Bitcoin price has entered a cautious phase after failing to hold its recent recovery, with price action gradually tilting back toward the downside. The pullback has been controlled rather than panic-driven, but signs of weakening demand are becoming harder to ignore. Spot buying remains limited, leverage continues to unwind, and sellers are still active beneath the surface. Together, these signals raise the likelihood of Bitcoin revisiting lower support levels, with the $75,000 region now emerging as a key area to watch as early February approaches.

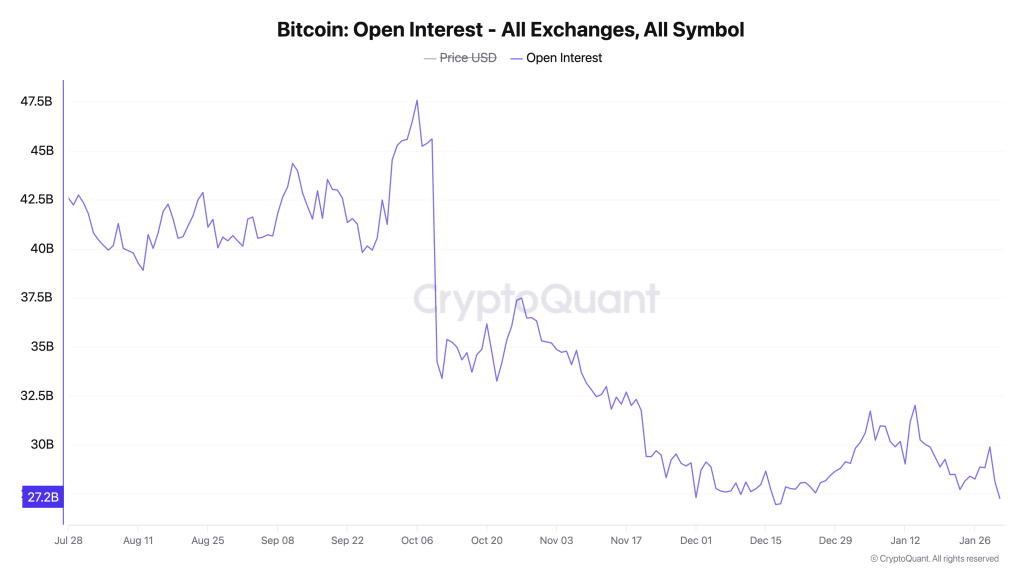

Open Interest: Leverage Steps Back, Not In

Open interest across exchanges has declined sharply, signaling broad deleveraging rather than aggressive dip-buying. This drop suggests traders are closing positions instead of building fresh longs to defend current levels. Importantly, open interest has struggled to recover alongside price, reinforcing the idea that conviction remains weak.

When leverage exits the market without being replaced, the price often drifts toward the next support zone. This behavior aligns with the broader correction seen on the price chart and adds weight to the bearish near-term outlook.

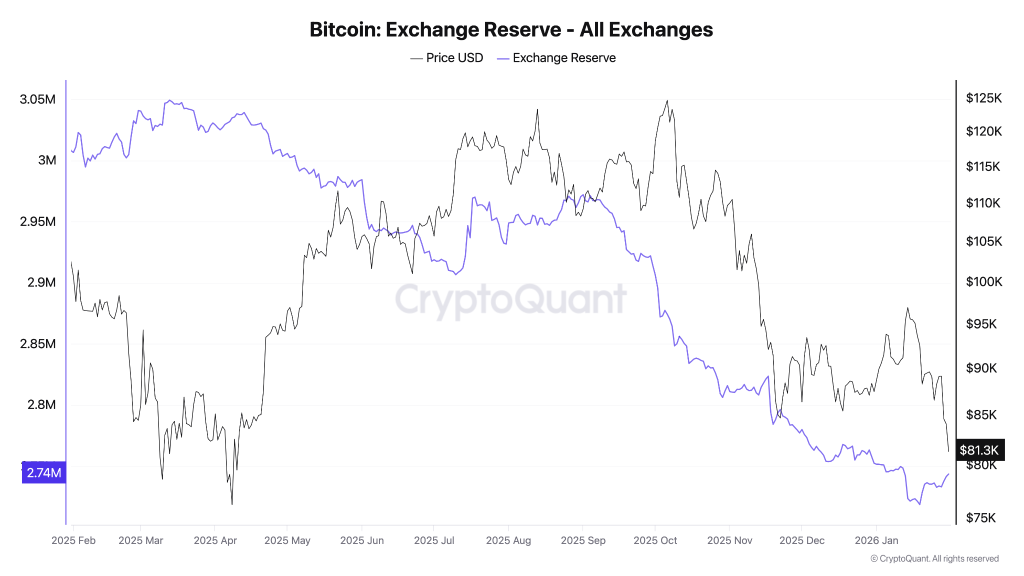

Exchange Reserves: Spot Supply Gradually Increases

Exchange reserve data shows Bitcoin balances ticking higher after a prolonged period of decline. While this does not point to panic selling, it does indicate that more BTC is becoming available to sell.

In past cycles, rising reserves during a corrective phase have often coincided with extended pullbacks rather than quick reversals. With spot supply increasing and no clear signs of aggressive accumulation, downside pressure remains a real risk if demand does not improve.

