Binance Coin (BNB) price extended its decline on Friday as the broader crypto market slid into a risk-off phase. BNB price fell more than 6% intraday, extending losses after failing to reclaim the psychologically important $900 level. The move comes amid a wider selloff across Bitcoin and major altcoins, where rising liquidations and tightening macro conditions are accelerating downside momentum. As price slipped below key support zones, derivatives data shows the decline was not driven by spot selling alone. Instead, the move unfolded as a liquidation-led breakdown, exposing structural weakness built up during the prior consolidation.

BNB Price Breaks Down After $900 Rejection

BNB price chart shows clear signs of breakdown. The rejection at $900 marked a failure at a key supply zone that has capped upside attempts multiple times. Once BNB price lost the $880 support, selling pressure intensified, breaking the short-term higher-low structure and confirming a shift toward lower-highs and lower lows. The current selloff has pushed BNB below the $850 mark, with $880 now acting as resistance rather than support.

If downside pressure persists, the $800-$830 emerges as the next major demand zone, aligned with prior liquidity absorption. A deeper move could expose the $800 psychological level, especially if broader market weakness continues. On the upside, any rebound toward $860-880 is likely to face selling interest unless BNB can reclaim $900 with strong volume, a scenario that currently appears unlikely given the derivatives backdrop.

Liquidations and Funding Rates Confirm Deleveraging Phase

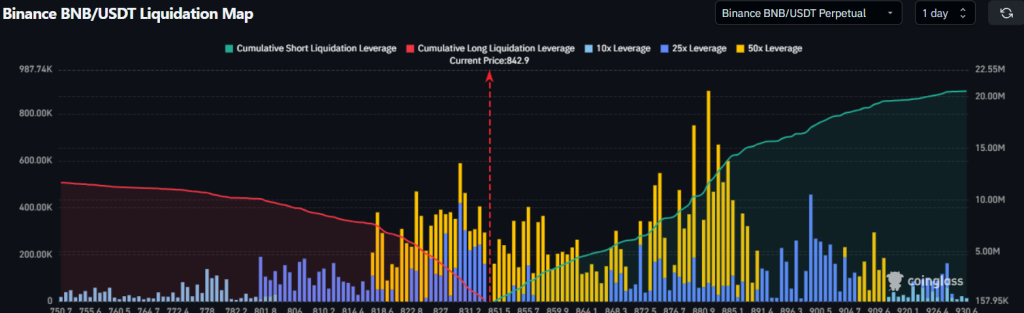

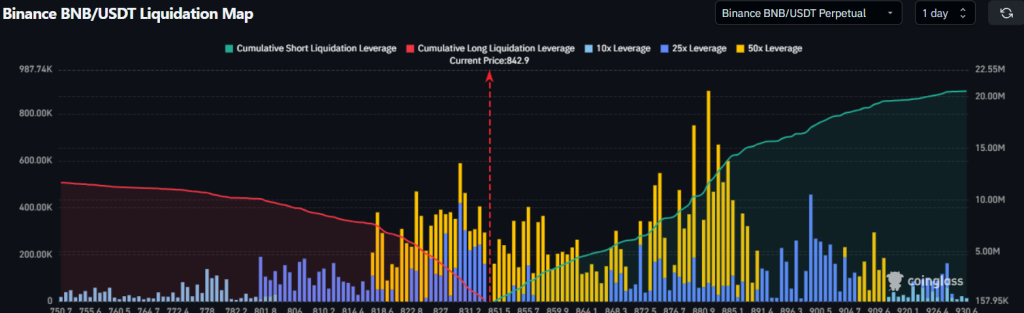

The sharp downside move in BNB was fueled by aggressive liquidation activity across derivatives markets. Liquidation heatmap data reveals dense long-position clusters stacked between $880 and $850, where leverage had accumulated over recent sessions.

Once BNB was rejected at $900, price quickly moved into this liquidity pocket, triggering a cascade of forced closures. During the selloff, BNB-related liquidations exceeded $100 million, with long positions accounting for the bulk of the wipeout. This confirms that bullish positioning had become overcrowded near resistance, leaving the market vulnerable to a rapid flush once support gave way.

Funding rates across major perpetual contracts flipped decisively negative, sliding into the -0.01% to -0.02% range, signalling traders paying a premium to stay short. At the same time, open interest dropped by roughly 8–10%, showing that leverage was being forcibly removed rather than rotated into new positions. Together, negative funding, falling open interest, and clustered liquidations point to a structural leverage reset, not a one-off panic move.

Final Thoughts

BNB’s price rejection at $900 has shifted the short-term trend firmly bearish, with liquidation-driven selling exposing fragile market structure. Until leverage resets and price stabilizes above key resistance, downside risks remain dominant. For now, traders are watching whether demand can re-emerge near support, or if further deleveraging extends the decline.

FAQs

BNB’s price fell over 6% after failing to break the $900 resistance, triggering a wave of leveraged long position liquidations amid a broader crypto market sell-off.

Over $100 million in long positions were liquidated as BNB broke below $880, accelerating the drop through forced selling rather than ordinary spot market activity.

A swift recovery appears unlikely; derivatives data shows negative funding rates and falling open interest, indicating a bearish deleveraging phase must stabilize first.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.