryptocurrency investors. Since October 10, cryptocurrencies have not been able to recover. At least we can focus on the possibility that the sellers will lose steam and the excitement will return. In other words, this decline is the kind of decline that makes drowning investors say “oohh, we are so relieved”.

Collapse in Cryptocurrencies

Bitcoin, which has been stuck in a tight range for 3 months, has moved largely sideways and ignored any of the good news. Since the events that would affect the outlook for 2026 were concentrated in the first quarter, such a start to the year was already anticipated. This is one of the reasons why good news is not priced in.

- trump new Fed chairman He announced the name that will be. Based on his previous views, Warsh is not expected to take a position in favor of monetary expansion. This is against cryptocurrencies.

- Trump plans to attack Iran soon. Against cryptocurrencies.

- Stocks rose excessively and the expected correction began.

- The Supreme Court is expected to rule against the tariffs on February 20.

- Bitcoin ETF lost investor cost and Strategy buying average.

- Demand for ETFs in cryptocurrencies has weakened.

- FUD on Binance regarding October 10 crash is growing.

- While Hyperliquid outperforms the Binance exchange in many parities, liquidity becomes inefficient.

- The bulls, worn out by billions of dollars of liquidation every day, have now become quite weak.

- MSCI has expressed its opinion against cryptocurrency reserve companies and still thinks that the classification should be changed. He just postponed this decision.

- Cryptocurrency market clarity legislation is not advancing in a bipartisan manner. Since a simple majority is not enough for a Senate vote, the chances of the law being passed in 2026 have dropped significantly.

- Trump is losing ground heading into the midterm elections in November 2026 and will likely lose the majority. This puts Trump at risk of impeachment. At best, Democrats will turn him into a lame duck.

- In the last season of cryptocurrencies, especially meme coins, investors see this field as gambling. In other words, it is clear that crypto attracts a different profile of investors than the investor profile it attracted in 2021 and previous cycles. A significant portion of them left crypto in 2025, and the image of crypto was damaged.

- BTC has clearly broken the bear flag and is rushing to the bottom after testing the resistance level only once this year.

You can add the sentences “this situation is in favor of cryptocurrencies” at the end of the sentences in all the above articles. If you have time, I can bring the number of reasons closer to 100.

When will the collapse end?

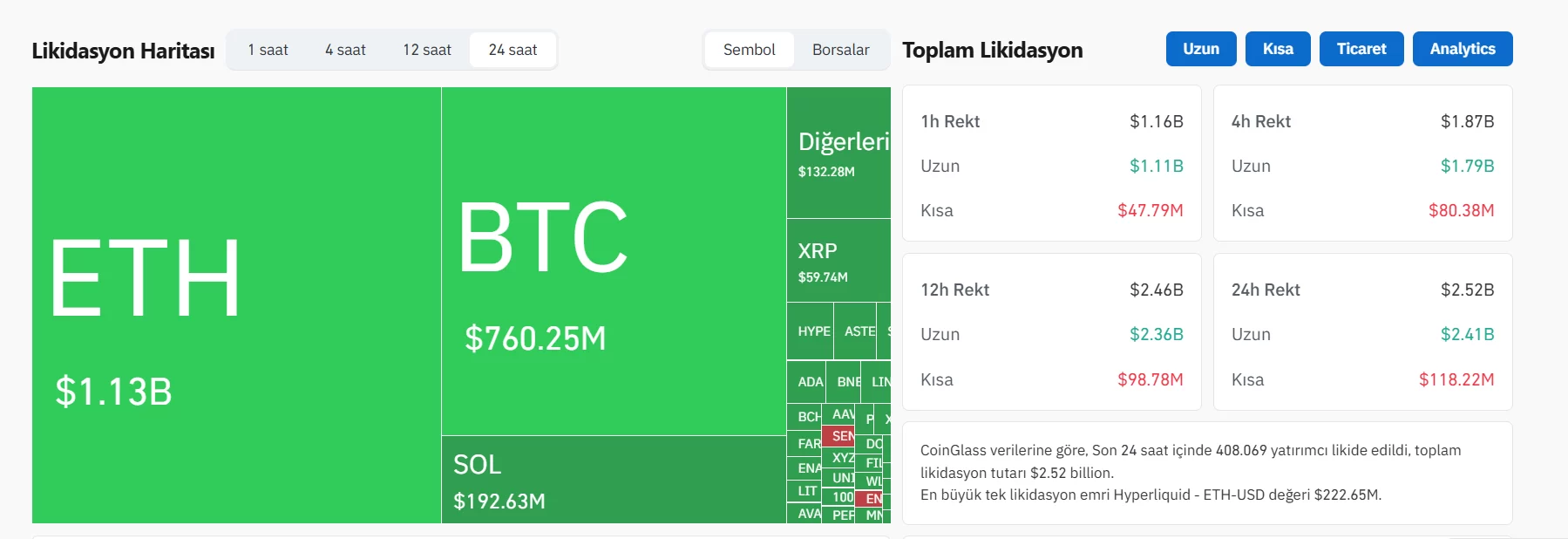

A position worth $1.16 billion was liquidated in the last hour alone. Losses in the last 24 hours exceeded $2.5 billion. SOL Coin is trying to hold on to $100, and close to $200 million in liquidations occurred here alone. This latest decline, similar to the crash on October 10 BTC Now is the decision moment for you.

If this is a downward break, BTC may gradually decline to 56 thousand dollars by 2026. This is the level pointed out by most analysts looking at long-term averages.

News of attacks against Iran is on the agenda for Sunday. If there is no attack tomorrow, the market may experience some reaction increase due to this news that is already priced in. Remember, declines in crypto are not always vertical and we always see ups and downs. There will be people who buy this dip and want to sell at the first top. Depending on the strength of these sellers, return prospects will also be sold.

Stock market performance on Monday will be important, it may be effective for us to see details about the independence of the Fed and the steps the new president will take for 2026. If ETF outflows accelerate as of Monday, BTC may experience another round of decline.

In the short term, if there is no attack on Sunday BTC price As we approach Monday CME close progress is expected.

The direction and speed will become clear depending on the news for the coming week and the trend in the stock market and ETF channel. Of course, none of us can see the future. If we had such an ability, we would not need to follow the news and graphs.