If cryptocurrencies start a big rise after such daunting moves, many investors will miss the rally. The four-year cycle story tells us that the decline must now accelerate, and for various reasons, especially in the last 3 months, every attempt to rise has failed. Bitcoin It is still below 90 thousand dollars and interestingly, it has not lost its support of 81 thousand dollars.

Historical Period in Bitcoin

Markets are experiencing abnormal days. While assets such as gold and silver are breaking records cryptocurrencies is falling. Under normal circumstances, a rise in the gold price would also mean a rally for Bitcoin, albeit with a delay. Bitcoin, which is assumed to have acted like a technology stock in the last 4 years, does not act accordingly. Today, BTC is still below $90,000 as US stocks race to new highs.

Taking a look at the status of hashrate, On-Chain Mind analysts say China crypto- He says that nothing like this has happened since the ban.

“Bitcoin’s hashrate has been trending downward since October and has now reached its annual moving average. Historically, this zone has marked miner stress and a reset of the network.”

“After the uninterrupted upward trend since China’s mining ban in 2021, could we be approaching a turning point?”

What Will Happen to Bitcoin?

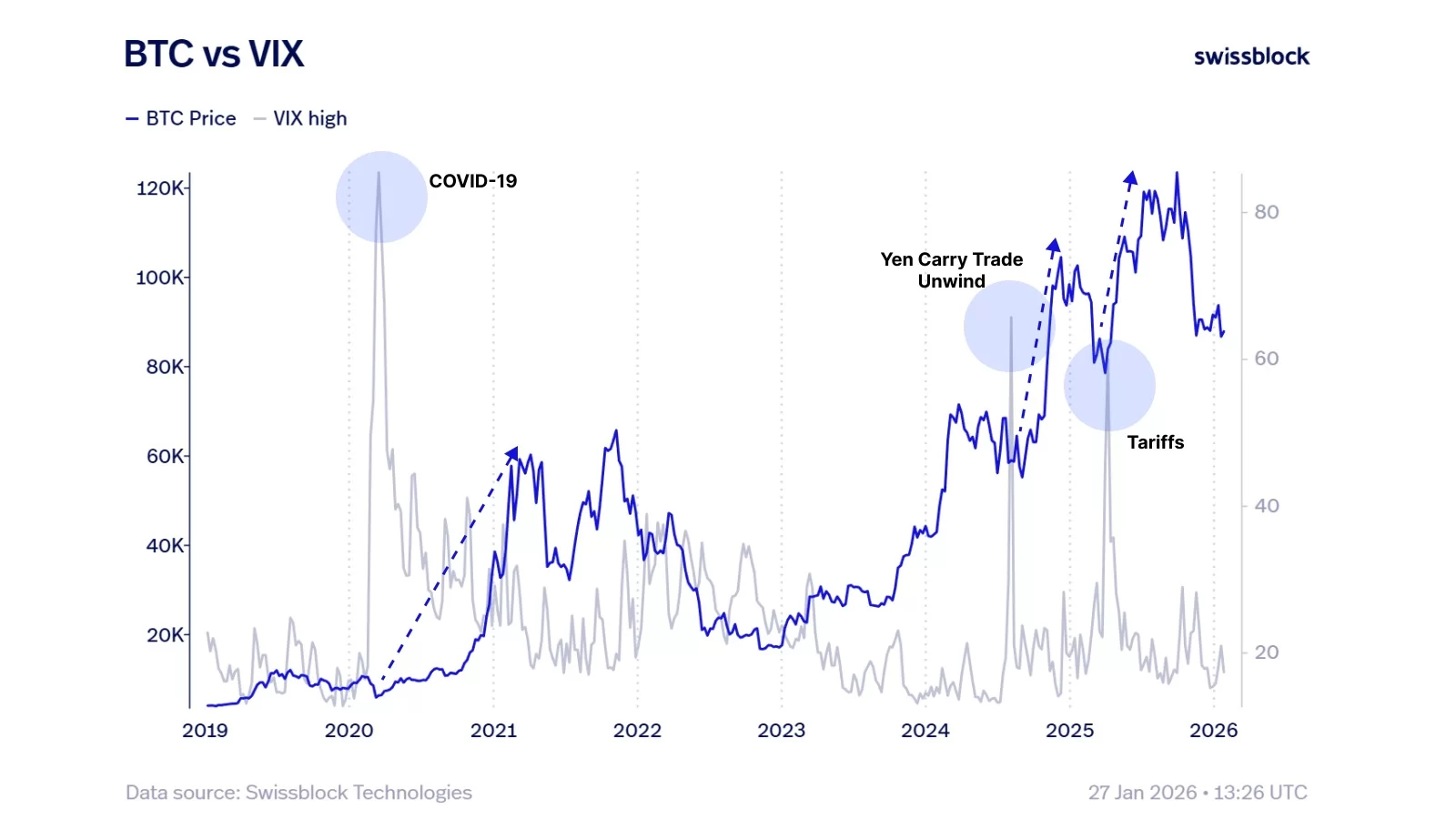

With Swissblock VIX BTC drew attention to the comparison. Historically, the VIX has predicted significant changes. customs duties Significant external factors, such as , had pushed the VIX above 60, effectively clearing out “tight” and unstable markets.

