The rising strength of precious metals like gold & silver has kept crypto markets largely muted, with Bitcoin once again slipping below the $88,000 mark. Major altcoins such as Ethereum, XRP, and Solana struggled to clear nearby resistance, reflecting broader indecision. Against this backdrop, Worldcoin stood out, posting a sudden surge of over 40% within minutes and briefly breaking away from the wider market trend. However, the move quickly unravelled. WLD price erased more than 12% soon after the spike, raising questions over the rally’s sustainability. What triggered the sharp reversal, and why did bullish momentum fade so quickly?

Rumour-Driven Rally Lacked On-Chain Support

A significant portion of Worldcoin’s sharp rally was fueled by renewed rumors that OpenAI could be exploring a “humans-only” social media platform that leverages Worldcoin’s identity-verification technology. The speculation was enough to ignite aggressive short-term positioning, triggering a sudden surge in trading activity. During the move, WLD volume spiked by over 800%, pushing the price rapidly from $0.45 to $0.65 as momentum traders rushed in.

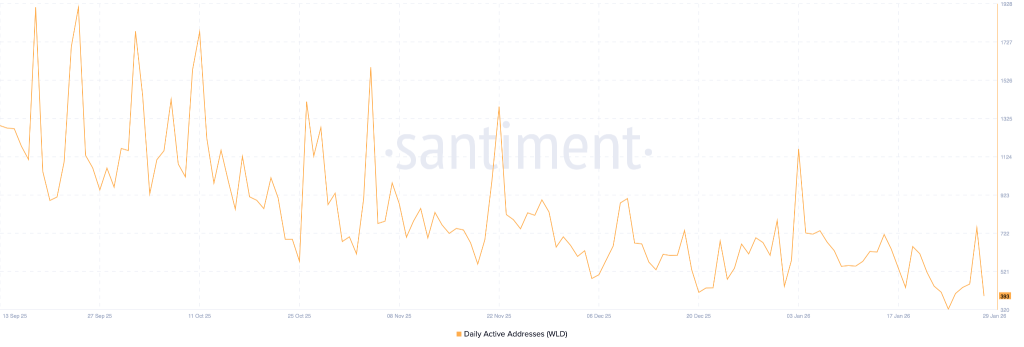

However, despite the explosive rise in volume, on-chain participation told a different story. Retail activity failed to expand meaningfully during the rally. Santiment data shows that active address counts have continued to decline since the Q4 2025 spike, indicating a lack of fresh network engagement. This divergence suggests the move was likely driven by large holders, institutional flows, or market-making activity, rather than broad-based retail accumulation. The swift 12%+ pullback that followed further reinforces the view that the rally lacked structural demand and was vulnerable once momentum faded.

Worldcoin Price Analysis: Can WLD Reclaim $0.7 This Month?

Worldcoin witnessed a strong upside expansion during the Q4 2025 mini bull run, rallying to highs above $2.20. Since then, price action has remained under sustained pressure, transitioning into a steep descending trend and eventually printing lows below $0.44. While the recent rebound attempted to reclaim the $0.70 supply zone, the move lacked strength and was decisively rejected, keeping the broader downtrend intact. This failure now raises a key question: is momentum fading further, or is WLD attempting to stabilize for a recovery?

As observed on the daily chart, WLD continues to trade within a descending parallel channel, reflecting persistent bearish control. Despite the latest pullback, the price is still hovering near the upper boundary of the channel, leaving room for short-term stabilization. However, momentum indicators flash caution. The RSI shows a bearish divergence, signaling weakening upside strength, while Bollinger Bands remain relatively expanded, suggesting the absence of volatility compression. Combined with subdued buying volume, this setup points toward continued consolidation or downside pressure, unless fresh demand enters the market.

The Bottom Line: Can Worldcoin Price Reclaim $1 in February 2026?

Worldcoin’s recent volatility highlights a market driven more by speculation than structural demand. While rumors sparked a sharp price and volume surge, on-chain data showed no revival in active addresses, weakening the rally’s credibility. Technically, the WLD price remains trapped within a descending channel, with momentum indicators flashing caution. Reclaiming $1 in February 2026 would require a decisive breakout above channel resistance, sustained volume, and renewed network participation. Until then, upside attempts risk fading into consolidation or further pullbacks.

FAQs

Such moves often rely on leverage and short-term traders rather than long-term investors. When confirmation or follow-up news fails to appear, liquidity dries up and prices retrace fast.

Falling active addresses usually signal weaker user participation. Without broad engagement, price gains are harder to sustain and more vulnerable to sharp reversals.

High-frequency traders and large liquidity providers can profit from rapid price swings. Long-term holders face higher risk if moves are not backed by fundamentals.

Clear product announcements, measurable user growth, or verified partnerships would matter more than speculation. Without these, price action may stay reactive and unstable.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.