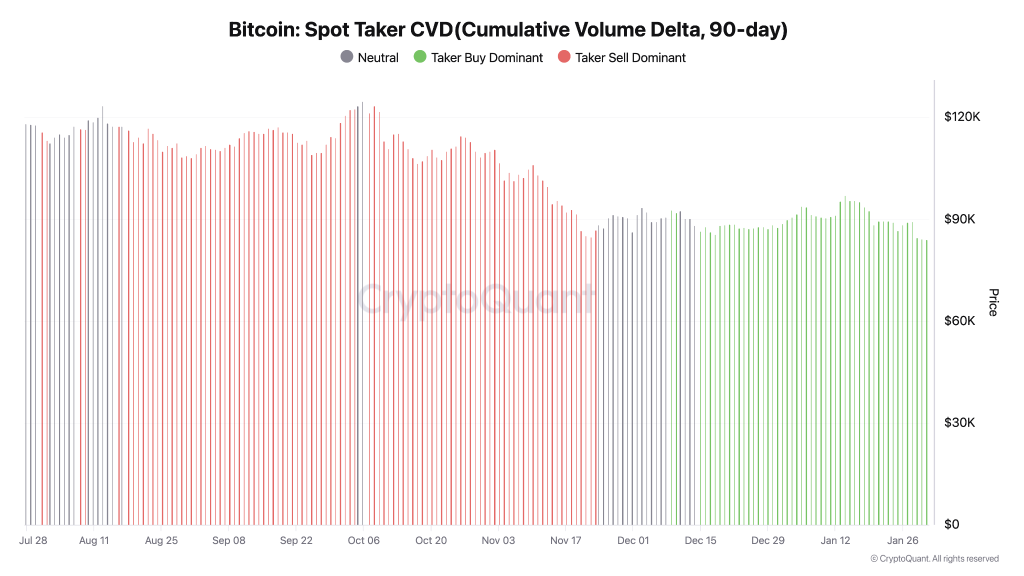

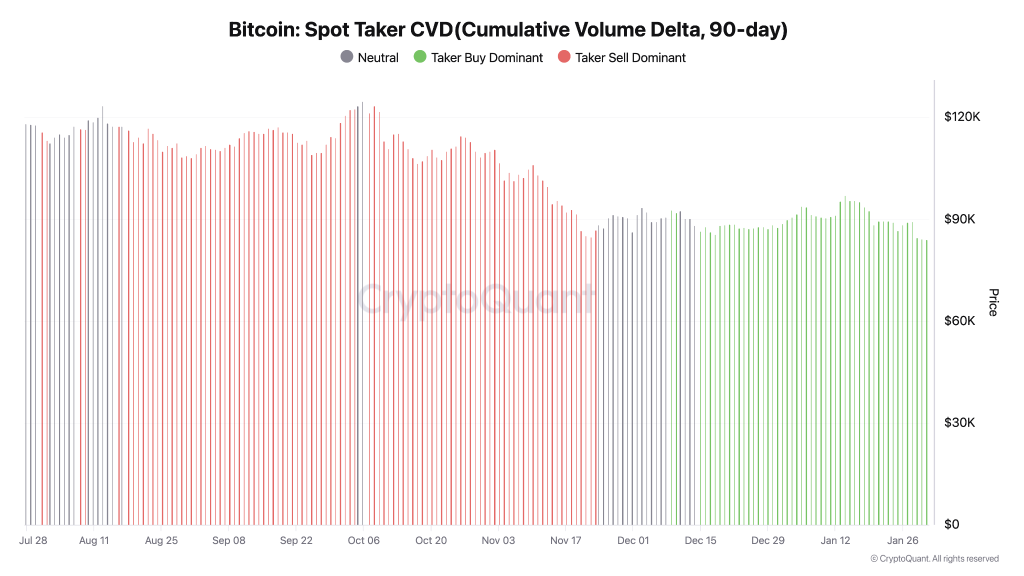

Spot Taker CVD: Sellers Still Have the Upper Hand

Spot taker CVD reinforces this cautious view. Over the past several months, sell-side market orders have dominated, and while selling pressure has eased slightly, buyers have yet to take clear control.

The lack of a strong bullish shift in CVD suggests that recent stabilization is more about sellers slowing down than buyers stepping up. Without sustained spot buying, any bounce is likely to remain corrective rather than trend-changing.

Is Bitcoin (BTC) Price Heading to $75,000?

Ever since the BTC price dropped below $100,000, it has slipped into extreme bearish conditions. It broke down below the rising wedge, which has been the start of a strong descending trend.

After breaking the wedge, the BTC price has also completed a small upside correction that resulted in a fresh descending trend. Meanwhile, the weekly RSI is also heading towards the lower threshold, indicating Bitcoin is yet to mark the bottom. Considering the chart structure, the next strong support is just below $75,000, at around $74,500, which could be the range where buyers may take control.

Conclusion: What Comes Next for Bitcoin?

Taken together, price structure, derivatives positioning, and spot market behavior all lean toward further downside exploration. Bitcoin does not appear to be in a capitulation phase, but it also lacks the conditions typically seen at durable bottoms. Unless spot demand strengthens and leverage begins to rebuild alongside rising prices, Bitcoin may continue drifting lower toward the $74,000–$76,000 support zone. A bounce from there is possible, but for now, the data supports caution rather than optimism.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.