Crypto markets faced a sharp leverage-driven reset as crypto liquidations accelerated across futures markets, wiping out more than $1.1 billion in leveraged positions. The liquidation wave swept through Bitcoin, Ethereum, and the broader altcoin market, exposing how fragile positioning had become after weeks of compressed volatility. Crucially, this move was defined by derivatives liquidations rather than spot panic. While prices moved lower, spot market behavior remained relatively orderly, reinforcing that the selloff was driven by forced liquidations and margin calls, not mass selling by long-term holders.

Crypto Liquidation Data Shows Long Positions Were Overcrowded

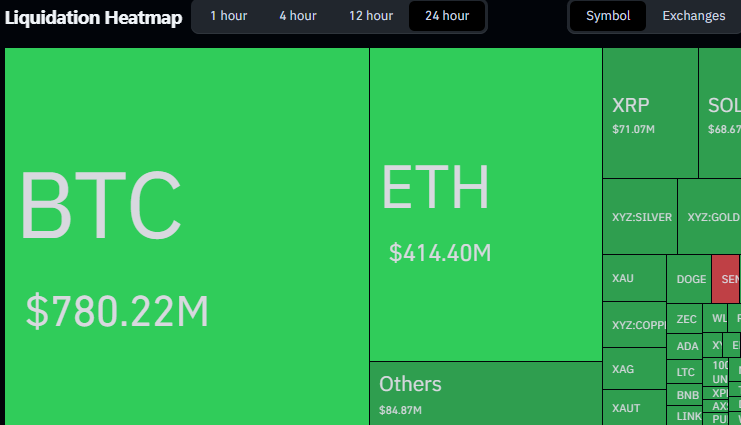

Liquidation heatmaps reveal that approximately two-thirds of all crypto liquidations came from long positions, confirming that traders were leaning heavily bullish before the move. More than $1.1 billion in crypto liquidations were recorded, with long positions accounting for the overwhelming majority of forced closures.

Bitcoin accounted for roughly $780 million in BTC liquidations, making it the single largest contributor to the crypto liquidation event. Ethereum followed with around $414 million in ETH futures liquidations, reflecting higher leverage density and tighter margin thresholds. Combined, BTC and ETH made up nearly 70% of total crypto liquidations. This concentration shows that leverage was not evenly distributed, but clustered around the largest assets, leaving the market vulnerable once momentum faded.

Beyond Bitcoin and Ethereum, crypto liquidations spread rapidly into altcoins, particularly high-beta and mid-cap tokens. Collectively, altcoins represented close to one-third of total liquidation volume, with some assets experiencing outsized percentage losses as leveraged longs were forced out in thin liquidity conditions. This pattern is typical during market-wide leverage flushes. As risk appetite contracts, traders exit higher-risk positions first, amplifying liquidation pressure in smaller tokens even without fundamental weakness. Importantly, these altcoin liquidations were driven by derivatives mechanics rather than spot capitulation.

Crypto Liquidations Coincide With Sentiment Turning Defensive

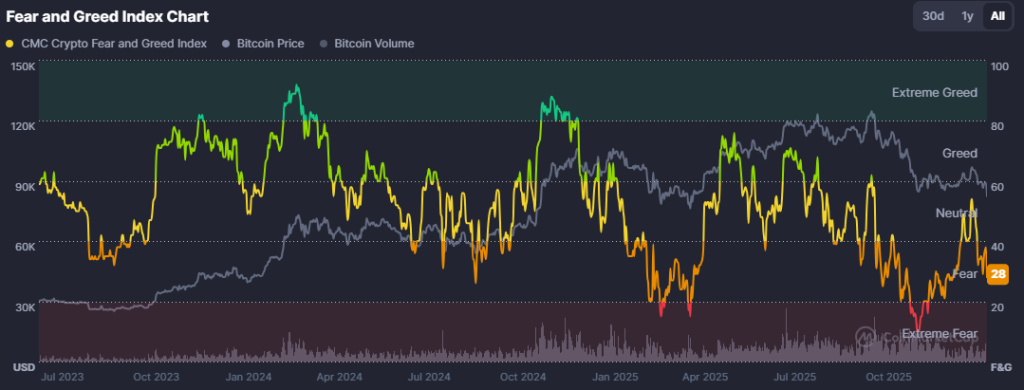

The spike in crypto liquidations aligned closely with a deterioration in market sentiment. The Crypto Fear & Greed Index dropped to 28, placing sentiment firmly in the “Fear” zone. Historically, readings below 30 tend to coincide with periods of forced deleveraging, reduced leverage appetite, and heightened volatility.

Rather than triggering the selloff, fear appears to have followed the liquidation cascade, as traders reacted to forced closures and rising volatility. Bitcoin and Ethereum sentiment indicators now reflect a more defensive posture, with participants prioritizing risk control over aggressive positioning.

Final Thoughts

With more than $1.1 billion in crypto liquidations now absorbed, the market has entered a recalibration phase. Futures open interest has cooled, leverage has been reduced, and sentiment has shifted toward caution.

Historically, large liquidation events tend to lead to range-bound price action, as markets stabilize after excess leverage is flushed. A renewed trend higher or lower will likely depend on whether leverage rebuilds alongside genuine spot demand, rather than speculative positioning alone. For now, crypto markets remain volatile but structurally intact, with crypto liquidations serving as a reset, not a breakdown.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.