“These shocks serve as a necessary market reset. Do we need a catalyst of this magnitude to overcome the current instability?”

The Supreme Court may make the tariff decision on February 20, or Trump may become even more at odds with Europe. Or Trump could attack Iran. You don’t need to have a great imagination for the “big things” that may happen, it is enough just to consider the possibility of the disasters that we are on the brink of happening in 2025.

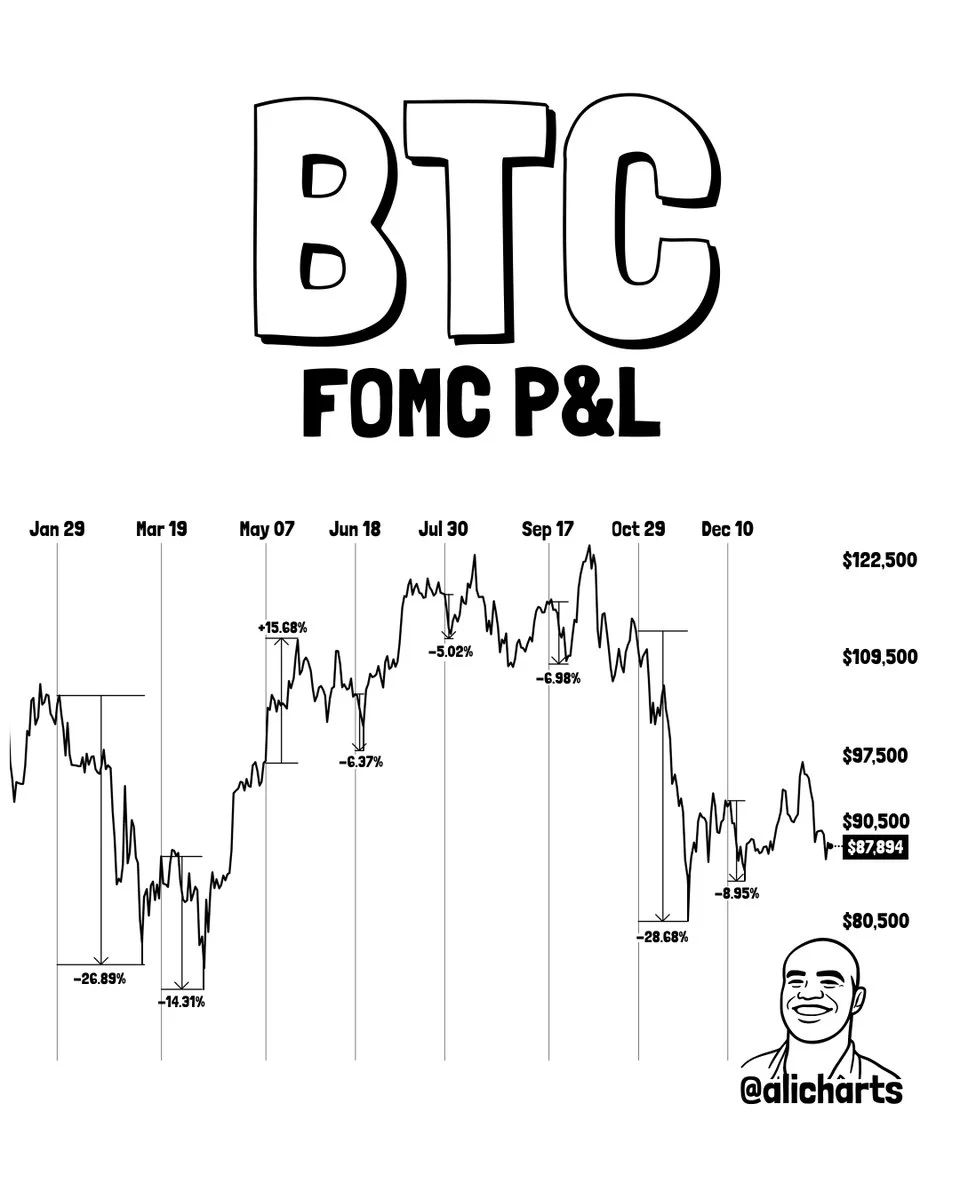

By this time tomorrow, there will be little time left until the interest rate decision. We usually see a decline after Fed meetings, so investors should be prepared for possible sell-offs, says Ali Martinez.

- January 29: –27%

- March 19: –14%

- May 7: +15%

- June 18: –8%

- July 30: –6%

- September 17: –7%

- October 29: –29%

- December 10: –9%